After reporting a combined ratio of 89 for the final quarter of 2020, Markel Corporation’s co-chief executive officers believe a goal of a 90 combined for full-year 2021 is well within reach.

“I feel like we’re there,” Richie Whitt, co-chief executive officer said, during an earnings conference on Wednesday, responding to an analyst who asked whether continually improving loss or expense ratios would be a bigger factor in driving the full-year combined ratio down from 2020’s full-year 98 to 10-points below breakeven.

Whitt, who noted that increasing scale coupled with a strategy to hold the line on controllable expenses is lowering Markel’s expense ratio, said he thought more improvement would come on the loss ratio side. He pointed out that in the fourth quarter of 2020, Markel’s combined ratio was 85 after stripping out four-points of loss ratio impacts from COVID-related losses and natural catastrophe losses, supporting his view that trends are pointing toward a 90 in 2021.

“We are hoping there is not another COVID-type loss in 2021, and we have significantly reduced our cat exposure by the end of 2020,” he added, suggesting that a normalized cat load brings the target into focus.

Whitt and co-CEO Tom Gayner were upbeat about the full-year 2020 results for all three engines that drive Markel’s financial results—insurance underwriting, investments and Markel Ventures (a unit that invests in businesses outside of the insurance industry).

Whitt said the full-year 98 combined ratio was not just a “strong” result, but an “amazing” one given the circumstances.

“While this is not the result we were aiming for as we entered 2020, after recording $360 million of underwriting losses related to the COVID-19 pandemic, followed by natural catastrophe events in the third and fourth quarter adding an additional $169 million in underwriting losses, this is an amazing accomplishment,” Whitt said, describing the insurance engine results.

For the year, COVID losses added six points to the combined ratio, while natural catastrophes added three points in 2020. In contrast, nat cat losses 2019 added only two points to the 2019 combined ratio.

More broadly, Gayner, giving the big picture at the start of the call said, “This was not an easy year [but] all three engines of Markel fired in 2020 and provided positive thrust,” he said, admitting that “it might not have seemed that way at various points of the year, especially early on, in the early days of the pandemic.”

Indeed, quoting boxer Mike Tyson, Gayner said, “‘Everybody has a plan until they get punched in the mouth.’ Well, we got punched in the mouth in the early days of the pandemic, but our plan is to build Markel in such a way that we can take a hit. We can get in the ring with Mike Tyson, we can take the punch in the mouth and keep on fighting.”

“That’s 2020 in a nutshell,” he said, referring to Markel as “a resilience machine.”

“Our three engines withstood the blows from the early days of 2020, and our 18,000-plus associates adapted and figured out how to recalibrate and accomplish our mission of taking care of our customers, our associates, and our shareholders,” he said.

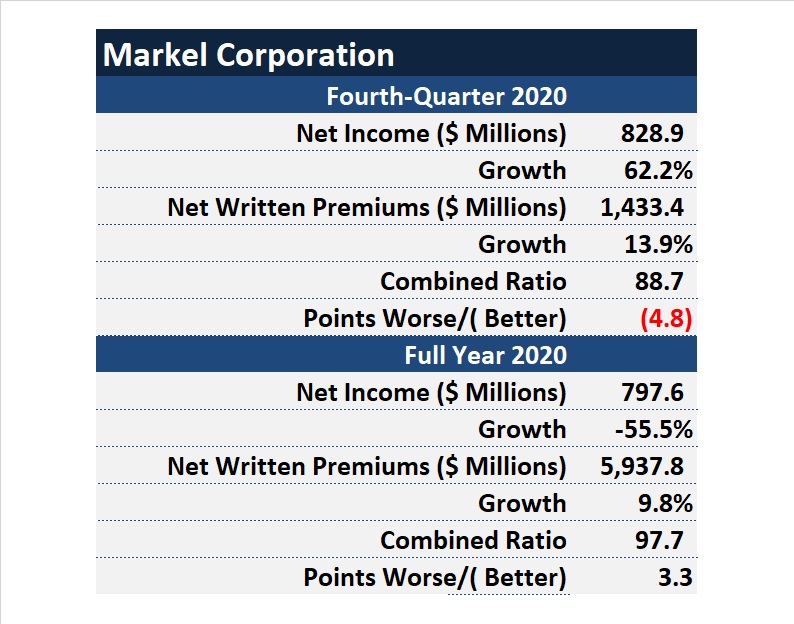

For the year, Markel reported net income of $797.6 million, down 56 percent from 2019’s $1.8 billion. Underwriting profit fell to $127.6 million, compared to $280.5 million in 2019.

