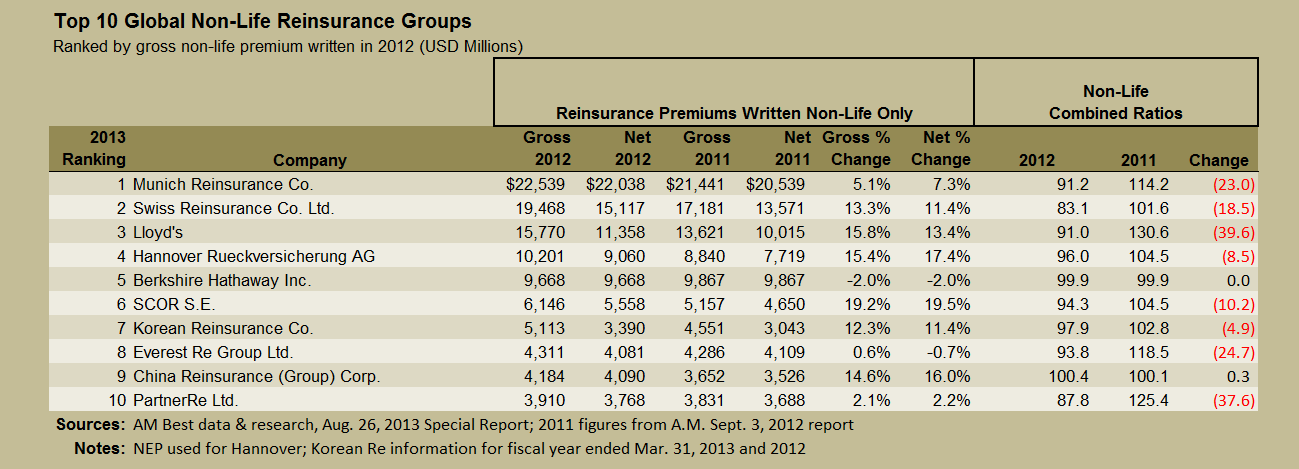

There is only one new name on the latest ranking of the top 10 global non-life reinsurers, with China Reinsurance (Group) Corp. replacing Transatlantic Reinsurance Co. on a list extracted from an A.M. Best analysis.

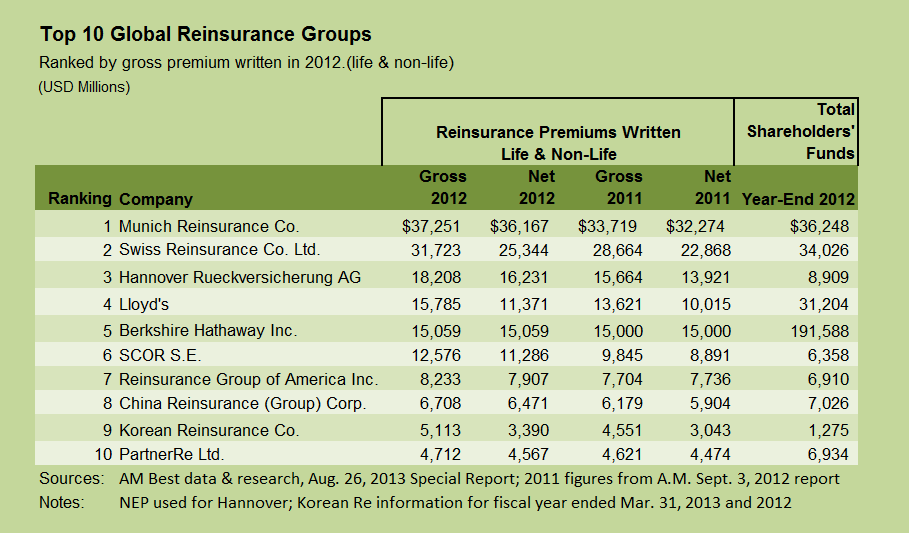

The rating agency’s special report on the reinsurance sector, which was published on Monday, contains a listing of the top 50 global reinsurance groups, ranked based on 2012 gross premiums written for life and non-life business taken together.

Extracting just the non-life gross premiums for 2012 and comparing those to 2011 non-life gross premiums presented in a prior A.M. Best report (published last year on Sept. 3, 2012) reveals China Reinsurance’s repositioning.

