Continuing a series in which we evaluate and discuss the financial performance and operating results of the InsurTech carrier trio of Lemonade, Root and Metromile, we find continued growth and improvement of loss ratios.

With permission, Carrier Management is republishing this analysis originally posted on the LinkedIn pages of Matteo Carbone or Sri Nagarajan.

But it looks to us as though the trio faces a pricing war to continue growing top lines, and also that the three carriers are missing an edge and story that will help them gain sustainable competitive advantage over the Goliaths of the insurance world—the incumbent carriers they seek to disrupt.

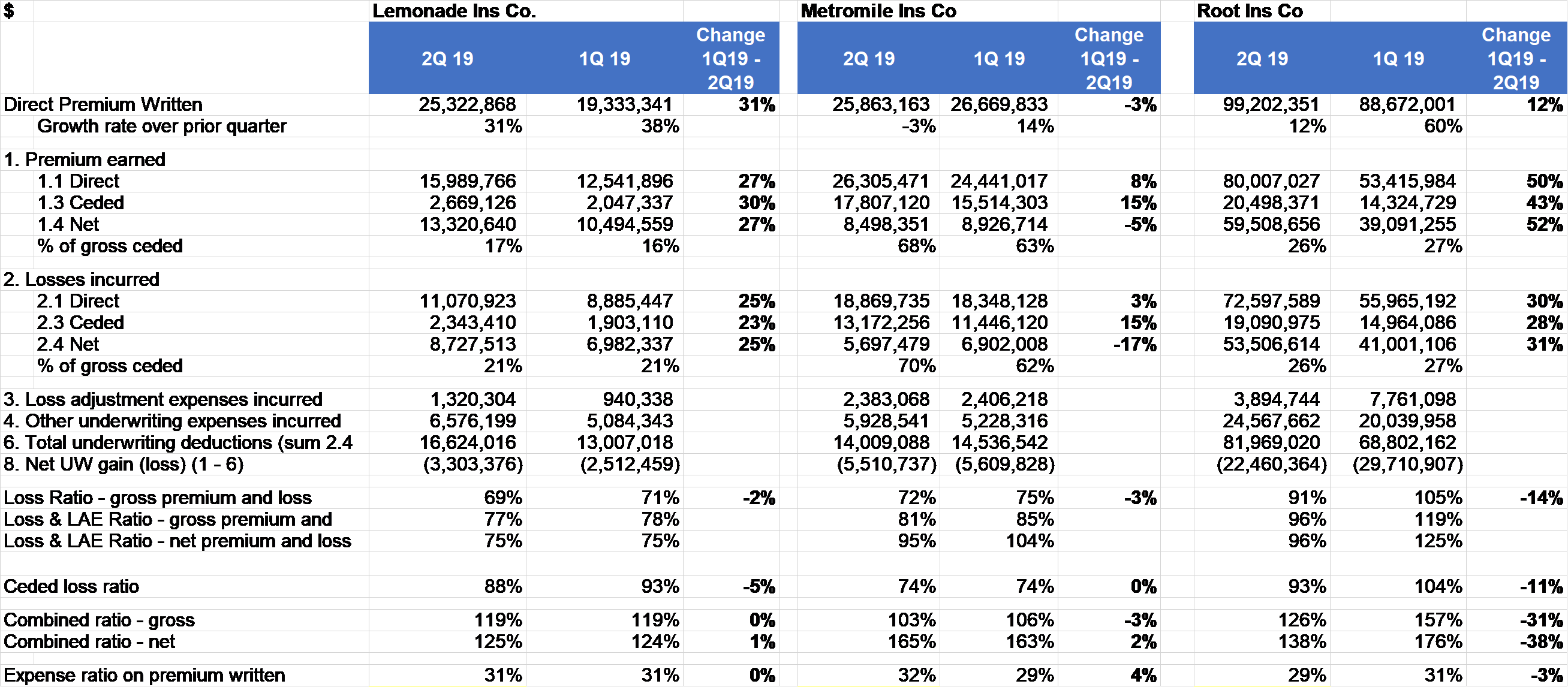

The results presented on the chart below suggest that all three firms are focusing heavily on containing and improving their loss ratios. Metromile and Lemonade continue to have a relatively stable loss ratio, while Root has drastically improved their loss ratio, compared to the prior quarter. At 91, Root delivered a better result compared to the 105 in first-quarter 2019, but the company still has some distance to go before they get closer to Lemonade or Metromile in terms of quality performance.

