The most recent tallies of financial results by rating agency analysts reveal that the property/casualty insurance industry weathered the storms of catastrophe losses and COVID, with one segment actually reporting better combined ratios and higher income than in 2019.

A Mar. 16 report from Moody’s Investors Service, “Rising commercial pricing and economic recovery support earnings in 2021,” reveals that catastrophe losses had a bigger impact than COVID on industry financial results. Analyzing the results for 22 rated U.S. P/C insurers, Moody’s estimates that the group posted $5 billion in coronavirus-related claims and $12.8 billion in weather-related catastrophe losses.

The $12.8 billion weather catastrophes compare to $9.5 billion in 2019 for the 22-company cohort. Already in 2021, AIR Worldwide has put a $10 billion estimate on one catastrophe for the entire industry—Winter Storm Uri in February 2021, the Moody’s report notes.

Insurers reporting the largest weather-related catastrophe totals were Allstate ($2.8 billion), Liberty Mutual ($2.5 billion) and Chubb ($1.4 billion). Still, Allstate and several other personal lines insurers, saw net income soar by double-digit percentages in 2020. Progressive topped the gainers with a 43 percent jump in net income, compared to 18 percent for Allstate.

Low levels of vehicle use during the pandemic benefited personal lines insurers, according to the Moody’s analysts, who calculated a weighted average personal auto insurance combined ratio of 87.9 for eight writers of the coverage. That was 5.5 points lower than a 93.4 personal auto insurance combined ratio for the same group for 2019.

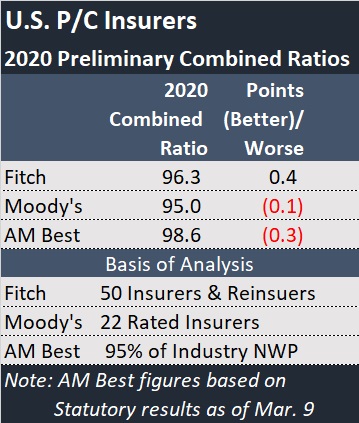

Across the entire 22-member sampling of U.S. insurers, less than one-quarter of which are personal lines writers, net income fell 8.9 percent to $28.1 billion in 2020. But shareholders equity grew 8 percent for the group, and the overall combined ratio for the 22 insurers stayed nearly flat at 95.0 in 2020 vs. 95.1 for 2019.

On the commercial lines side, “We expect pricing increases to exceed loss cost trends, leading to higher underlying underwriting margins,” the Moody’s report says, pointing to factors of rising litigation and reinsurance costs, low interest rates, and coronavirus-related claims, which are likely to support further commercial rate increases over the next 12 months.

Another positive indicator in the Moody’s report comes from an macroeconomic forecast, projecting that the U.S. economy will grow by 4.7 percent in 2021 and 5.0 percent in 2020, reversing the 3.5 percent contraction in 2020—with the economic activity expected to reach the pre-COVID level in the second half of this year.

Sector By Sector

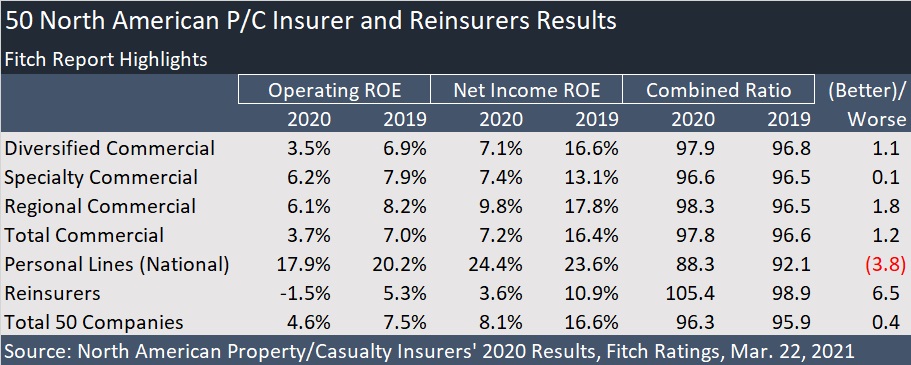

Like Moody’s, analysts at Fitch Ratings see improved underwriting margins for participants in the U.S. P/C industry in 2021, with broad premium rate increases and tighter policy terms supporting the view. But Fitch’s report on “North American Property/Casualty Insurers’ 2020 Results,” which includes reinsurers omitted in the Moody’s report as well as a higher number of commercial insurers in a 50-company cohort, gives a dimmer picture of what happened last year.

