Direct premium production for the U.S. P/C industry through third-quarter 2021 improved as insurers increased rates, but adverse trends in loss costs for many lines of business continue to dampen profitability.

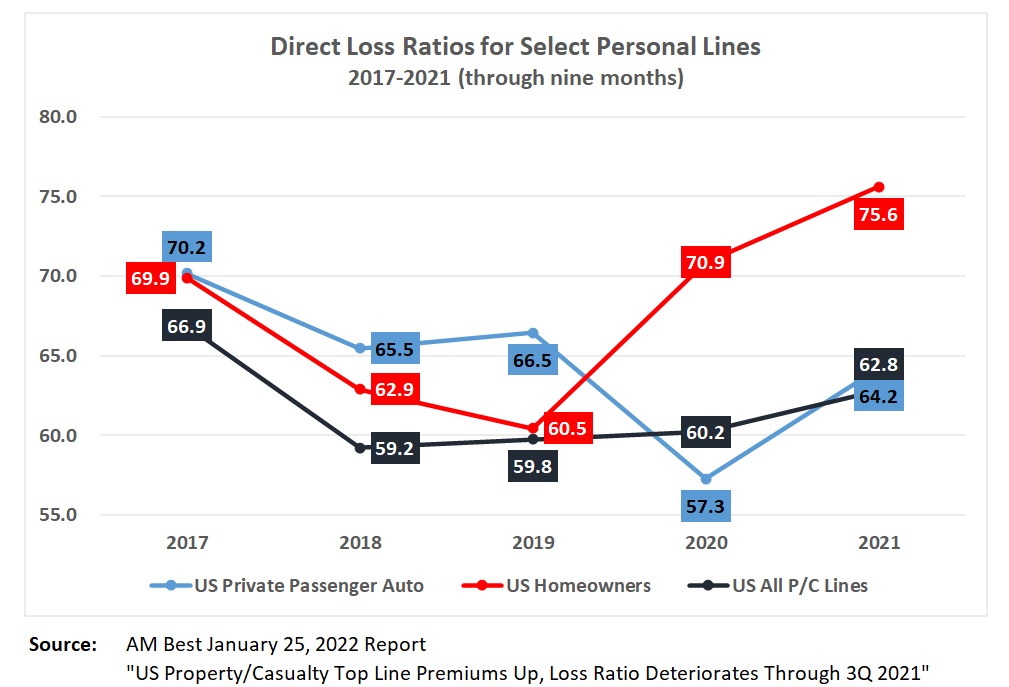

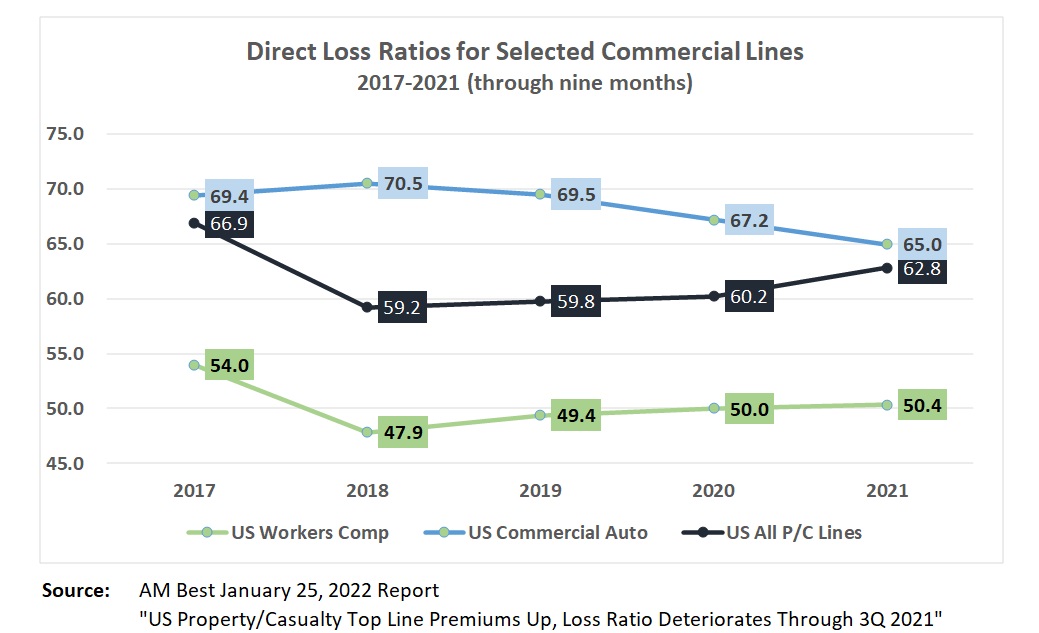

Through the first nine months of 2021, the U.S. P/C industry recorded a 10 percent increase in direct premiums compared with the same period in 2020. However, the industry’s direct loss ratio fell to 62.8 from 60.2, according to an AM Best special report.

“Although premium volumes have rebounded with the pandemic slowdown, natural catastrophe insured losses in 2021 were nearly double that of 2020, mainly from Hurricane Ida,” said Christopher Graham, an AM Best senior industry analyst, in a statement. Natural catastrophe losses in 2021 could be the second highest ever for the insurance industry.

The rating agency said the insurance industry “showed extraordinary resilience” to produce positive results while continuing to deal with the effects of COVID-19 as well as the effects of inflation, natural catastrophes, supply-chain disruptions, investment volatility and socio-political challenges.

“Growing inflation will likely affect the profitability of all major P/C lines of coverage, especially those insuring long-tail lines of coverage with significant outstanding reserves,” said David Blades, associate director of industry research and analytics at AM Best. “Trends related to social inflation and nuclear jury verdicts also could intensify those concerns.”

Inflation and supply-chain backlogs are driving up repair costs for private passenger and commercial auto insurers. Direct premiums written increased 3.1 percent and 21.1 percent, respectively, through the first three quarters of 2021, but AM Best said premium increases are trailing loss costs in each line of business.

In homeowners multiperil, premiums increased 8.4 percent over three quarters compared with the prior year, but inflation on lumber and other building materials are increasing losses. The loss ratio for U.S. homeowners insurers through Q3 was 75.6, up from 70.9. AM Best noted inflation will also increase home values—in turn increasing premiums—but the “benefit will lag the increase in loss costs also related to inflation.”

Direct premiums written increased 7.5 percent year-over-year in commercial multiperil, while direct losses increased 5.1 percent. Also, AM Best said prior-year reserves in this line of business went from “modestly favorable to modestly adverse” from 2018 to 2020.