View this article online: https://www.carriermanagement.com/news/2023/03/09/246139.htm

2022 In Review: It Was Bad

March 9, 2023

The year 2022 is in the books for most U.S. property/casualty insurers as the days tick down to statutory filing deadlines. Putting the numbers together, AM Best revealed just how bad the aggregate results looked overall.

The rating agency’s market segment report for the U.S. P/C insurance segment, released on Tuesday, delivered these takeaways for the year that saw inflation soar to a 40-year high and included the second-costliest catastrophe event on record:

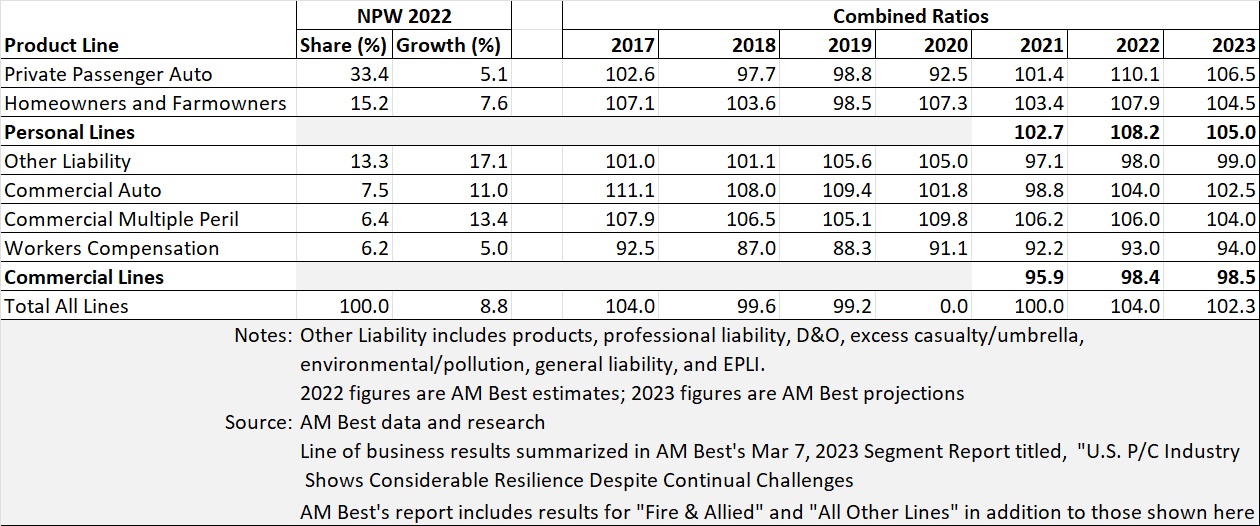

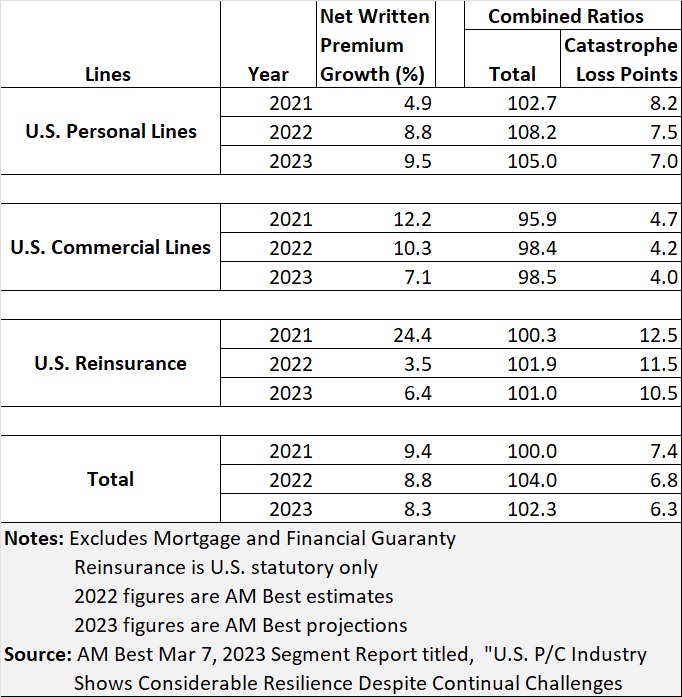

- The overall 2022 combined ratio is estimated at 104.0, exactly 4 points higher than 2021, and matching the 104 combined ratio of the last year that came in below breakeven—2017.

- Estimates of U.S. catastrophe losses are on track to exceed $90 billion, with $50-$65 billion from Hurricane Ian making it the second highest event ever, the report said, attributing the historical record information to Swiss Re.

- Catastrophe losses contributed 6.8 points to the industry overall combined ratio. That’s on par with the 7.0 point average over the prior five years (2017-2021), with 2017 showing the highest cat contribution (9.8 points) of the period. The report notes that this is a change from prior years, citing a 5.7 point average from 2009-2013.

- While pricing momentum continued into 2022, driving an 8.8 percent jump in net premiums for the year, that was down from 9.4 percent in 2021.

- The 4.0-point deterioration in the combined ratio was almost entirely attributable to a high loss and loss adjustment expense ratio. “The industry’s underwriting expense ratio is expected to remain relatively flat [at 26.4] despite the increase in [premium] volume, as acquisition costs remain high and any impact from streamlining costs hasn’t been reflected yet,” the report said.

- Excluding impacts of prior-year reserve takedowns, the estimated normalized accident year combined ratio deteriorated by almost five points to 98.4 in 2022 from 93.5 in 2021.

- The estimated 2022 combined ratio for personal lines segment alone is looking like 108.2, compared to 102.7 in 2021. In dollars, that $34.9 billion of underwriting losses for personal lines vs. $12.3 billion in 2021.

The report also reviews investment income results and loss reserve positions by line of business.

As for the overall underwriting results, the reports confirms that trends in personal auto were the biggest drag on the overall U.S. P/C segment’s results. “The private passenger auto segment—long the linchpin of the P/C industry—had its comeuppance in 2022,” the report said, noting that personal auto net written premiums account for roughly on. Personal auto is a significant P/C segment, accounting for about one-third of U.S. P/C net premiums in total and roughly 70 percent of the personal lines segment.

Breaking down personal lines, AM Best estimates a 2022 personal auto combined ratio of 110.1 and a 107.9 for the homeowners line.

The report also summarizes AM Best’s factors underpinning its segment outlooks for personal and commercial lines—negative for personal and stable for commercial—as well as subsector outlooks for individual lines. Commercial auto and commercial casualty have negative outlooks, for example, while property and workers compensation are stable.