The U.S. property/casualty insurance industry saw its surplus drop by a record amount in the 2020 first quarter, thanks to stock market turmoil driven by the coronavirus pandemic’s rapid arrival. But other fundamentals for the sector remained solid.

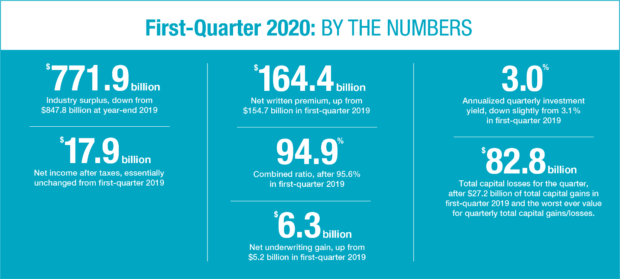

Surplus levels plunged to $771.9 billion as of March 31 2020, a nearly $76 billion drop from the record high $847.8 billion surplus achieved at the end of 2019, according to a new report from the American Property Casualty Insurance Association and data analytics firm Verisk.

That drop – the industry’s largest-ever quarterly decline – stemmed from a plunge in value for insurers’ investments, knocking the surplus back to levels hit in mid-2018, the report found.

Neil Spector, president of Verisk-owned ISO, said the plunge in industry surplus drew notice pretty quickly.

“The historic drop in industry surplus in the first quarter was concerning for many insurers, as it began to show the impact of COVID-19 on their results,” Spector said in prepared remarks. “But the impact of COVID-19 on the industry is just beginning to unfold.”

Unanswered questions remain, Spector said, including whether personal auto insurers will see the reduction in losses matching policyholder rebates and credits offered earlier this spring. Also unclear: how commercial lines premiums will be affected by COVID-19-related challenges, and how carriers will adapt to pandemic conditions longer-term.

While surplus dropped dramatically, the report noted that other industry results either stayed steady or improved year-over-year. Among those numbers:

- Net income after taxes in the 2020 first quarter was $17.9 billion, about same as the year before.

- The net underwriting gain was $6.3 billion, nearly 20 percent higher than in the 2019 first quarter.

- Net written premiums grew by 6.2 percent to $164.4 billion, from $154.7 billion in the 2019 first-quarter.

- Insurers combined ratio for the 2020 first quarter improved to 94.9, compared to 95.6 in the 2019 first quarter.

Other results were neutral or trended downward:

- Net investment income for U.S. P/C insurers was at $13.2 billion in Q1, flat compared to the same quarter a year ago.

- Insurers’ realized capital gains fell to $1.1 billion from $1.6 billion. This produced $14.3 billion in net investment gains for Q1, $500 million less than the same period in 2019.

- Insurers’ annualized rate of return on average surplus dropped to 8.8 percent in AQ1 2019, versus 9.4 percent in Q1 2019.

Those positive numbers don’t mean that the industry is out of the woods, the report cautioned, considering the pandemic’s economic impact for insurers has been much wider than the Q1 2019 investment losses.

The turnaround from what had started out as a stellar growth year has been profound, Robert Gordon, the APCIA’s senior vice president for policy, research and international, said in prepared remarks.

“Property/casualty insurers started the year with solid net written premium growth, but that was the calm before the storm,” Gordon said. “By the end of the first quarter, insurers experienced their largest-ever quarterly surplus decline as the stock market suffered its largest drop since 1987 and interest rates reached a record low.”

Gordon stressed that the industry “remains safely capitalized” but said some carriers face profound uncertainty, including unknown coronavirus liability exposures and the continued possibility of mandated retroactive and prospective COVID-19 coverage due to the political and regulatory climate.

The full report is: “Property/Casualty Insurance Results: First-Quarter 2020.

Source: Verisk/APCIA

Despite Break in Car Prices, Soaring Insurance Costs Hit U.S. Buyers

Despite Break in Car Prices, Soaring Insurance Costs Hit U.S. Buyers  Viewpoint: Risks for D&O Insurers Exploring the New Frontier of Gen AI

Viewpoint: Risks for D&O Insurers Exploring the New Frontier of Gen AI  AM Best Downgrades State Farm General Ratings

AM Best Downgrades State Farm General Ratings  Survey: Majority of CA/FL Homeowners See Rise in Insurance Costs, Coverage Changes

Survey: Majority of CA/FL Homeowners See Rise in Insurance Costs, Coverage Changes