With unfavorable development and product mix changes propelling fourth-quarter and full-year loss 2021 ratios into the 90s—up 20 points over comparable 2020 periods—Lemonade guided shareholders that results will get worse in 2022.

“2022 is expected to be our year of peak losses,” the InsurTech’s leaders wrote in a letter to shareholders. On an earnings conference call yesterday, Chief Executive Officer Daniel Schreiber clarified that the guidance remark relates to the bottom-line net losses rather than aggregate levels of insurance claims.

More specifically, Schreiber said, “We project that 2022 will be a year of peak losses with our EBITDA improving in each subsequent year,” forecasting that in late 2022 and the years that follow, Lemonade will be able to start leveraging machine learning capabilities to lower its loss ratio and also be able to lower its expense ratio through automation. “This year will shift much of our firepower to the next phase of our growth,” he added, explaining that a diversified product suite, which now includes renters, home, pet, life and auto, will allow the company to grow with existing customers through cross-selling and bundling opportunities.

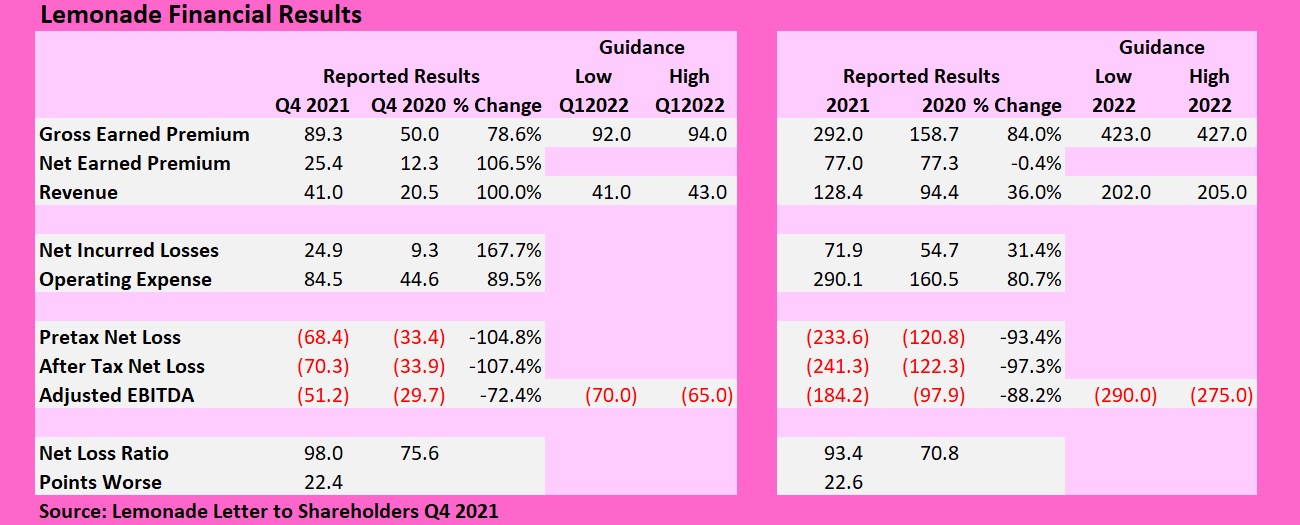

The peak losses—expressed in terms of an “adjusted EBITDA loss” metric—could be somewhere in the range of $275-$290 million in 2022.

In Lemonade’s financial reports, “adjusted EBITDA losses” are net earnings (or losses) before interest, taxes, depreciation, and amortization adjusted for a few other items—the most significant of which is stock-based compensation expense. In 2021, the “adjusted EBITDA loss” figure was $184.2 million. Removing the stock-based compensation expense and other adjustments, the unadjusted bottom-line net loss figure (after taxes) was $241.3 million in 2021. Information in the guidance footnotes suggests that the unadjusted net loss figure for 2022 could be as high as $370 million.

