What makes a good chief financial officer?

The answer varies depending on whether you ask leaders of finance themselves, the chief executive officers of their companies or executive recruiters. And all three groups reveal keys to success that are different for CFOs of insurers vs. other types of companies, for global insurers vs. U.S. insurers, and for large public companies vs. smaller mutual carriers.

Executive Summary

“Renaissance CFO” is the term KPMG uses to describe the global innovators CEOs are looking for in their finance leaders. But industry experience and a public accounting background are still other items insurance company CFOs have on their résumés.Attention to detail, big-picture strategic thinking, collaboration and partnership were the personal traits that we heard from a small sample of CFOs of global property/casualty insurers that we profiled in a special feature of Carrier Management’s Q2 2016 edition (publishing later this month). And their backgrounds reveal years of professional experience in the insurance industry, prior stints at public accounting firms, as well as involvement with operational transformations and with vetting and implementing strategic combinations—mergers and acquisitions.

Erin Hamrick, a partner with Sterling James, a New York-based insurance industry executive search firm, said that it’s tough to break in from another industry. “Given the complexities in insurance from a reinsurance and accounting perspective, especially in a public environment, relative to [an industry like] retail banking, for example, there’s a fairly steep learning curve. It’s not to say that you can’t do it, but I’d be hard-pressed to think of anyone that has made the transition successfully,” she told Carrier Management, noting that CFOs also need to build relationships with the CEOs and the investment community.

Hamrick also struggled to think of any CFOs of large public insurers who didn’t start in public accounting. Running down the names of several P/C insurance CFOs, Hamrick noted that many weren’t just previously partners at the Big Four firms, they also headed up the local or national insurance industry practices for their firms. “They all started in public accounting and have risen up through their organizations because they do become that trusted right hand to the CEO…As their organizations have grown, the CEOs and CFOs have grown together,” she said.

What business experiences do the CEOs think are most beneficial for the leaders of their finance teams?

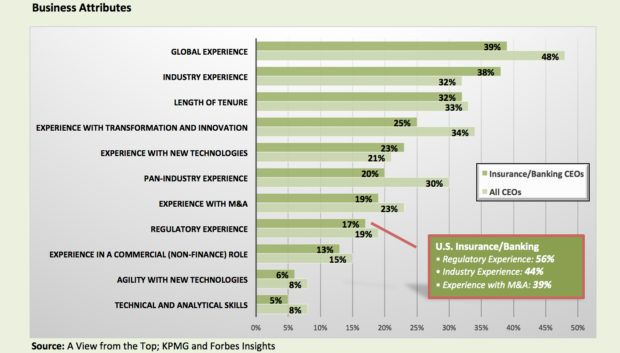

“Having industry experience is very important, and having global experience is considered the most important,” noted Gary Reader, global head of Insurance for KPMG, summarizing the results of a survey CEOs conducted late last year. CEOs in the insurance and banking industries ranked global experience and industry experience above other CFO business qualifications KPMG asked about, according to a report on the survey findings, “A View from the Top,” published late last year.

“What is interesting is that having experience with transformation and innovation, along with experience with new technologies, is seen as more important by the CEO than regulatory experience,” Reader said, analyzing the results for the insurance and banking industries.

“This is likely a result of the significant change that is underway in the sector, primarily driven by new digital technologies, the Internet of Things and changing customer demands. I suspect that many CEOs look at regulatory experience as table stakes for their CFO—it is something they are just supposed to have vs. a competitive advantage,” Reader said.

The Bigger Picture—Across Industries

In fact, “global experience” and “experience with transformation and innovation” topped the list when KPMG tallied the responses of 549 CEOs from 11 different industries at organizations with annual revenues of at least $500 million around the globe. “Those far outranked and superseded anything related to specific industry knowledge or specific functional or technical skills,” Morris Treadway, global head of Financial Management at KPMG, said on a webinar about the survey results. (See related article, “Co-Pilots in the C-Suite: How CEOs View CFOs,” for more survey results.)

“Organizations are in a state of continuous change, and the CFO needs to be able to understand and have experience beyond the finance function, identifying areas for growth and operational excellence across all business domains,” KPMG said, interpreting the finding in its report. “This requires a range of skills from the foundation and basics of the finance function to a strategic level with a focus on the outside world.”

With the particular emphasis on worldliness and innovation, the picture painted by all the responses is one of “Renaissance CFO,” KPMG said.

“We didn’t come up with the term ‘Renaissance CFO’ because we want to put a new, fancy consulting twist out there that we can market. It has meaning behind it,” Treadway said. “Renaissance refers to a cultural rebirth. That’s what we’re talking about,” he said, insisting that CFOs need to change with a changing world. “It starts with a different mindset.”

“How do I have a different mindset? How do I look at the organization differently? How do I play my role differently across that organization? How do I change my own, personal culture and how I approach this role to not just build on what I know from the past but embrace the technology of the present and imagine the innovation of the future?”

These are all questions CFOs need to be asking themselves, he said. “If you don’t do it, others will…You’ve got the competition that’s coming in faster, nimble. And the technology isn’t just an idea anymore. It’s here to stay. The cloud, big data, all those are proven and here to stay,” he said.

“The ‘Renaissance CFO’ must absolutely think and act beyond finance and also think and act beyond regulatory issues or compliance areas,” Treadway said.

David Brown, global lead for KPMG’s Shared Services and Outsourcing Advisory, noted that CFOs still remain the “gatekeepers for financial planning” for their organizations. But now that means they have to critically evaluate emerging technologies that are coming in for investment. “It’s not just about understanding the numbers,” he said, explaining that operating models and service models—not just within finance but for all parts of the business—are more related to automation, cognitive computing and data analytics. “All those things continue to drive efficiencies and effectiveness for the entire operation.”

