While marine insurers remain well-capitalized, the line faces many risks. A protracted soft market has eroded margins, large losses have put pressure on rate adequacy, and marine cat experience has been highly correlated with that of property—all of which highlight multiline accumulations, an area of increasing concern. And yet, the marine industry has not fully embraced the robust catastrophe analytics adopted by property insurers.

Executive Summary

Large marine catastrophe losses, increasing accumulations of cargo exposure and a continued soft market have put insurers and reinsurers under pressure to better understand marine risk. RMS Director Chris Folkman offers a perspective on the unique risk management problems facing the marine industry and how new marine catastrophe models can provide deeper insight into the loss potential.Marine is a uniquely challenging line of business to model. Unlike houses and buildings, marine cargo is mobile, and its vulnerability differs widely depending on the product, packaging and storage. Exacerbating the challenge is the accumulation of cargo in ports and storage facilities. As shipping vessels have grown larger, storage facilities busier and terminal operations more efficient, port values have grown to staggering levels. Today, the world’s largest ports process more than 30 million TEUs (20-foot equivalent units) of cargo annually. If laid end-to-end, the containers would circle the world five times. Much of this cargo is stored at sea level, on open lots or inside warehouses, plainly exposed to wind, surge and earthquake perils.

The coverage provided by cargo policies highlights formidable risk management challenges. First, most standard cargo policies contain an “accumulation clause,” which can double the policy limit in the event of a loss to an unexpected accumulation of exposure. No other line of business carries this kind of automatic coverage increase.

Second, cargo policies are increasingly written on a “stock throughput” basis, covering manufactured products from cradle to grave. For example, a clothing manufacturer purchasing this coverage is protected at every stage in the product’s life cycle: cotton and fabrics in production facilities; finished clothes awaiting shipping; inventory stored at distribution facilities; and even clothing at its final destination, hanging on racks in retail stores. Assessing the loss potential to such broad coverage can involve modeling the entire supply chain.

Finally, cargo losses are highly influenced by salvageability, which can differ dramatically by product. Jewelry inundated by a storm surge can be dried out and resold. Electronics or pharmaceuticals would not fare as well, most likely resulting in total loss. Brand protection clauses, which allow policyholders to forgo salvage efforts, are commonly selected for high-end consumer goods and luxury cars, but these variables have never been explicitly considered in the modeling of marine cargo.

How Catastrophe Models Help Address Marine Risk

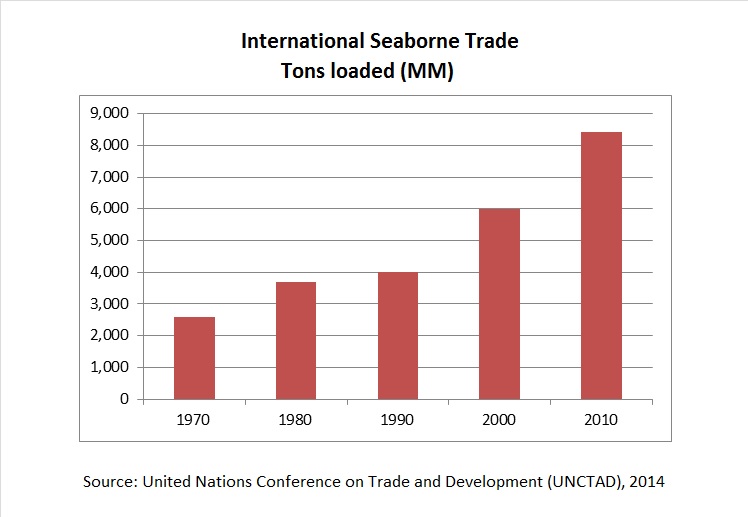

Despite the many challenges of managing marine risk, the line’s exposure base continues to grow. Seaborne trade is a $10 trillion industry, and continued growth is projected as the size of container ships and port facilities increases. But this growth further necessitates the need for more robust underwriting and portfolio management.

Empowering marine insurers to accurately measure cat loss potential must start with a different risk model. Risk should be modeled not as buildings and contents, as it is done today, but as cargo in all of its diversity: inside shipping containers, on retail shelves or open lots, and in tanks or warehouses. In addition, the underlying product must be carefully considered. Cars, for example, carry a different vulnerability profile than consumer goods or break bulk. Understanding how each product might perform when subjected to hurricane-force winds or extreme flooding is critical.

The new RMS Marine Model, currently scheduled for release in spring 2016, will help marine insurers overcome the challenges of marine catastrophe management. It will include a complete vulnerability module for cargo, taking into account hundreds of products and storage configurations at ports as well as inland storage facilities, warehouses and retail premises. The marine model works by integrating with existing cat models, such as hurricane and earthquake, to assess cargo vulnerability for wind, storm surge and earthquake at a granular level.

Determining how cargo accumulates at ports is equally important. Ports differ widely in the types of cargo they handle, the layout of terminals and the seasonality of traffic. Quantifying exposure in key ports at both average and peak times could allow insurers to manage problematic accumulations and adapt their risk management strategies.

Industry exposure databases (IEDs) accompanying the new RMS marine model provide a means to estimate cargo exposure at key ports worldwide. By combining port traffic data with geospatial intelligence, the IEDs will characterize the geographic distribution of cargo exposure at high resolution. For perils like storm surge, where loss is highly sensitive to exposure positioning, the IEDs will enable catastrophe managers to differentiate between cargo accumulations that are relatively safe and those highly vulnerable to loss.

In 2012, Superstorm Sandy emphasized the potential for marine cat loss. The devastating effects of surge on marine cargo included 16,000 lost autos, 7,500 flooded containers and more than 100 miles of damaged railcars, resulting in $3 billion of marine claims—the costliest loss in the line’s history. Sandy stressed the need for improved catastrophe risk management by marine insurers.

By applying cutting-edge catastrophe analytics to marine, the world’s oldest form of insurance, new models will help to strengthen the industry and enable more granular and ultimately more profitable underwriting and portfolio management decisions.

Flood Risk Misconceptions Drive Underinsurance: Chubb

Flood Risk Misconceptions Drive Underinsurance: Chubb  Lessons From 25 Years Leading Accident & Health at Crum & Forster

Lessons From 25 Years Leading Accident & Health at Crum & Forster  Earnings Wrap: With AI-First Mindset, ‘Sky Is the Limit’ at The Hartford

Earnings Wrap: With AI-First Mindset, ‘Sky Is the Limit’ at The Hartford  How Americans Are Using AI at Work: Gallup Poll

How Americans Are Using AI at Work: Gallup Poll