For the year, Markel reported net income of $797.6 million, down 56 percent from 2019’s $1.8 billion. Underwriting profit fell to $127.6 million, compared to $280.5 million in 2019.

Investment income added $371.8 million to full-year income for 2020, with investment gains adding another $618 million. But the nearly $1.0 billion total was less than half of the $2.0 billion total from $451.9 million of investment income and $1.6 million of investment gains in 2019.

Chief Financial Officer Jeremy Noble explained that lower investment gains were impacted by unfavorable market value movements resulting from the onset of the pandemic in the first quarter, but added that those were more than offset by increases in the fair value of Markel’s equity portfolio over the last three quarters of 2020. The decline in net investment income was largely due to lower short-term interest rates and lower holdings of fixed maturity securities in 2020, he said.

Providing more details of the underwriting engine, Whitt noted that gross premiums soared 15 percent to $1.7 billion in the fourth quarter and 11 percent to $7.2 billon for the year, pointing to rate increases across insurance lines like professional liability, general liability and marine and energy as the drivers.

He noted that while insurance premiums grew 13 percent, reinsurance premiums were flat.

Explaining the top-line drivers for the insurance and reinsurance segments individually, Whitt said that nearly all the growth in insurance came from “preferred product offerings,” while Markel made “targeted reductions” on products and accounts that didn’t meet its profitability goals.

“We’re always remixing the portfolio, and there was over $100 million of business that we exited during 2020 because it wasn’t performing to our return hurdles,” he reported. “Our growth was net of having to get out of some of that business,” he said, later identifying some of the exited business to include one large underperforming program, as well as some smaller camps and social services programs.

“Where we are really focused is professional liability, casualty, property, marine and energy where we’re growing nicely. And our rate increases are not just double-digits, they’re mid-to-high, 15-20 [percent] sorts of increases.”

Turning to reinsurance, Whitt said 2020 was the fourth consecutive year of reinsurance underwriting losses for Markel, with “unprecedented and significant catastrophe activity” pushing the combined ratios to 104 in both years.

The 2020 combined ratio was impacted by seven points of underwriting losses from COVID-19 and five points from natural catastrophe events, compared with a 10-point nat cat impact in 2019.

Even though the ex-COVID, ex-cat combined ratio improved, and while “there are certainly opportunities in the current market to grow” the reinsurance top line, Markel is “going to be very cautious about growth in the near-term until we are convinced profitability issues have been resolved by a combination of price increases and portfolio management,” Whitt said.

“While this is not the result we were aiming for as we entered 2020, after recording $360 million of underwriting losses related to the COVID-19 pandemic, followed by natural catastrophe events in the third and fourth quarter…, this is an amazing accomplishment.”

Richie Whitt, Markel

Turning to the Ventures segment, Gayner was the executive that expressed amazement as he and Noble reported operating revenues up 36 percent to $2.8 billion and EBITDA up 39 percent to 366.9 million. While Noble noted that two acquisitions were big drivers of the results—the latest being an April acquisition of a supplier of exterior building products and materials to professional contractors called Lansing Building Products—Gayner focused his remarks on the resilience of manufacturing and transportation-related holdings that were severely impacted by COVID shutdowns early last year.

There are only two words to describe the Ventures results—”amazed and grateful,” Gayner said several times during the call. “When we looked at the economy being shut down in April and May, and order books that just disappeared, the recovery that has already taken place is spectacular,” he said, highlighting the work of the “the management teams that run those businesses and the workforces who just figured [it] out.”

In particular, he cited the example of a company in the Ventures portfolio that makes wood flooring for trucks. The leader of that particular business said, “You can’t make wood floors from home,” according to Gayner who noted that that workforce figured out a way to operate safely and continue to make wood floors, ultimately capturing “a pretty good amount of business that started to show up in the second half of the year.”

According to Gayner, transportation and trailer businesses are picking up orders that vanished in the first part of last year.

“I don’t think there’s much that I can control about general economic conditions. That would be like thanking the weatherman for a sunny day, but as the weatherman, I would predict that the conditions are getting better,” Gayner said.

[inline-ad-1]