Schreiber, Co-CEO Shai Wininger, and Chief Financial Officer Tim Bixby referenced deteriorating loss ratios to explain the bottom-line red ink for 2021. The shareholder letter attributed the bottom-line net loss of $70.3 million for the fourth-quarter to a higher loss ratio (98 vs 75.6 in fourth-quarter 2022), greater sales of newer products, an increased pace of hiring for Lemonade Car, and greater marketing-spend growth.

In offering their guidance for 2022, the executives noted that the forecasts they came up with do not include the impact of the closing of the acquisition of Metromile, which is expected to happen in the second quarter.

Although part of the earnings call and shareholder letter was devoted to a discussion of Lemonade’s advantages over incumbents—specifically the technological foundations “to move from proxy-based pricing to precision pricing”—Wininger sounded a bit like an incumbent carrier executive as he explained why the fourth-quarter 2021 loss ratio leapt to 98, compared to 75.6 in fourth-quarter 2020. “A meaningful driver of this increase was a handful of older large losses for which in retrospect we underreserved. We have a strong record of cautious reserving, but reserving is an imprecise science. And so adverse developments do happen every now and then,” he said.

Asked to clarify the types of large losses involved, Bixby said these mainly came in the homeowners line. The loss of an entire $1 million home, he said, would be an example of a large loss. “Given our rate of gross earned premium, one or two large losses of that nature can clearly move the loss ratio pretty significantly,” he said.

An analyst suggested that the adverse development to create 20 points of deterioration needed to involve more than a few $1 million homes, and also questioned how Lemonade’s AI claims management processes could underreserve such claims. “How do you lose a whole home in the quarter and not put something up for it?” the analyst asked.

Responding to the first observation, Bixby noted that only half of the loss ratio increase was attributable to adverse development. The rest, he said, was caused by mix shift—something which Wininger had mentioned as well.

“I do expect to be able to display trend lines for both expense ratios and loss ratios that begin to evidence the force and the power of what we’ve been building—and for those to manifest towards the end of this year. And from this year onwards, I think it will reflect itself also in steadily improving EBITDA margins charting a steady and fairly clear path to profitability.”

Daniel Schreiber, Lemonade

In fact, Wininger noted that Lemonade has seen elevated loss ratios for several recent quarters. “The underlying cause is the welcome and intentional shift in our business mix,” he said, noting that newer lines of business—home and pet insurance—have higher loss ratios than the more mature renters book. “We have projects across all of our newer product lines to address underwriting profitability and these are yielding steady improvements in loss ratios for both pet and home. These improvements have been outpaced by these products’ growth meaning that our aggregate loss ratios have climbed even as our product-specific loss ratios improved. In time, the one should catch up with the other. So we expect loss ratios of all Lemonade products to be below 75 in due course,” he said.

“In the short term, though, our newer products will likely be above these targets even as they trend downward given the natural and temporary costs of scaling new businesses.”

Responding to the analyst’s shot at Lemonade’s “AI Jim” claims bot, Schreiber said that the adverse development was related to some major catastrophe events. “What generally just happens there is that oftentimes the reporting comes in later.” So, the claims haven’t been recorded. “This isn’t the kind of claim that the AI handles anyway,” he added. “This is handled by humans, by professionals.”

Schreiber, echoing the other executives, added that Lemonade tends to reserve conservatively, with prior-period development typically moving in the favorable direction. “We’ve had many, many more quarters of positive development than adverse development but when you have a relatively small book, a few homes can swing things one way or another, particularly in cat season. And that’s what happened to us this time,” he said.

Schreiber also addressed a pre-submitted question from someone wanting to understand when Lemonade’s technology advantage would start showing up on the bottom line. Here, he pointed to the improvement in Lemonade’s oldest product line—renters—to give the questioner some comfort. He noted that the renters loss ratio, once as high as 300 had settled down to 59 at the time of Lemonade’s IPO. “We saw record drops in loss ratio, the likes of which traditional insurance companies have not delivered in the past,” he said, referring to a “data feedback loop” that operated to drive the loss ratio down rapidly.