Note: the expenses ratios are not significant because part of the expenses are paid by the parent companies and not reported on the Yellow Books.

It is a Pricing War

We believe the InsurTech trio is facing a pricing war. After a robust first quarter, in which all three players displayed robust growth rates, second-quarter 2019 presents a different story. We find the most interesting perspective by looking at the performance over the last year and half.

Let’s go back to look at the top-line numbers. Root and Lemonade registered a net increase in direct premium written compared to first-quarter 2019. Metromile on the other hand registered a marginally lower DPW than what they earned in the first quarter.

(Editor’s Note: After Carbone and Nagarajan wrote this article, Root announced the launch for renters insurance for its auto customers and non-auto customers as well.)

Having looked at the top line, let’s switch our attention to the loss ratios. For an insurance carrier, the loss ratio is really the litmus test that assesses the strength and quality of the top-line numbers. Loss ratio is a fundamental insurance number, and the fact that all three players have improved this crucial metric is a sign of increased maturity for the “not so” fast growing InsurTech trio.

All three players have improved their loss ratios compared to the prior quarter. This tightening of loss ratio is a positive sign and bodes well for the trio. Of the three, Root continues to have the highest loss ratio at 91, suggesting that between new sales and renewal they are still underpricing the risks they have underwritten.

Loss Ratio (gross premium and loss) shown above. Loss & LAE Ratios shown below.

Missing an edge and story

In our last article talking about InsurTech direct to consumer (DTC) as a “price game”, we highlighted how InsurTech carriers have not been able to make customers fall in love with something they offer other than “saving money.” We noted that tribes have not developed around these players as they have for FinTech unicorns (like UK mobile banker Monzo). On this point, we were obviously going beyond the tribe of insurance leaders and practitioners that has fallen in love with Lemonade.

In our last article talking about InsurTech direct to consumer (DTC) as a “price game”, we highlighted how InsurTech carriers have not been able to make customers fall in love with something they offer other than “saving money.” We noted that tribes have not developed around these players as they have for FinTech unicorns (like UK mobile banker Monzo). On this point, we were obviously going beyond the tribe of insurance leaders and practitioners that has fallen in love with Lemonade.

We would like to share some thoughts on the business models of these three full-stack carriers, investigating where and how their approaches might both enable and impede them from the perspective of gaining a sustainable competitive advantage. In other words, what might be the proverbial sling that the InsurTech Davids can use against the entrenched Goliaths of State Farm, GEICO, Progressive, Allstate, etc.

Considering the economics of an insurer, you have three areas where you can obtain a competitive advantage that can allow financing this kind of “pricing war”:

Investment income

Investment income, even in the current environment of low interest rates, represents the main source of profit for the U.S P/C Insurers. A recent report by Credit Suisse has pointed out how “over the last five years, approximately 90 percent of the industry’s profits have been generated from the investment income (float) component of the income statement.” In 2018, U.S. P/C insurers generated $53 billion of net investment income, representing 8.6 percent on the premium written.

All three InsurTech carriers were far from this investment performance in the same period.

There is probably some additional investment income, obtained from investing the cash received by their investors, hidden in the parent companies income statements. As of today, however, the return obtained from investing float is clearly a competitive disadvantage for the InsurTech players as they try to play a pricing war with incumbents.

Loss ratio

As discussed in a previous article, the loss ratio is the key measure of the technical profitability of an insurance business. The U.S. P/C market showed $366 billion in net losses incurred in 2018, which means almost 61 pure loss ratio (excluding loss adjustment expenses). Can any InsurTech attribute allow Metromile, Root, or Lemonade to have a competitive advantage on the loss ratio?

Metromile and Root are telematics-based auto insurers. Co-author Matteo Carbone is a fan of the using telematics data on the auto business, and an evangelist of these approaches through his IoT Insurance Observatory, an international think tank which has aggregated almost 60 insurers, reinsurers, and tech players in North America and Europe.

Based on the Observatory research, four value creation levers have been the most relevant in telematics success stories:

Metromile and Root are mainly using telematics for pricing purposes.

(Editor’s Note: Carbone and Nagarajan wrote this article before Root announced the launch for renters insurance for its auto customers and non-auto customers as well.)

