Fairfax Financial Holdings Ltd., the Canadian insurer that announced its largest acquisition last week, is selling shares in an initial public offering for a fund that will make investments in Africa. The company is seeking to raise as much as $1 billion from the sale, people familiar with the matter said.

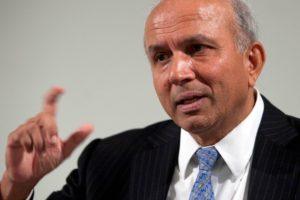

Fairfax, run by value investor Prem Watsa, is hunting for countries on the continent with fast-paced economic growth, according to a prospectus filed Friday. The Toronto-based firm has $416 million already committed from its own funds and partners including Ontario Municipal Employees Retirement System and CI Investments Inc. for the venture, called Fairfax Africa Holdings Corp. A $1 billion IPO would be the largest in Canada since Hydro One Ltd. raised C$1.8 billion ($1.33 billion) last year, according to data compiled by Bloomberg.

This would be the insurer’s second public fund specific to a region. Two years ago, Fairfax offered shares in an investment vehicle that targeted Indian firms, securing C$500 million from partners and its own funds, and raising about $1 billion. After debuting at $10 a share in 2015, the Fairfax India Holdings Corp. stock is up 15 percent to $11.50. The Africa shares would also be sold on the Toronto Stock Exchange at $10 each.

Fairfax agreed to buy Allied World Assurance Co. for $4.9 billion in cash and stock in Chief Executive Officer Watsa’s biggest purchase last week.