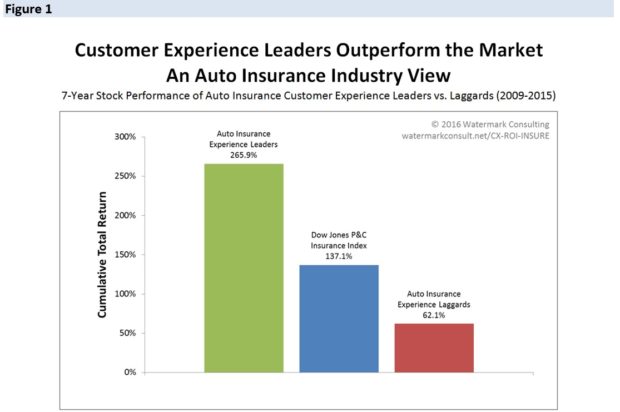

The difference between companies that deliver a great customer experience and those that deliver a below-average customer experience has always been clear regardless of the industry served.

Executive Summary

Understanding the relationship between a company’s customer satisfaction performance and its financial results allows executives to make better decisions on the investment of resources for the benefit of owners and members, argues J.D. Power’s Jessica McGregor. Here, she presents results of a J.D. Power analysis of the links between underwriting profit and customer satisfaction indices, along with a Watermark Consulting analysis of the relationship between customer satisfaction and stock price performance.A great customer experience is just as important for insurance companies as it is for companies like Amazon and Google.

J.D. Power’s cross-industry research demonstrates that companies that deliver the best customer experience also end up with the greatest financial performance. Insurance executives must balance profitability, investments in operations and customer satisfaction improvement initiatives, as moving the level on one can significantly impact the others.

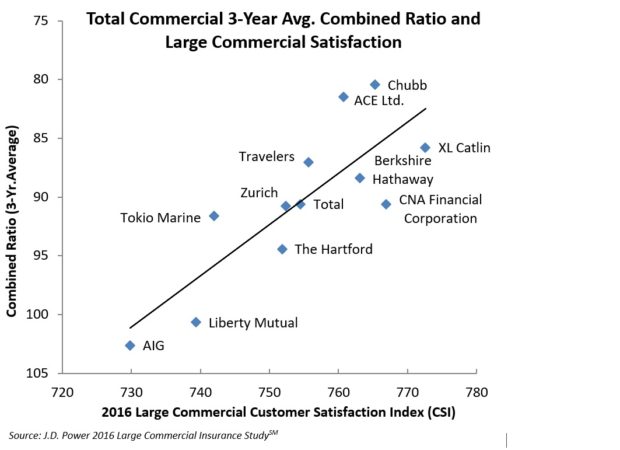

Commercial Insurance Satisfaction and Profit

Rates across the U.S. commercial property/casualty insurance market continued to decline in 2016, according to MarketScout, the Council of Insurance Agents and Brokers and other sources. Lower rates in commercial property, general liability and workers compensation contribute to the overall decline. In these soft market conditions, insurers have focused on more disciplined underwriting and risk management to improve their loss ratios. In 2014 and 2015, total commercial lines loss ratios were at the lowest levels over the past six years, while the commercial lines expense ratio has remained relatively constant across the same time period, according to data compiled from J.D. Power’s Insurance Performance Portal.

In the “J.D. Power 2016 Large Commercial Insurance Study,” XL Catlin earned the highest customer satisfaction score and one of the best combined ratios of the carriers profiled. The biggest customer satisfaction distinguisher for XL Catlin was its ability to provide a flexible program design and implementation at a fair price to customers. XL Catlin achieved this customer satisfaction success while maintaining a profitable combined ratio.

