Unpredictable and severe weather patterns are a continuous and growing concern for property/casualty insurance companies. In fact, data findings from a new study in the journal Naturedemonstrate that more “extreme rain” events can be expected in the near future, bringing higher risks of flash flooding, costing millions of dollars in damages. (“More extreme precipitation in the world’s dry and wet regions,” Nature, published online March 7, 2016.)

Executive Summary

With unpredictable weather creating more total loss auto claims, combining title procurement and auction management functions into one cohesive system can help carriers avoid costly errors and more effectively manage their claims. Once the vehicle is declared a total loss, every step of the process could be managed through one platform, allowing claims departments to focus on value-adding tasks, according to Pat Walsh of Insurance Auto Auctions.For the P/C insurance industry, it is critical to be prepared for unexpected influxes of claims. Therefore, a rapid response plan and the right infrastructure need to be in place for times when natural disasters strike. This is where a reliable and cost-effective total loss claims management process becomes a market differentiator to insurers. By combining efficiency and customer satisfaction, insurers are better equipped to manage unforeseen events that may require them to move more nimbly with fluctuating claims numbers while still being able to keep customers informed and satisfied.

By streamlining processes to simultaneously manage costs and keep customers in the loop as their claims settlements move forward, auto insurance companies are able to handle the average claims volume and scale up or down after a severe weather occurrence.

Moving Forward

The National Flood Insurance Program has said that all 50 states have experienced floods or flash floods in the past five years. According to the National Insurance Crime Bureau, Superstorm Sandy alone damaged over 230,000 vehicles, predominantly due to the salt water that surged into seaside communities, filling engines and interiors with sand and corrosive saline. Severe weather patterns and disturbances—flash floods, fallen trees and hurricanes to name a few—force hundreds of thousands of people to face the damaging aftereffects of vehicle loss every year.

According to IHS Automotive, the average age of the vehicle population has been increasing, currently sitting at 11.5 years, and is expected to increase to 11.7 years by 2018. The percentage of claims deemed a total loss increases as the vehicle population ages, according to CCC Information Services. From 2011 through 2015, over 70 percent of all total loss valuations were attributed to vehicles older than seven years. During that span, the percentage of all claims declared a total loss increased from 14.7 percent in 2011 to 15.4 percent in 2015. (“Crash Course 2016,” www.cccis.com/crash-course-2016.)

The data clearly demonstrates that older cars are more likely to experience total loss, and the impact of unpredictable severe weather on older cars further increases the chances of total loss. As more flash floods and hailstorms create large-scale total loss claims situations, it becomes increasingly important to not only ensure that your company is equipped to adapt quickly but also that your customers continue to experience a high level of satisfaction with their services—even during high-stress situations.

Given the rise in total loss percentage, it is no surprise that average length of rental (LOR)—a proxy for average length of repair—has also increased. According to Enterprise Holdings Inc., average LOR rose to 11.5 days in the fourth quarter of 2015, up 0.3 days year-over-year. Assuming a daily rental charge of $31.00, this would equate to approximately $356.50 per claim.

A higher average LOR is certainly unwelcome news, with claims departments facing constant pressure to reduce cycle times and costs in order to attract and retain customers. This is even more concerning in times when customers may be dealing not only with auto claims due to a weather-related incident but also damages to their homes—when all they want is for life to return to normalcy as quickly as possible. Therefore, it is important that every customer’s experience is seamless and timely, even in the face of surging claim rates.

According to Capgemini’s World Insurance Report 2015, throughout the insurance life cycle, claims servicing has the lowest percentage of customers with a positive experience. The report also found that customers who file an insurance claim tend to have lower positive customer experience levels than those who do not. In North America in 2014, 37 percent of customers surveyed by Capgemini reported a positive experience with auto insurance if they made a claim in the past year versus 46 percent of customers who made no claim during that same period. (Editor’s Note: Globally, in 2015, 43 percent of customers who made an auto claim had a positive experience compared with 58 percent of customers with no claims, according to Capgemini’s more recent World Insurance Report 2016.)

Unexpected disruptions—such as golf-ball-sized hail—can further impact a customer’s already adverse experience with claims servicing, as unanticipated events further illustrate the need for quality service that tackles all angles of the customer’s needs.

While a total loss claim is a stressful experience on its own, severe weather occurrences pile on additional worry for customers. With claims servicing being arguably the most important factor for customer retention, the need for P/C carriers to identify and consider a variety of options for improvement is critical.

Benefits of On-Demand Access

Managing an insurance claim is often a challenge for policyholders, even under the best circumstances—from communicating with the necessary parties to submitting paperwork correctly while also managing and understanding claim status. These potential setbacks emphasize the importance of effective and consistent communication regardless, but especially in the case of an unexpected spike in claims.

Severe weather patterns bring about the need to adapt quickly and effectively—leaving no room to fall behind on communication. A reliable self-service tool can lessen the chance of this happening. By utilizing a web-based self-service tool, carriers can give policyholders the freedom to track claims from any Internet-connected device without being required to call and connect with the claim agent or adjuster.

From downloading and submitting paperwork or photos of damage to facilitating efficient communication, the self-service approach provides better access to information, visibility of real-time status updates and a reduction in documentation errors. Overall, using on-demand technology to significantly transform the customer experience positively impacts customer satisfaction and retention while also freeing up employees to do more engaging, value-add tasks.

