Progressive Corp.’s Susan Patricia (“Tricia”) Griffith earned the fifth-highest U.S. property/casualty insurance CEO salary in 2018, even as the company she runs landed in the top slot in terms of premiums written.

The dynamic became clear after Carrier Management compiled 2018 CEO compensation data based on company proxy statements and compared that with year-end financial statement filings.

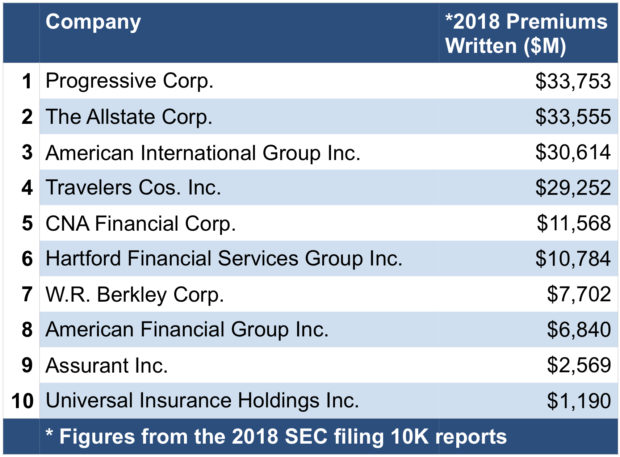

Griffith was paid nearly $14.2 million in total compensation in 2018 (including base salary, bonuses, etc.) while the insurer as a whole booked more than $33.7 billion in premiums written during the year, landing it in the top spot among property/casualty carriers in the category, according to regulatory filings.

By contrast, Brian Duperreault made close to $21 million in CEO compensation for his work running American International Group in 2018, even though the insurer scored third in terms of net premiums written at $30.6 billion.** AIG shareholders narrowly approved the pay after the company struggled through 2018 before posting a long-promise general insurance underwriting profit in the 2019 first quarter. In 2017 Duperreault pulled in $43 million in total compensation. That salary included a sign-on award and one time payments such as $12 million in cash for shares Duperreault forfeited from Hamilton Insurance, a company he co-founded and led, to take the AIG job. Excluding those extras, his 2017 compensation would have been nearly $16.6 billion.

Duperreault’s compensation for 2018 included a $1.6 million base salary, close to $11.8 million in stock awards and $4.2 million in options, $3 million in non-equity incentive plan compensation, and $257,500 in other compensation.

Griffith became Progressive’s CEO three years ago, after the insurer’s longtime leader Glenn Renwick retired, capping a 15-year stint in the top spot. She had previously been Progressive’s personal lines chief operating officer.

Her 2018 compensation included a $791,346 base salary, $11 million in stock awards, $2.3 million in non-equity incentive plan compensation and $114,239 in other compensation. Griffith was paid a net of $6.9 million in 2016 and $9.3 million in 2017.

Progressive noted in a regulatory filing that Griffith’s base salary for her first full year of CEO, set in early 2018, was below the average of $1.33 million for CEO salaries at comparable companies. The idea was that the other earnings incentives in place would help boost her compensation if the company performed well.

The top 10 CEO salary list ranks as follows, from 1-10: AIG’s Duperreault, Allstate’s Thomas Wilson II, Universal Insurance Holdings’ Sean Downes, Travelers’ Alan Schnitzer, Progressive’s Griffith, The Hartford’s Christopher Swift, Assurant’s Alan Colberg, Berkley’s W. Robert Berkley Jr., American Financial Group’s Carl Lindner and S. Craig Linder, and CNA’s Dino Robusto.

The corresponding top property/casualty insurers in terms of 2018 premium written, from 1-10: Progressive, Allstate, AIG, Travelers, CNA, The Hartford, W.R. Berkley, American Financial Group, Assurant and Universal Insurance Holdings Inc.

*Pam Simpson compiled the data used for this report.

**Editor’s Note: AIG’s consolidated revenue for 2018 was $47.4 billion, including $30.6 billion in premiums written, but also net investment income and revenue from retirement products and other financial services.

*** Chubb, which is incorporated in Switzerland, produced nearly $30.6 billion in consolidated premiums written for 2018, and CEO Evan Greenberg’s compensation for the year was close to $20.4 million, according to the company’s year-end proxy statement.

**** For comparative purposes comparable premium figures are based generally on P/C lines, from publicly traded companies.