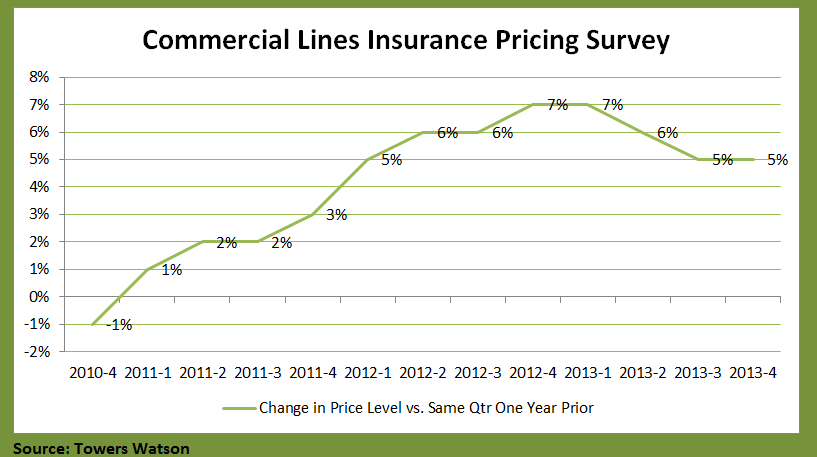

Commercial insurance prices have risen for 12 straight quarters, including the latest jump of 5 percent in aggregate during fourth-quarter 2013. But price gains are slowing down, according to Towers Watson.

The global professional services company published the fourth-quarter update to its Commercial Lines Insurance Pricing Survey (CLIPS) on Monday. The survey compares carriers’ pricing on policies underwritten during the fourth quarter of 2013 to those underwritten in the same quarter of 2012.

The latest 5 percent price-level increase falls below a 7 percent figure estimated for fourth-quarter 2012.

The aggregate figure of 5 percent for fourth-quarter 2013 was level with the third-quarter 2013 survey result. For individual lines of business, Tower Watson reports that price hikes were lower in the fourth quarter than those reported in the third quarter in all lines with the exception of general/products liability and excess/umbrella liability.

Without revealing specific figures, Towers Watson said that employment practices liability experienced the largest price increase year over year, with workers compensation and excess/umbrella liability also showing substantial increases.

Other key findings were:

- Prices for most lines of commercial insurance showed gains in the mid-single digits

- Specialty lines prices increased at a lower rate than standard lines.

- No line of business reported a price decrease.

- Price increases were consistent across account sizes, with small, mid-market and large accounts showing similar gains.

Turning to loss ratios, Towers Watson said that survey respondents are reporting improved loss ratios, with accident-year 2013 ex-catastrophe loss ratios estimated to be 3 points better than accident-year 2012. Offering an explanation, Towers Watson said that earned price increases are more than offsetting claim cost inflation.

Towers Watson also noted that the 3 point loss-ratio improvement builds upon estimated improvements of more 2 percent in each of the two prior years—2012 and 2011.

“Commercial insurance prices are still on the rise and have now been increasing for three full years, but we are beginning to see a moderation in that trend,” said Tom Hettinger, Towers Watson’s Property & Casualty sales and practice leader for the Americas, in a statement about the latest CLIPS update.

About CLIPS

CLIPS data are based on both new and renewal business figures obtained directly from carriers underwriting the business. CLIPS participants represent a cross section of U.S. property/ casualty insurers that includes many of both the top 10 commercial lines companies and the top 25 insurance groups in the United States.

This particular survey compared prices charged on policies underwritten during the fourth quarter of 2013 to the prices charged for the same coverage during the same quarter in 2012. For the most recent survey, data were contributed by 43 participating insurers representing approximately 20 percent of the U.S. commercial insurance market (excluding state workers compensation funds).

Source: Towers Watson

Beazley Agrees to Zurich’s Sweetened £8 Billion Takeover Bid

Beazley Agrees to Zurich’s Sweetened £8 Billion Takeover Bid  How Americans Are Using AI at Work: Gallup Poll

How Americans Are Using AI at Work: Gallup Poll  Preparing for an AI Native Future

Preparing for an AI Native Future  Modern Underwriting Technology: Decisive Steps to Successful Implementation

Modern Underwriting Technology: Decisive Steps to Successful Implementation