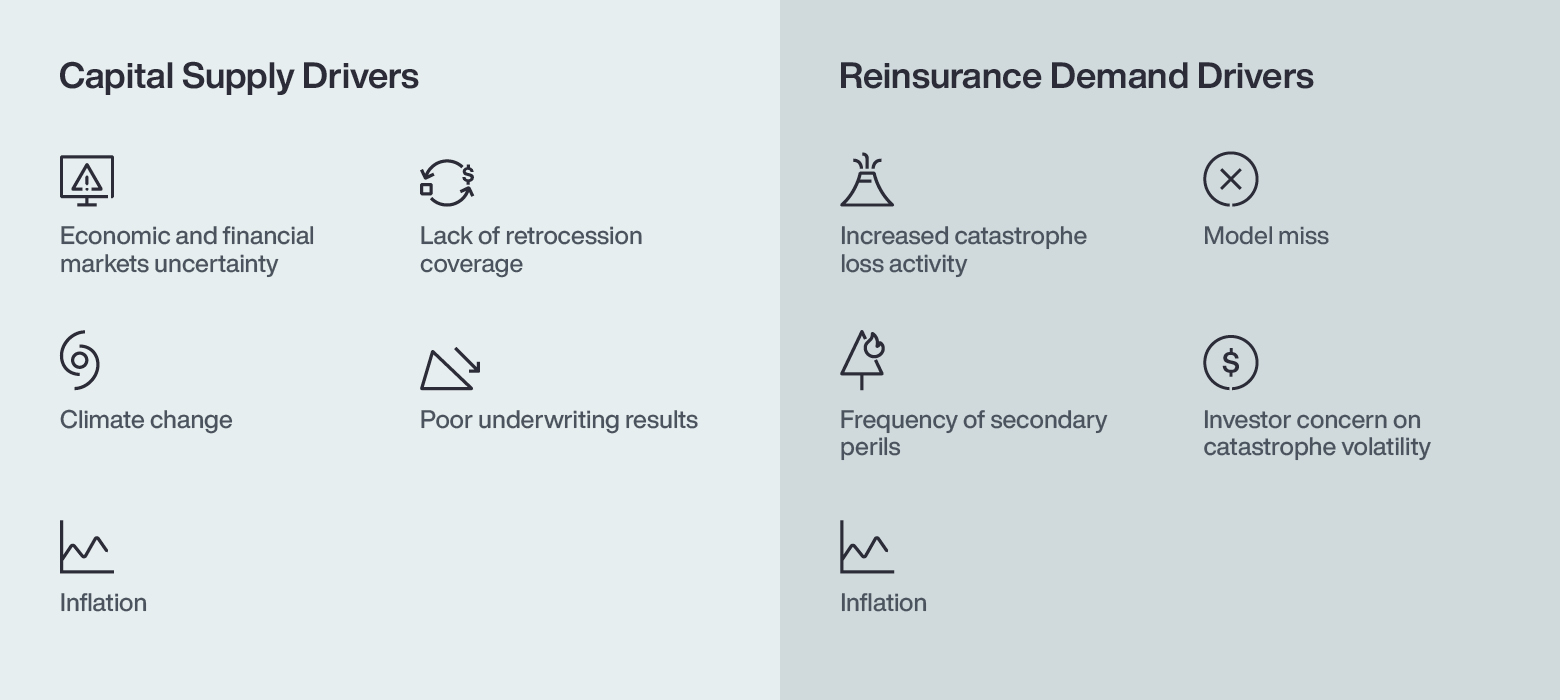

For the first time since the devastating U.S. hurricanes of 2004 and 2005, property-catastrophe capacity contracted during the June/July reinsurance renewal period, Aon said in a new report released yesterday.

While the reinsurance market remained stable on the casualty side, property reinsurance capacity constraints were exacerbated by insurers’ rising demand for reinsurance protection, Aon said in its “Reinsurance Market Dynamics” report.

Lower layers of reinsurance limit for Florida catastrophe risk were particularly scarce on the supply side, as some reinsurers refused to write those at any price. On the demand side, macroeconomic forces, such as inflation and volatility in investment markets, combined with elevated natural catastrophe losses, drove insurer demand for higher reinsurance limits.

The 2004 and 2005 years—the last time property-cat capacity dropped—included Hurricanes Charley, Ivan, Katrina, Rita and Wilma.

The report, referring to the opposing forces of capacity constraints and greater demand, describes the situation for property-cat reinsurance buyers as “a near-perfect storm” but indicates that the majority of insurers were ultimately able to satisfy their reinsurance needs during the renewals in spite of the challenges.

Joe Monaghan, global growth leader for Aon’s Reinsurance Solutions, said: “The property reinsurance market may be fast approaching a true ‘hard’ market, where overall demand is not readily satisfied.”

“Inflation, economic and financial markets uncertainty, and climate change will increase volatility and put insurer capital under growing pressure, just as reinsurers retrench,” he continued in a media statement.

The report also includes information on reinsurance capital, finding that the aggregate amount decreased to $645 billion at March 31, 2022, from $675 billion at Dec. 31, 2021. Within that total, alternative capital increased slightly to $97 billion from $96 billion at year-end 2021. (Editor’s Note: Aon’s capital tally is higher than those presented by other reinsurance brokers, including Guy Carpenter, which estimated $441 billion of traditional capital and $94 billion of alternative capital at year-end 2021, for a total of $534 billion vs. $675 billion for Aon. In the past, Aon executives have explained its total counts “every aspect that’s devoted to taking catastrophe risk for insurance companies,” including “all the capital in platforms where a carrier writes both insurance and reinsurance” and government funds that provide reinsurance-like capital.)

Aon attributed the $31 billion drop in traditional capital to unrealized losses on bonds, linked to rising interest rates. Meanwhile, reinsurer underwriting results were strong with the combined ratios of 17 reinsurers tracked by Aon averaging 92.9.

The report details various supply and demand factors for the Florida and Australia hot spots in the property market and for the property, casualty and specialty markets globally overall. Among other factors impacting the property reinsurance market, Aon notes that S&P’s recently delayed changes to its Risk-Based Capital Adequacy methodology will create further uncertainty in the supply of reinsurance capacity in the second half of this year. Although Aon believes the new capital model won’t change overall reinsurance capacity, those reinsurers that are impacted could seek higher rates or reduce their exposures, the report says.

The report also highlights a “flight to quality” during the renewals for June and July, as reinsurers diverted capital to the best performing insurers. This increased the need for clients “to differentiate their portfolios, using data and analytics to present the best possible story to the market.”

“Clients that differentiated their portfolios were able to mitigate capacity challenges, while the introduction of additional terms—such as advanced premiums and downgrade triggers—helped secure reinsurer support in certain areas,” the report says.

Pennsylvania Issues ‘Expectations’ for Carriers Regarding AI Use

Pennsylvania Issues ‘Expectations’ for Carriers Regarding AI Use  Viewpoint: You’re at a Competitive Disadvantage If You’re Not Innovating

Viewpoint: You’re at a Competitive Disadvantage If You’re Not Innovating  Active Workstations May Improve Cognitive Performance: Study

Active Workstations May Improve Cognitive Performance: Study  Despite Break in Car Prices, Soaring Insurance Costs Hit U.S. Buyers

Despite Break in Car Prices, Soaring Insurance Costs Hit U.S. Buyers