Fairfax Financial Holdings Ltd., the Canadian insurer that announced its largest acquisition last week, is selling shares in an initial public offering for a fund that will make investments in Africa. The company is seeking to raise as much as $1 billion from the sale, people familiar with the matter said.

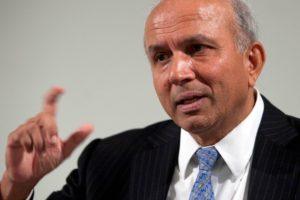

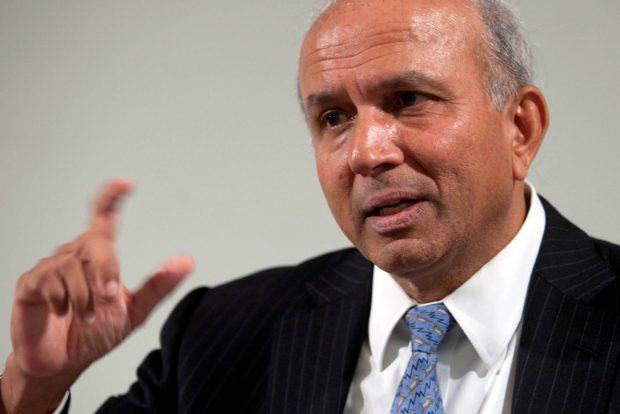

Fairfax, run by value investor Prem Watsa, is hunting for countries on the continent with fast-paced economic growth, according to a prospectus filed Friday. The Toronto-based firm has $416 million already committed from its own funds and partners including Ontario Municipal Employees Retirement System and CI Investments Inc. for the venture, called Fairfax Africa Holdings Corp. A $1 billion IPO would be the largest in Canada since Hydro One Ltd. raised C$1.8 billion ($1.33 billion) last year, according to data compiled by Bloomberg.

-

Prem Watsa, CEO of Fairfax, speaking to financial journalists following the annual general meeting of Fairfax Financial Holdings Limited, held April 22, 2010 in Toronto, Ontario, Canada. Photographer Norm Betts/Bloomberg News - “We believe Africa will be transformed in the coming years by positive demographic trends led by a large emerging middle class, substantially improved political stability and governance, and increased integration with global markets,” Watsa said in a press release announcing the fund. RBC Capital Markets is leading the IPO.

This would be the insurer’s second public fund specific to a region. Two years ago, Fairfax offered shares in an investment vehicle that targeted Indian firms, securing C$500 million from partners and its own funds, and raising about $1 billion. After debuting at $10 a share in 2015, the Fairfax India Holdings Corp. stock is up 15 percent to $11.50. The Africa shares would also be sold on the Toronto Stock Exchange at $10 each.

Fairfax agreed to buy Allied World Assurance Co. for $4.9 billion in cash and stock in Chief Executive Officer Watsa’s biggest purchase last week.

20,000 AI Users at Travelers Prep for Innovation 2.0; Claims Call Centers Cut

20,000 AI Users at Travelers Prep for Innovation 2.0; Claims Call Centers Cut  Retired NASCAR Driver Greg Biffle Wasn’t Piloting Plane Before Deadly Crash

Retired NASCAR Driver Greg Biffle Wasn’t Piloting Plane Before Deadly Crash  What Analysts Are Saying About the 2026 P/C Insurance Market

What Analysts Are Saying About the 2026 P/C Insurance Market  Execs, Risk Experts on Edge: Geopolitical Risks Top ‘Turbulent’ Outlook

Execs, Risk Experts on Edge: Geopolitical Risks Top ‘Turbulent’ Outlook