Policyholders today are zeroing in on an insurer’s reputation, premium affordability, and personalized services and products when shopping for insurance coverage, according to results of a new survey.

The 2023 survey of U.S. insurance policyholders by Capco, a global technology and management consultant, highlights consumer attitudes toward insurance, key innovation trends, and opportunities for insurers to increase trust and engagement.

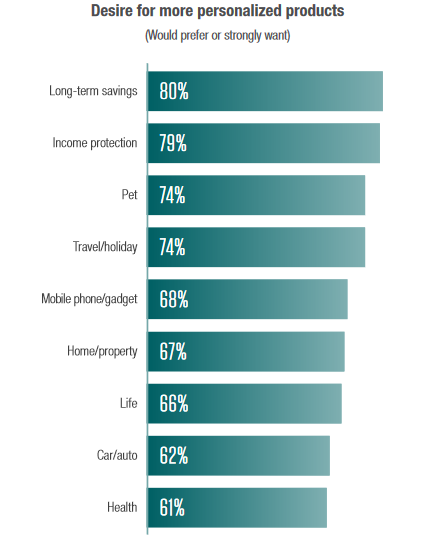

The new research revealed insurance consumers’ heightened appetite for personalized insurance offerings related to changing life circumstances and values.

“U.S. insurers made huge leaps during the pandemic in terms of digital maturation and are now better equipped to drive digital enablement,” said Lance Levy, CEO of Capco. “The learnings and innovations from this period will be incredibly valuable as insurers investigate new ways to build truly personalized product offerings for consumers.”

The survey found that consumers are willing to share more personal data to secure tailored products, services and “enjoy cheaper premiums and benefit from an enhanced claims process.”

The vast majority of policyholders surveyed (89 percent) reported being willing to share additional personal data with their insurers in return for cheaper premiums and more tailored services — a 17 percent increase from the 2021 survey.

The pressure of inflation has pushed consumers to place greater emphasis on “affordable premiums, value for money and brand reputation when they shop for insurance products.”

Non-policyholders contacted during the research said the top reason for not buying insurance is cost.

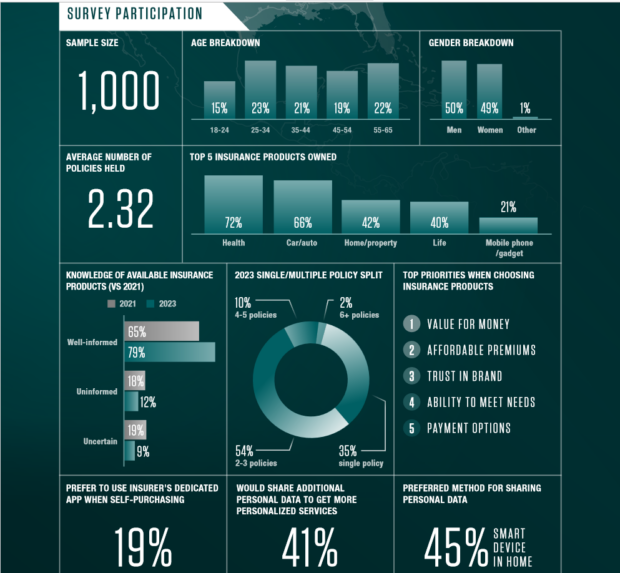

The survey captures consumer attitudes across several areas including types of policies held, levels of confidence and knowledge about insurance products, preferred channels for purchasing coverage and communicating with insurers, and claims management experiences.

Key findings include:

Women are more likely to hold only one insurance policy and to feel uninformed about available insurance products.

- Single policyholder – 43 percent of women, 26 percent of men, 35 percent of all respondents (up from 30 percent in 2021).

- Feel well-informed – 74 percent of women, 85 percent of men, 79 percent of all respondents. Overall, there has been a 16 percent increase in the number of policyholders who consider themselves well-informed.

Women, older adults (55-65 years) and policyholders with children are least comfortable sharing additional personal data.

- Men, married individuals and higher income respondents are more open to data sharing.

- Only 5 percent of respondents do not trust their insurer with any additional personal data.

Value for money and affordable premiums are important to everyone but particularly for older adults and women.

- Value for money – 42 percent of all respondents, 53 percent of older adults, 47 percent of women.

- Affordable premiums – 42 percent of all respondents, 63 percent of older adults, 49 percent of women.

Only 21 percent of survey respondents holding multiple insurance policies use a single insurance company to meet all their coverage needs.

- Average number of polices held – 2.32; average number of insurers used – 2.61.

In addition, nearly two-thirds of consumers surveyed prefer to purchase their insurance either through an insurer’s website or app.

The Capgo report suggests insurers ‘target, innovate and invest’ to deliver data-driven experiences and products to satisfy customers’ expectations and enhance engagement and loyalty.

Drilling down to personalized products consumers demand along with engaging underserved markets will be key.

Cross-selling was another recommended strategy.

Insurers should focus on maintaining agility in an ever more digitalized insurance landscape, the report added.

“The year ahead will be pivotal for building new relationships with consumers through hyper-personalized offerings, delivered at just the right time in just the right way. Partnerships between insurers and external parties will facilitate creative solutions in both product scope and market reach,” said Ernst Renner, partner & US insurance lead.

“Carriers should be refining the capabilities required to simplify data exchange and the flow of digital interactions across the ecosystems that are now such a strategic focus for the industry. At the same time, they will need to navigate a range of associated technical, security and regulatory challenges that will impact both their legacy portfolio and fresh initiatives,” he added.

Telematics and Trust: How Usage-Based Insurance Is Transforming Auto Coverage

Telematics and Trust: How Usage-Based Insurance Is Transforming Auto Coverage  From Skill to System: The Next Chapter in Insurance Claims Negotiation

From Skill to System: The Next Chapter in Insurance Claims Negotiation  Focus on Ski Guides After Deadly California Avalanche Could Lead to Criminal Charges, Civil Suits

Focus on Ski Guides After Deadly California Avalanche Could Lead to Criminal Charges, Civil Suits  Teens’ First Year on the Road Most Deadly

Teens’ First Year on the Road Most Deadly