Emerging technologies call for critical evaluation by the CFO, Brown believes. “What’s the real business value actually that connection brings? Which ones are the ones that are really going to bring value to the organization versus what is still sitting as a hype? I see that as an extremely important role for the CFOs in understanding what are the innovations, technologies and emerging trends in that space, and that’s where we see more focus ongoing,” he said.

Treadway added: “Traditionally, we’ve seen the CFO take a primary role around driving transformation [as] relates to the back-office processes. Now, we’re seeing the CFO partnering with the CEO and COO and other C-suite officers to really drive enterprise transformation across front-, middle- and back-office processes. That’s really key for the CFO to embrace that challenge and do that with balancing the needs of efficiency while still creating a competitive advantage.”

One Size Doesn’t Fit All

Breaking down the survey results by region and industry, however, KPMG found that CEOs from U.S.-based financial services firms actually ranked regulatory experience, industry experience and experience with M&A as the top three business attributes for valued CFO partners—above global, transformation experience or familiarity with new technology.

And regional differences emerged as well. While 48 percent of all surveyed CEOs said global experience is the most important business attribute for CFOs, European CEOs value global experience even more than their U.S. counterparts across industries—60 percent for Europe compared to 42 percent for the U.S.

“European markets are nowhere near the size of an American market, and so there’s a scale point here,” Reader said, suggesting one explanation for the difference. “European companies have to look outside their local markets to grow, [but] you can be a very large domestic player in the Americas and not have to go outside your borders.”

Hamrick noted that the right stuff for CFOs will also change on the life-cycle stage of a particular company and the business environment in which it operates.

If the market is such that the executive mantra is “grow, grow, grow, then the ‘bean-counter CFOs’ are out and the ‘MBA-finance-strategist CFOs’ are in,” she said. On the other hand, when statements like “We need to look at costs” or “We need to ratchet back,” better summarize the corporate goals of an organization, “then all of a sudden the CFOs with MBAs are out and those with more discipline—with a CPA [designation] and public accounting background—are in,” she added, noting that this is true across all industries, not just insurance.

In spite of all the discussion about changes impacting the insurance industry, Hamrick noted that even at the present moment—when growth is the focus at many P/C insurers—one constant tends to be the CFO. “For larger companies, there really hasn’t been a lot of turnover in CFOs,” she said, contrasting the situation for small firms (those $1 billion and below) where the name on the plaque on the CFO’s office does change quite often.

Company type is a factor too, she said, noting that while CEOs may call the shots on who fills the CFO slot in a large public company, for a startup backed by private equity, investors will be very involved in the CFO hire. The CFO selection also tends to be very driven by the CEO at smaller mutuals, but these CEOs also “tend not to hire someone exactly like themselves,” she said. “They’ll want complementary skills.”

Getting Personal

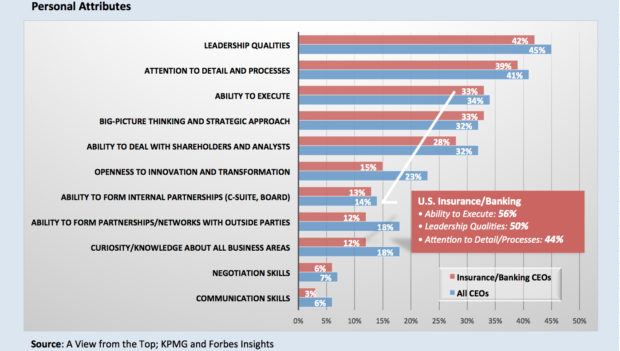

As for personal attributes, CEOs surveyed by KPMG ranked leadership qualities above everything else—in the insurance industry and in other industries as well.

“Silos need to be broken down if insurers are going to realize all the benefits to be gained from new technologies. The only way to do this well is with strong leadership,” Reader said.

Big-picture thinking, the ability to execute and attention to detail also rank high on CEOs’ lists of personal qualities they think are important to successfully fill the CFO role. Traits like communication and negotiation skills appeared much farther down the list.

“If you think about it, at that level—that CFO level—all these men were practice leaders, partners in charge. In order to get to that position, they weren’t introverts,” Hamrick said. “They all have personalities…To get you to that spot, you have personality. You’re comfortable with who you are. You’re a great communicator. You have great leadership skills because the partnerships elected you. Not only are you this internal person that is well regarded, but you have great client relationships as well,” she said, mainly speaking of former audit partners who have landed CFO spots at large publicly traded insurers.

CEOs for smaller mutuals may also not put communication, negotiation or even leadership on their lists, she suggested, but not because those are givens. “Depending on the size of the company, that CFO is expected to be fairly hands-on and know everything that’s going on financially in the company. There’s a big difference between being a $500 million company and a $10 billion” global organization, she said, also noting that financial professionals who started in public accounting are often not the best fit for a small mutual.

“At $500 million, you probably are expected to know just about where every single dollar is” rather than managing a team, she said. “The job is more about doing than being the advisor to the CEO,” she said, adding that CFOs of small companies and mutuals also aren’t worried about managing investor perceptions.

AIG, Chubb Can’t Use ‘Bump-Up’ Provision in D&O Policy to Avoid Coverage

AIG, Chubb Can’t Use ‘Bump-Up’ Provision in D&O Policy to Avoid Coverage  Earnings Wrap-Up: AXIS Expanding Insurance Biz, Shrinking Re Book

Earnings Wrap-Up: AXIS Expanding Insurance Biz, Shrinking Re Book  Nearly 26.2M Workers Are Expected to Miss Work on Super Bowl Monday

Nearly 26.2M Workers Are Expected to Miss Work on Super Bowl Monday  Insurance Groundhogs Warming Up to Market Changes

Insurance Groundhogs Warming Up to Market Changes