A new report on the state of the homeowners market in the U.S. highlights how insurance carriers used timely rate actions to thwart residual inflationary pressures, improving the overall prospective return on equity (ROE).

Aon’s “Homeowners Return on Equity Outlook – November 2023” reported a prospective 6 percent ROE for the national cohort of insurers, with claims reserves and underwriting profits taking a hit due to loss cost inflation.

According to the report, macroeconomic, political and healthcare changes between 2020-2022 “resulted in significant changes in claims propensity, materials costs, labor and construction costs, and monetary policy.”

A spike in inflation was the result, with the “inflationary impact to insurers and reinsurers’ claims cost exceeding CPI/PPI estimates.”

The inflation guard mechanism policy provision found in most homeowners policies typically offsets the impact due to rising costs; however, according to Aon, the provision can miss in two ways. One way is that it may underestimate loss inflation. The second way is that “while claims cost inflation can affect the entire outstanding reserve immediately, inflation guard must be earned in over the policy period.”

So, when the inflation guard fails to keep pace with increasing claims costs, the difference must be corrected with new rates. This takes time since the rates must then be filed for approval with state insurance regulators. This can take a few years to correct before allowing underwriting profitability, Aon stated.

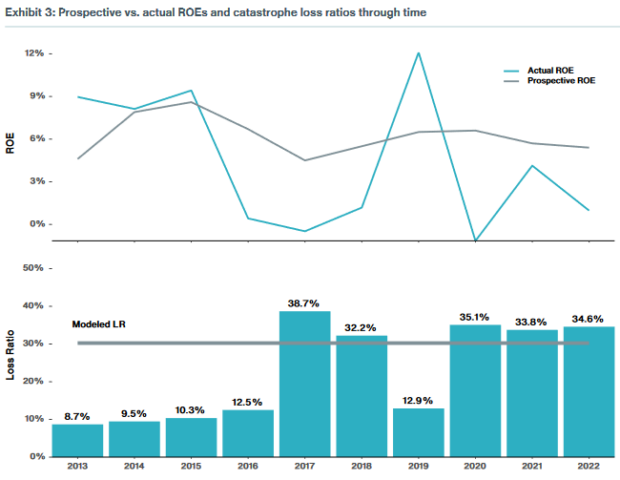

The industry exceeded Aon estimated ROE four out of the last 10 years. Only one of those years (2019) exceeded the target (at the time) of 10 percent.

“The target ROE is supposed to reflect an expected return to attract capital over the long term, supporting a healthy insurance marketplace,” the report stated.

Of note, when actual ROE exceeded Aon’s prospective ROE, catastrophe losses were below average.

Though changing long-term loss costs, including associated rising costs of climate change, are especially relevant to homeowners coverage affordability, Aon stated they are “unlikely more than a percent or two versus the macroeconomic conditions and resulting premium lags described above hurting insurers’ recent performance with 10 to 20 percent inflationary pressures.”

Regulating price has a downside as evidenced by undercapitalized insurers “that tried to fit their balance sheet size inside the prices the regulators would allow,” the report noted. A bleak reminder of the 10 insurer insolvencies in Florida since 2019.

Mitigation initiatives like promoting better building codes to increase home resilience to loss will assist both homeowners and insurers overall.

Consistent review and management of the book of business combined with an insurer’s expertise and business appetite will also assist in negating outside factors impacting rates and profitability.

Aon’s analysis showed how single state monoline carriers do better because of deep relationships stakeholders in their markets, while national multiline carriers struggle in states with many wildfires and thunderstorms.

Aon found that for a diversified national insurer, the target combined ratios fall into three main categories:

- Peak (TX/NY)

- Other hurricane-exposed states

- States not materially exposed to hurricanes

The analysis also highlighted how reinsurance allows peak states, like Texas and New York, to mitigate their combined ratios.

Reinsurance buying habits vary significantly amongst the specialists depending on their geographic footprint, the report found.

“Midwest insurers buy limits to higher return periods than Northeast insurers because of the trade-off between modeled tail loss (Northeast hurricane is riskier than Midwest thunderstorm) and the pricing levels in the reinsurance market (Midwest thunderstorm tends to be priced lower as a diversifying peril), the report stated.

Aon noted that “direct written premiums increased from $86 billion in 2014 to $132 billion in 2022, with a projected $144 billion for 2023 given prospective rate activity (and assuming no further growth).”

It is likely that given the rate hikes seen across the homeowners market, “policyholders changing insurers will prevent the industry from realizing the full aggregate benefit of the individual carriers’ rate actions.”

Earnings Wrap: With AI-First Mindset, ‘Sky Is the Limit’ at The Hartford

Earnings Wrap: With AI-First Mindset, ‘Sky Is the Limit’ at The Hartford  RLI Inks 30th Straight Full-Year Underwriting Profit

RLI Inks 30th Straight Full-Year Underwriting Profit  How Americans Are Using AI at Work: Gallup Poll

How Americans Are Using AI at Work: Gallup Poll  20,000 AI Users at Travelers Prep for Innovation 2.0; Claims Call Centers Cut

20,000 AI Users at Travelers Prep for Innovation 2.0; Claims Call Centers Cut