With $4.2 billion of non-life gross premiums written in 2012, China Reinsurance moved up from 11th to ninth place.

Absent from the top 10, Transatlantic Re, with non-life gross premiums dropping 11.3 percent to $3.6 billion in 2012 from $4.0 billion in 2011, now ranks 11th below PartnerRe Ltd.

The A.M. Best report, which focuses on total gross reinsurance premiums—life and non-life combined—highlights the movement of Lloyd’s to overtake Berkshire Hathaway. With total reinsurance premiums growing 16 percent, Lloyd’s secured fourth place, moving up from fifth in 2011.

While Best attributes Lloyd’s reinsurance premium growth to treaty reinsurance and facultative property, Berkshire Hathaway slipped to fifth place, in part due to the end of its 20 percent quota-share agreement with Swiss Re, the A.M. Best report said, adding that the full impact of that change was tempered by new opportunities that Berkshire found in Asia after the catastrophe losses of 2011.

Considering just non-life reinsurance premiums, both Lloyd’s and Hannover Rueckversicherung AG managed to overtake Berkshire, as Berkshire’s non-life gross premiums fell 2.0 percent, while Hannover saw a 15 percent jump in non-life premiums in 2012.

Also on the non-life side, other notable upward moves in rank below the top 10 include:

- Odyssey Re Holdings Corp., with non-life gross premium growing 16.1 percent to more than $2.0 billion in 2012, moved up five spots to 15th place from 20th in 2011.

- Tokio Marine Holdings Inc., with nearly a 26 percent jump in non-life reinsurance premiums, also advanced five spots to 18th place with just under $2.0 billion in non-life premiums for 2012.

- Arch Capital Group Ltd. also took a five-spot leap, moving into the 27th spot with non-life gross premiums written of $1.2 billion for 2012—28 percent higher than the level just under $1 billion ($999 million) for 2011.

In its report, A.M. Best provided more insight into the advances for Arch and Tokio Marine, noting that Arch Capital’s growth is attributable mainly to premiums from “other” lines, which include mortgage reinsurance and significant growth in non-cat property/casualty reinsurance, while Tokio Marine continued to focus on growing international business, particularly in commercial specialty and in standard reinsurance lines in the United States.

Moving in the opposite direction on the non-life ranking were AXIS Capital Holdings, with a 7 percent decline in gross non-life premiums pushing the company out of the top 20, and Validus Holdings, Ltd., sinking to 31st place from 26th a year earlier on a 3 percent decline in premium.

In addition to AXIS and Validus, A.M. Best also took note of single-digit premium declines for American Agricultural Insurance Co., Maiden Holdings and MS&AD, as well as a double-digit drop for Platinum Underwriters—all of which the rating agency attributes to the cycle management and continued discipline under current market conditions.

A.M. Best’s top 50 ranking displays non-life combined ratios and capital levels by reinsurer.

Nearly every non-life reinsurer saw combined ratios decline in 2012, and the rating agency reported that the aggregate reinsurance combined ratio for 2012 was 92 for reinsurers in the United States, Bermuda, Europe (the “big four”) and Lloyd’s, compared to 107.4 for 2011.

For the same group of global reinsurers, the five-year average combined ratio was 95.9, and it was 89.3 for the first half of 2013, Best reports, also noting that favorable reserve development has cumulatively contributed $37 billion to the bottom line for the segment.

The A.M. Best special report also includes a discussion of the impact of the influx of third-party capital into the reinsurance industry and separate analyses of reinsurance market conditions in Brazil, MENA, Asia and the Lloyd’s market.

RLI Inks 30th Straight Full-Year Underwriting Profit

RLI Inks 30th Straight Full-Year Underwriting Profit  Five AI Trends Reshaping Insurance in 2026

Five AI Trends Reshaping Insurance in 2026  Winter Storm Fern to Cost $4B to $6.7B in Insured Losses: KCC, Verisk

Winter Storm Fern to Cost $4B to $6.7B in Insured Losses: KCC, Verisk  Berkshire-owned Utility Urges Oregon Appeals Court to Limit Wildfire Damages

Berkshire-owned Utility Urges Oregon Appeals Court to Limit Wildfire Damages