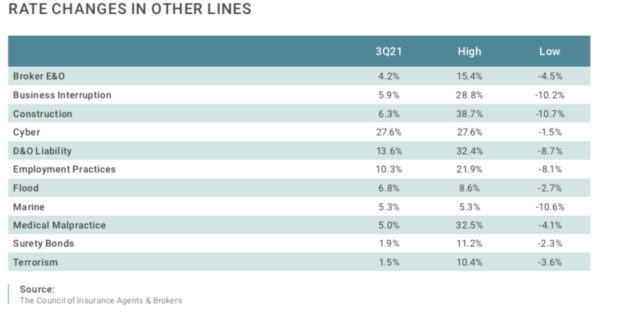

Insurers are continuing to take a hard line on underwriting and pricing cyber coverage. While commercial lines prices overall rose 8.9% in the third quarter, cyber premiums increased 27.6%, according to The Council’s Commercial Property/Casualty Market Index for the third quarter.

Surveyed commercial lines brokers told The Council that a primary driver of the cyber increases is the rise in cyber attacks including ransomware, phishing and social engineering attacks. But they also offered that cyber has been underpriced in the past, so they see this as an adjustment period in terms of premium pricing.

Brokers in the survey noted that cyber insurers in particular are more disciplined in their underwriting, calling for stricter loss controls, and reviewing clients’ loss histories more closely.

Also, according to some respondents, their clients could not obtain any cyber coverage at all if they did not implement specific carrier-requested cybersecurity measures.

Ken A. Crerar, president and CEO of The Council, noted that there are things clients and brokers can do to mitigate the price increases.

“Brokers and clients that take proactive action on cybersecurity risk by implementing stricter loss controls, such as requiring multifactor identification for access to company systems and employee training, will be at a distinct advantage when it comes to finding robust, affordable cyber coverage,” Crerar said.

Overall Commercial Market

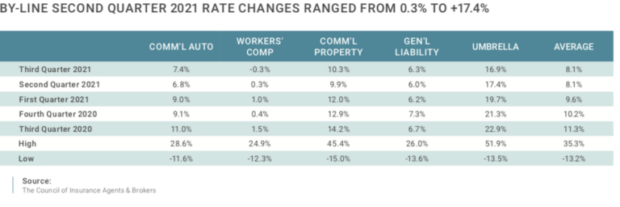

Overall commercial insurance prices increased for the 16th consecutive quarter across all account sizes at 8.9%, which was up slightly from the average increase of 8.3% in the second quarter. Large accounts had the highest increase out of all account sizes, at 10.4%, while prices for small accounts increased the least, at 6.2%.

Prices increased for all lines of business, except workers’ compensation. After five quarters of slight increases, workers compensation, premiums began to fall once again, at -0.3%, according to The Council’s survey.

Prices were also up for directors & officers, umbrellas, commercial property and employment practices, according to the survey:

Brokers said they have seen an uptick in claims in some lines including commercial property, commercial auto, and workers’ compensation as more employees return to the workplace.

Nearly 80% of respondents said “driving organic growth” was a top priority in the third quarter 2021, while 67% cited “recruiting and developing talent” as a priority as well.

“We need to be creative, hire people from other locales who can work remote,” said one broker from a large Northwestern brokerage. According to another from a large Midwestern firm, “The ease for employees to change employers [while] working virtual can either be a problem or an opportunity for brokers.”

Source: The Council

*This story ran previously in our sister publication Insurance Journal.