“I do expect to be able to display trend lines for both expense ratios and loss ratios that begin to evidence the force and the power of what we’ve been building—and for those to manifest towards the end of this year. And from this year onwards, I think it will reflect itself also in steadily improving EBITDA margins charting a steady and fairly clear path to profitability,” he asserted.

“Our biggest investments, as a percentage of our revenue at least, are largely behind us—or soon will be,” he said, reiterating that the path to profitability will be clearer after this year’s peak losses.

Still analysts wondered about the impacts of loss ratios for the newer car insurance product and the integration of Metromile.

“I don’t think that we can tie down with that level of precision,” Schreiber told an analyst who asked if auto insurance would add 2 points or 10 points of pressure to near-term loss ratios. “Our car product has been in market for such a short period of time. And the data that we have hasn’t even gone through a single renewal cycle ….We are data-driven and the data just isn’t all in for us to be able to say anything with precision,” he said, adding that Metromile—with 10 years and billions of mile of experience—had pure loss ratios in the 70s in recent quarter (with LAE, “low 90s trending, I think, in a good direction”).

He added that the entire auto insurance industry—”from Progressive on down”—has seen recent pressure due to inflation. “So these are unusual times. And for us, unpredictable times because it’s early in the game. But I think that over time, this is a place where we expect, frankly, to shine and to be able to outperform incumbents just because of [Lemonade’s] ability to monitor and to adapt prices with much greater speed and precision.”

“I do think that we’ll be in a very place to get to a good loss ratio for car,” he said, adding the caveat that loss ratios for “first-year policies are always higher.”

“Even companies like Progressive, which have been doing this for decades and are perceived as being the industry leaders, they don’t break out their first year policies. But if they did, you’d see much higher ratios there as well.”

As for the impact of Metromile on the 2022 results, Schreiber and Bixby, separately addressing premiums and loss ratios, seemed to suggest that while the guidance does not include the impact of the transactions, results might be similar as Metromile-generated premiums and losses hit the books.

“On the day we announced [the deal], and I think in all our communications including this morning, we’ve spoken about it as being something that will flatten risk and collapse time, but not as a new bolt-on business. We’ve never thought about it as a standalone business or [deemed it to be] additive in terms of its business. It’s replacement,” Schreiber said. “In our operational plans, we don’t think of Metromile as being a bolt-on or an addition, but being organic and being part of our Car launch plans….We’ll see a similar rate of growth in ’22 albeit with substituting some of the things that we would have built in-house and some of the investments that we would have made on our own with investments that we are acquiring, and markets and products that we’re acquiring through Metromile.”

Will 2022 still be a peak loss year with Metromile factored into the mix?

“It’s fair to say it largely holds true with Metromile with a couple of exceptions,” Bixby said. “With the integration of two companies, there will be a step change that will create a different curve to the year in terms of spending growth and expenses than we would see without that. But absent that sort of step change, I would expect to see a consistent pattern with what we’ve seen in prior years. And that is true, I think, for peak losses as well.”

Viewpoint: Risks for D&O Insurers Exploring the New Frontier of Gen AI

Viewpoint: Risks for D&O Insurers Exploring the New Frontier of Gen AI  Survey: Majority of CA/FL Homeowners See Rise in Insurance Costs, Coverage Changes

Survey: Majority of CA/FL Homeowners See Rise in Insurance Costs, Coverage Changes  Progressive Gains as Drivers Shop Around for Auto Insurance—Again

Progressive Gains as Drivers Shop Around for Auto Insurance—Again  Despite Break in Car Prices, Soaring Insurance Costs Hit U.S. Buyers

Despite Break in Car Prices, Soaring Insurance Costs Hit U.S. Buyers