United States Senator Elizabeth Warren said the Securities and Exchange Commission should be vigilant in ensuring that billionaire investor Carl Icahn isn’t using his role as an adviser to the Trump administration to gain unfair trading advantages.

“I do not understand how we can have someone who continues to trade in a market and is influencing regulatory policy simultaneously,” the Massachusetts Democrat said Thursday at the Senate confirmation hearing for Jay Clayton, President Donald Trump’s nominee to lead the SEC. “I want to hear the chair of the SEC say he’s going to look into this and I hope put a stop to it.”

In December, then-President-elect Trump announced that he’d tapped Icahn as a special adviser on rules. Icahn’s “help on the strangling regulations that our country is faced with will be invaluable,” Trump said at the time.

The unusual nature of the special adviser role, Icahn’s extensive investment portfolio and some of the trades since his appointment have raised conflict of interest concerns. As Wall Street’s main regulator, the SEC plays a leading role investigating market violations such as insider trading.

EPA Administrator

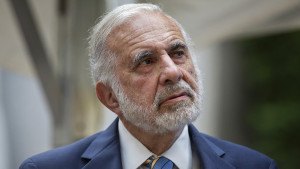

(Photo Victor J. Blue/Bloomberg )

Icahn helped choose the administrator of the Environmental Protection Agency, pressing at least three potential candidates about an obscure policy issue that affects the value of a pair of oil refineries he owns. He said he met twice with Trump’s choice to lead the agency, Scott Pruitt, and had additional phone calls prior to the selection. In February, he convinced a leading ethanol trade group to drop its opposition to the EPA policy change he’s seeking, and the group’s president said Icahn appeared to be driving government policy on theissue.

If carried out, Icahn’s advice on the EPA issue would lead to a collapse in thevalue of a type of renewable fuel credit traded by oil refineries. Icahn said this month that he was wagering on a decline in the value of these credits.

Clayton, a Wall Street lawyer who has represented banks and hedge funds, said at Thursday’s hearing that he met with Icahn shortly after being nominated to lead the SEC. Their discussion was focused on activist investing—buying shares in a publicly-traded company with the goal of gaining influence to push for changes—and Icahn’s view that such trading strategies are beneficial to markets, he said.

Clayton added that they didn’t talk about any of Icahn’s specific investments. Asked whether any trades could be deemed illicit, Clayton cautioned that insider trading is very fact specific.

Icahn said in an interview earlier this month that his conversation with Clayton lasted about 10 minutes and the two discussed the billionaire’s view that the SEC should focus enforcement actions on executives and directors responsible for wrongdoing, rather than the companies themselves. Clayton agreed with that philosophy, Icahn said. After the meeting, Icahn said he told Trump in a brief phone call that he’d made a “good choice” in picking Clayton.

A representative for Icahn didn’t immediately respond to a request seeking comment on Warren’s statements at the hearing.

Earlier in the hearing on Thursday, Clayton told senators he wouldn’t play favorites as head of the SEC and that he’s committed to going after misdeeds.

Clayton, an independent, will probably be cleared by the Senate as Republicans have enough votes to approve him. No date has been set for a full Senate vote on his confirmation as chairman.

Winter Storm Fern to Cost $4B to $6.7B in Insured Losses: KCC, Verisk

Winter Storm Fern to Cost $4B to $6.7B in Insured Losses: KCC, Verisk  Retired NASCAR Driver Greg Biffle Wasn’t Piloting Plane Before Deadly Crash

Retired NASCAR Driver Greg Biffle Wasn’t Piloting Plane Before Deadly Crash  How Americans Are Using AI at Work: Gallup Poll

How Americans Are Using AI at Work: Gallup Poll  Lessons From 25 Years Leading Accident & Health at Crum & Forster

Lessons From 25 Years Leading Accident & Health at Crum & Forster