Together, the 50 insurers and reinsurers included in Fitch’s analysis experienced $9 billion in COVID losses and over $20 billion in catastrophe losses, leading to 32 percent drop in operating income and a 45 percent decline in overall net income.

Still, the overall combined ratio for the 50-company group deteriorated less than 0.5 points to 96.3 in 2021 from 95.9 in 2019. Like Moody’s, Fitch shows large personal lines carriers having the best results, with seven national personal lines insurers reporting a combined ratio of 88.3 writers.

Sixteen specialty commercial insurers had the second-best overall combined ratio, 96.6, almost unchanged from a 96.5 ratio for 2019.

On the opposite end of the spectrum, Fitch analysts calculated an 105.4 combined ratio for six reinsurers, and a 118.6 for five Florida homeowners insurers. Reinsurers’ underwriting results were impacted by 7.4 points of pandemic-related losses. The Florida group experienced 24.7 points of catastrophe losses in 2020, compared to 8.8 points in 2019.

The Fitch report, which is based on GAAP financials, notes that several reinsurers hiked reserves for pandemic losses in the fourth quarter of 2020, based on information the cedents supplied about their underlying exposure for Jan. 1, 2021 renewals. And the reinsurance group as a whole shifted to unfavorable development, increasing the reinsurer-group combined ratio by 1.2 points, compared to a 0.4 point benefit from reserve releases in 2019. Everest Re’s $400 million of reserve strengthening in fourth-quarter 2020 had a big impact for the reinsurance cohort, the Fitch report notes.

Putting insurers back into the mix to analyze the impact of loss reserve actions for all 50 companies, the Fitch report notes that prior-year reserve releases totaling $2.4 billion shaved 0.6 points off the aggregate combined ratio in 2020, compared to 0.8 points in 2019. But half of the $2.4 billion, $1.2 billion of the favorable development, can be traced to subrogation settlements between four of the insurers and utility companies PG&E and Southern California Edison (relating to 2014 and 2018 wildfires in California).

Putting insurers back into the mix to analyze the impact of loss reserve actions for all 50 companies, the Fitch report notes that prior-year reserve releases totaling $2.4 billion shaved 0.6 points off the aggregate combined ratio in 2020, compared to 0.8 points in 2019. But half of the $2.4 billion, $1.2 billion of the favorable development, can be traced to subrogation settlements between four of the insurers and utility companies PG&E and Southern California Edison (relating to 2014 and 2018 wildfires in California).

Still, putting everything together, including an 8.9 percent drop in investment income for the 50 insurers and reinsurers included in the Fitch report, 14 of them managed to chalk up double-digit returns on equity, including one reinsurer—RenaissanceRe with an 11.8 percent net income ROE. The aggregate ROE for the national personal lines writers was 24.4 percent, the commercial lines figure was 7.2 percent, and reinsurers averaged only 3.6 percent.

For the 50-company group overall, Fitch calculated a 2020 ROE of 8.1 percent, which was less than half the 16.6 percent figure for 2019.

Earlier this month, AM Best in a first look at statutory rather than GAAP results, reported only a slight dip in after-tax ROE and improved underwriting results in 2020 for insurers and reinsurers writing 95 percent of total net premiums. Best analysts estimated a 7.0 percent return on surplus for 2020, compared to 7.2 percent for 2019, with net income rising 4.4 percent and year-end surplus growing 7.5 percent. The 2020 statutory combined ratio in the Best report—98.6—was higher than the GAAP ratios of 96.3 and 95 in the Fitch and Moody’s analyses, but like Moody’s, AM Best reported a slightly improved industry combined ratio.