Mapping the Course

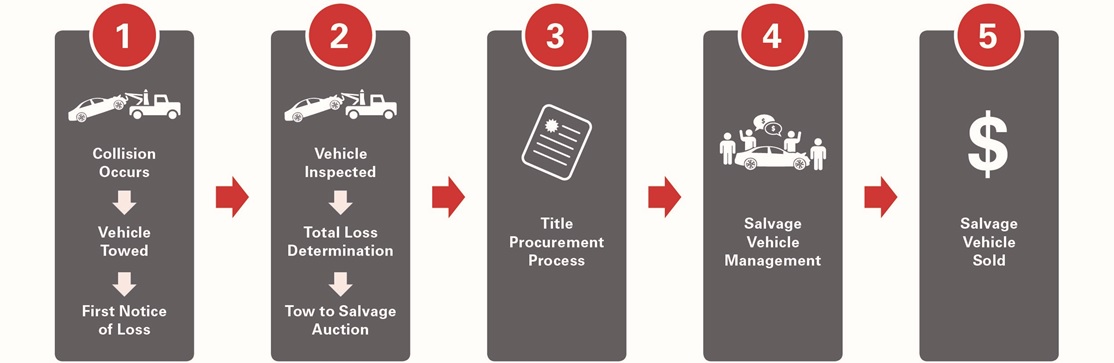

Along with allowing customers to have instant access to claims information, it is just as important to make the entire process as prompt and seamless as possible from first notice of loss (FNOL) to the customer’s claim being resolved. As unpredictable natural disasters are an ongoing hardship rather than a one-time occurrence, it is even more critical to have a steady, transparent process in place from beginning to end. In the instance of Superstorm Sandy, the disaster hit in the most densely populated area of the United States, leading to an overload of flooded cars and not enough land to support them. With a catastrophe of that magnitude, evaluating damage appropriately can be a slow and muddled process if your company is not prepared for catastrophic events. Although the process varies by insurance carrier, an average industry process will help identify pain points that may become major roadblocks in the processing of mass claims. (See accompanying figure below.)

In the case of a natural disaster, the severe weather’s impact causes an influx of vehicle claims, resulting in the towing of vehicles to a designated location. This is the point in the process where FNOL is communicated and claims representatives are deployed to inspect the vehicles. Those vehicles determined to be a total loss are then assigned and towed to a salvage auction. In the specific case of severe weather, a salvage auction partner with both a large footprint and substantial capabilities in the area can be invaluable. Particularly, in times when space is limited and chaos can take hold, direct towing to auction removes the redundancy of multiple tows.

A salvage auction partner can then either handle the entire inspection process or alternately integrate with a carrier’s existing data or current appraisal partners to ensure a seamless operation. High-resolution imagery to match the carrier’s specifications can be provided, as well as a condition report to save the expense of sending an appraiser to inspect the vehicle. Presenting the carrier with a technology-based option that manages the entire inspection process can enable fast and accurate desk appraisals that not only reduce cycle times but also digitize the progress for their customers to track online.

Procuring the Right Solution

As many claims managers know all too well, the title procurement process has a major influence on customer satisfaction, as well as employee satisfaction. From a cycle time perspective, expediting title procurement often has the greatest impact on overall efficiency. Furthermore, as severe weather patterns create inevitable spikes in claims, insurance companies are faced with more stress than ever before. Employees are left dealing with an overwhelming workload, and companies resultantly struggle to maintain the balance between ensuring efficiency and offering engaging work. Needless to say, this illustrates another significant pain point in the process.

While this is occurring, claims departments are also managing the auction process—assigning vehicles, monitoring inventory and more—through a separate system. This lack of alignment points to an obvious solution: combine the title procurement and auction management functions into one cohesive system. With all of the necessary information in one location, carriers can avoid costly errors and more effectively manage their claims. Once the vehicle is declared a total loss, every step of the process could be managed through one platform, allowing claims departments to focus on value-adding tasks. With talent representing the most important investment a P/C company can make, freeing up time for more engaging work is an appealing factor strongly valued by employees and the company as a whole.

A Road to Achievement

Insurers aim to simultaneously satisfy customer expectations, maximize employee engagement and manage costs—and this can all be made possible by concentrating on strategic options that take every step of the claims process into consideration, including unexpected fluctuations in claims. Since weather patterns and the resulting upticks in claims can be so unpredictable, it is no wonder that the P/C industry is turning to partners who are focused on innovating the entire claims management process. Companies with weather-pattern tracking capabilities and full-service technology platforms are providing the ability to implement procedures that can be easily ramped up or down post-catastrophe. Auto insurance companies must take action now to stay competitive by getting ready for the worst case scenario and being better prepared to handle the volatility that comes with severe weather.

AIG, Chubb Can’t Use ‘Bump-Up’ Provision in D&O Policy to Avoid Coverage

AIG, Chubb Can’t Use ‘Bump-Up’ Provision in D&O Policy to Avoid Coverage  Earnings Wrap-Up: AXIS Expanding Insurance Biz, Shrinking Re Book

Earnings Wrap-Up: AXIS Expanding Insurance Biz, Shrinking Re Book  Chubb CEO Greenberg on Personal Insurance Affordability and Data Centers

Chubb CEO Greenberg on Personal Insurance Affordability and Data Centers  Nearly 26.2M Workers Are Expected to Miss Work on Super Bowl Monday

Nearly 26.2M Workers Are Expected to Miss Work on Super Bowl Monday