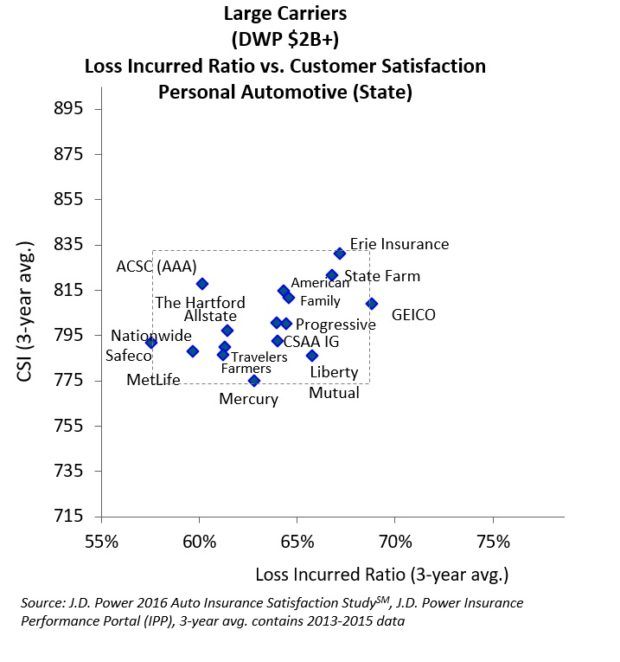

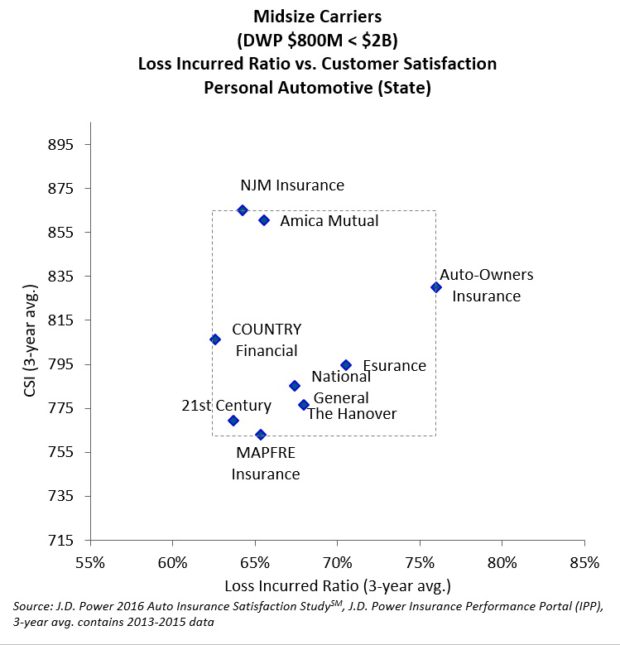

Personal Lines Satisfaction and Profit

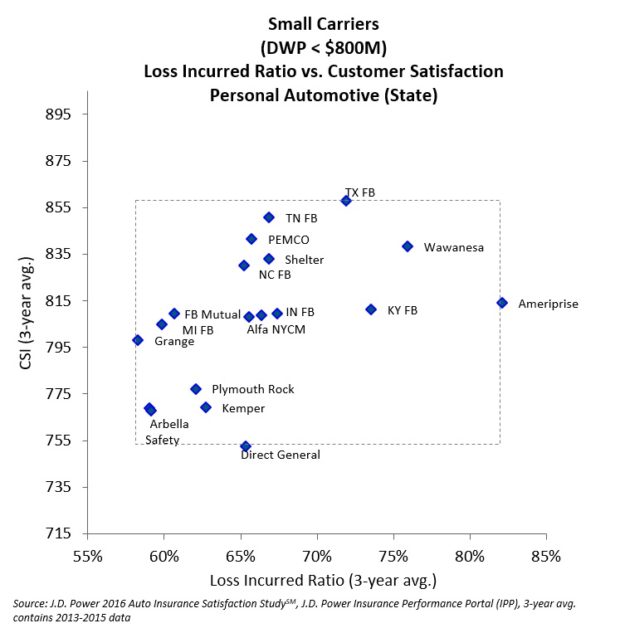

This may be because they are a more homogenous group in terms of their mix of business than are smaller insurers. It appears that to gain great size, a carrier must accept a mix of business that mutes or limits specialized differentiation in both overall risk and customer type. The range of the loss incurred ratios from highest to lowest is only 11 percentage points among the larger insurers compared to 24 percentage points among the smaller insurers.

The Right Balance

Looking across J.D. Power P/C insurance satisfaction studies shows that insurer profitability and customer satisfaction are linked. Insurers have many levers to choose from when balancing investments in operational day-to-day activities, operation upgrades, technology, staffing and customer satisfaction priorities. The fact that P/C insurers with the highest levels of customer satisfaction also have the highest levels of profitability and revenue suggests that this connection should be capitalized upon. However, executives must determine how moving a lever on customer satisfaction could impact profitability and vice versa.

Executives need to determine the incremental value created by customer satisfaction initiatives relative to other uses of their company’s resources. The starting point would be to get a clear picture of where the company stands on both customer satisfaction and financial results over time and relative to peers. Knowing where their firm currently stands on these measures provides a foundation for determining if it would be in the best interest of their company’s profitability and stock performance to push for higher customer satisfaction levels, or if their current levels are sufficient.

Many executives think of customer satisfaction as a “soft” measure of performance. The reality is that there is a strong relationship between customer satisfaction and “hard” financial performance measures. Understanding the relationship between a company’s customer satisfaction performance and its financial results allows executives to make better decisions on the investment of resources in the operations that benefit owners/members. This understanding of customer satisfaction and financial performance will be all the more critical if the industry starts to shift to a firming or hard market pricing environment.

Winter Storm Fern to Cost $4B to $6.7B in Insured Losses: KCC, Verisk

Winter Storm Fern to Cost $4B to $6.7B in Insured Losses: KCC, Verisk  AIG, Chubb Can’t Use ‘Bump-Up’ Provision in D&O Policy to Avoid Coverage

AIG, Chubb Can’t Use ‘Bump-Up’ Provision in D&O Policy to Avoid Coverage  Lessons From 25 Years Leading Accident & Health at Crum & Forster

Lessons From 25 Years Leading Accident & Health at Crum & Forster  RLI Inks 30th Straight Full-Year Underwriting Profit

RLI Inks 30th Straight Full-Year Underwriting Profit