In 2022, the U.S. private auto insurance industry reported its worst underwriting results in over two decades, according to a S&P Global Market Intelligence analysis.

The net combined ratio for the sector — when excluding policyholder dividends — was 111.8. That figure was 11 points higher than 2021’s ratio.

The 2022 net combined ratio topped the previous high of the past 27 years: 110.4 seen in 2000, according to the S&P review of available annual regulatory statements.

The motor vehicle insurance consumer price index soared by 15.5 percent year-over-year in April — more than three times the overall CPI and the highest such increase since 1977, when adjusting for the one-time impact of COVID-19 premium rebates.

“Because underwriting results were so poor in 2022, consumers can expect to see significant increases in their higher auto insurance premiums for at least the balance of 2023, and in some cases into 2024,” said Tim Zawacki, Principal Insurance Analyst, S&P Global Market Intelligence.

Key Highlights from the Analysis

Progressive Slides into Second

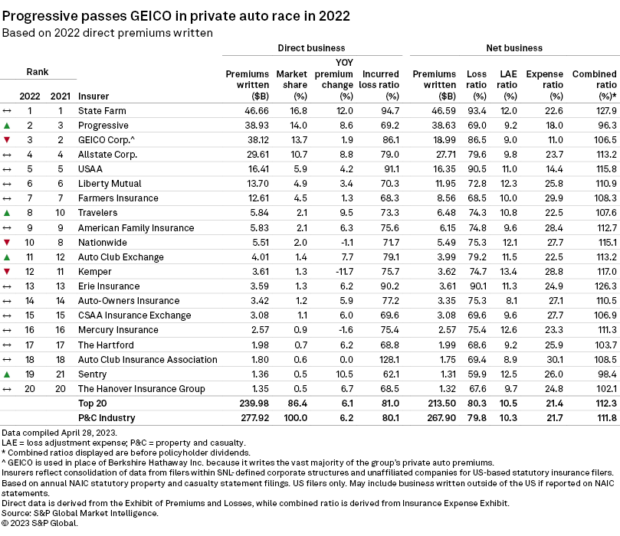

State Farm reported a private auto combined ratio of 127.9 in 2022, which was the highest ratio among the 20 largest private auto underwriters.

S&P said State Farm remained the largest U.S. private auto insurer based on 2022 direct premiums written, but among notable changes to the top 20 was Progressive’s move ahead of GEICO into second place. Progressive was one of two auto insurers with a combined ratio below 100 in 2022.

Also, Travelers and Nationwide switched spots from the prior year.