By contrast, the Metromile pay-per-mile approach is constantly monitoring the driver for the entire duration of the policy, which is the necessary foundation for those telematics value creation levers. As of today, the only area where Metromile seems to exploit the value of telematics data is for claim management. The biggest limitation for Metromile seems to be the nature of the pay-per-mile business that has found only a limited market fit given the niche nature of the mileage-based approach.

See related article, CEO Interview: Metromile Shaking Up the Auto Insurance Industry With a Lifestyle Product, for Metromile CEO Dan Preston’s view of Metromile’s competitive advantages and positioning in the market.

So, we think that both the players are still far from the telematics best practices currently represented by a few incumbents. However, the evolution of their telematics approaches can generate them some competitive advantages against many other incumbents which are less advanced on this topic.

Turning to Lemonade, the possibility of generating a better loss ratio than other renter insurers hinges on the carrier’s famous focus on behavioral economics and the tentative to influence the human behaviors with the iconic giveback within their storytelling. Everyone (among insurance executives) remembers Lemonade for the fixed percentage of premium it charges—the iconic slice of pizza—while all the rest is used to ensure they will always pay claims, and whatever is left, goes to charities. As of today, nothing in their loss ratio show benefits achieved for this approach. We ask you our readers to think if you would avoid submitting a claim or resisting the urge to file an inflated claim (asking more of is due, an unfortunate reality in our industry) because “whatever is left goes to charities.”

We find it hard to believe that the fundamental economic incentives will invert to move from individual gain to “community” gain. Ancient Latins had a saying that applies—”Homo homini Lupus.”

Moreover, a recent comment by Lemonade CEO Dan Schrieber suggests that “AI may have played a role in higher loss ratios.” (Source: “AI can streamline insurance claims—but at what cost?” by Oliver Ralph, Financial Times, Sept. 23 2019) The increase of straight-through processing combined with a vast reduction or elimination of legacy checks and balances can increase the risk of fraud. Co-author Sri Nagarajan and his team at Camino Ventures, a Charlotte N.C.-based AI/ML fintech, believe that this is a natural phenomenon with respect to AI/ML adoption. Ilich Martinez, Co-Founder and CEO at Camino Ventures says “Companies need to take a holistic view of AI/ML integration into business processes and business rules. Piecemeal or spotty inclusion of advanced AI/ML capabilities can be akin to installing a Tesla induction motor on a gas guzzler. It simply does not work.”

Nagarajan expects to see a spurt in fraudulent claims in certain domains where autonomous claims management is introduced or expanded. As bad actors try to game the system, it is imperative that insurance companies expand the fraud detection models and be willing to enter a phase of continuous and strenuous test and learns.

Eventually, usage of AI/ML can be crucial to achieving better administrative cost positions but the path to that destination will not likely be a straight line to success.

Administrative costs

The U.S. P/C markets showed costs that represent 37 percent of written premiums in 2018 (of which 10 percent was loss adjustment expenses). Unfortunately, we are not able to see anymore the real costs of Root and Lemonade, as part of the costs are on the income statement of their parent companies. Efficiency—if it will ever be achieved by these InsurTech startups—can be a way to compete and to sustain a pricing war, however scale also matters.

We ask whether the AI-driven approach of a player such as Lemonade will become a key competitive advantage against the current established incumbents? Can an early, extensive and immersive adoption of AI/ML provide InsurTech leaders and entrants a competitive edge? Will incumbent leaders be fast followers or late adopters in a domain as critical as AI/ML?

We are already seeing the incumbents make early and deliberate moves to gain an AI/ML capability advantage. From domains like telematics to computer-vision enabled image processing for claims processing, we see that Goliaths are not waiting to be left behind. They are quickly moving from a “test and learn” approach to wide-scale adoption of numerous AI/ML capabilities, and are finding early success. This adoption is further accelerated by nimble, agile fintech and InsurTech enablers, who help industry leaders quickly move from opportunity to outcomes. Given these market conditions, we believe that advanced AI/ML capabilities would give InsurTech an edge only against incumbents who are less focused, capable or invested in integrating InsurTech solutions into their value chain.

In short, we believe the current business models are not yet showing any clear competitive advantages that can make pricing wars sustainable for the three full stack InsurTech carriers. However, they have a lot of cash combined with highly talented teams that can experiment and find new ways to build moats and forts to gain competitive advantages.