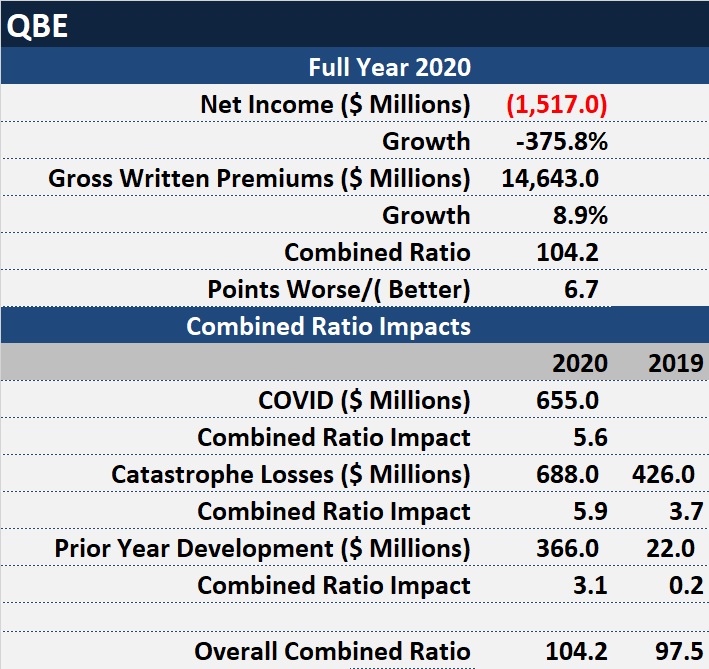

QBE officially announced a $1.5 billion bottom-line net loss for 2020 late last week, confirming a figure the Australia-based insurance group preannounced in late mid-December.

The result represents nearly $1 billion downward swing from a $522 million net profit reported in 2019.

Multiple issues including high catastrophe losses and social inflation pressures in North America combined with COVID-related charges to push the group’s combined ratio to 104.2.

Excluding a COVID impact amounting to $655 million, which added 5.6 points to the combined ratio, the 2020 combined ratio would have been 98.6, less than a point away from the 97.5 figure recorded in 2019.

But catastrophe losses also came in higher in 2020 than in 2019, with wildfires in the U.S. and Australia and a record level of Atlantic hurricanes adding 2.2 more points to QBE’s 2020 combined ratio than natural catastrophes contributed in 2019.

A starker year-to-year difference came from strengthening prior-year loss reserves. The combined ratio impact of a $366 million boost in prior-year losses was 3.1 points in 2020. In 2019, QBE recorded only $22 million for upping prior-year reserves, translating to just 0.2 combined ratio points.

The reserve charge primarily reflected development in North America, QBE said, noting that QBE NA’s reserves were strengthened by $100 million in the second-half of 2020 “largely to address systemic risks including social inflation and higher severity trends in casualty lines,” not in response to any specific observed underlying development. In addition to that, prior-year development in QBE NA included $71 million related to an E&S runoff portfolio, $60 million for a single aviation claim, and $33 million for Hurricane Irma losses, QBE noted in its annual report.

Prior-year development added 9.0 points to QBE NA’s combined ratio, which came in at 112.7 for 2020. In contrast, the combined ratio for Australia Pacific operations was 92.8 and for other international business was 91.3.

Taken together, the impacts of catastrophes and prior-year development and COVID for all regions contributed to a total of $869 million in underwriting losses for 2020, compared to just $2 million in 2019.

Lower investment profits and the costs of IT modernization also drove 2020 results lower than 2019.

Net investment income fell to $226 million in 2020, compared to more than $1 billion in 2019.

In light of the substantial 2020 statutory loss, the Board has elected not to declare a final dividend. If global economic conditions do not deteriorate materially, however, the board expects to resume dividend payments in conjunction with the 2021 interim result.

Commenting on the results, Interim QBE Group CEO Richard Pryce, said in a statement: “While obviously very disappointed with the headline loss, premium momentum accelerated across 2020 and has continued into 2021. Coupled with the improved positioning of the underlying business, we enter this year with confidence and optimism.”

“While obviously very disappointed with the headline loss, premium momentum accelerated across 2020 and has continued into 2021. Coupled with the improved positioning of the underlying business, we enter this year with confidence and optimism.”

Richard Pryce, QBE

Overall, gross written premiums jumped 8.9 percent according to the figures set forth in the annual report, and 10 percent on a constant currency basis. For the group overall, premium renewal rate increases averaged 9.8 percent—10.2 percent in North America, 5.4 percent in Australia Pacific regions and 12.8 percent elsewhere.

“I look forward to leading the business in 2021,” Pryce continued in a statement released with the earnings report. “My primary focus remains performance improvement including that the Group takes full advantage of currently favorable market conditions by maximizing premium rate increases while driving targeted growth in portfolios and regions offering the most profitable new business opportunities,” he said.

[inline-ad-1]