Economic and global trade concerns are challenging organizations’ ability to invest adequately in preparing for and protecting the continuity of their operations, according to findings from Aon’s 2019 Global Risk Management Survey, which aims to identify the challenges organizations face in assessing and responding to traditional and emerging risks.

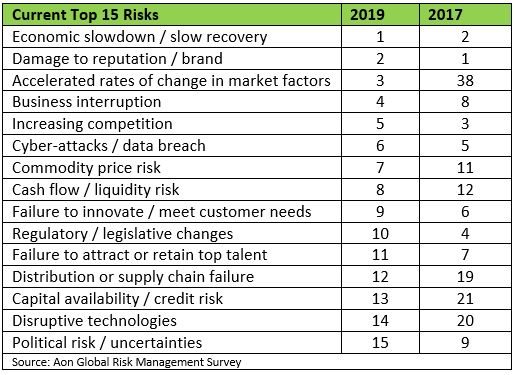

Survey respondents ranked economic slowdown as their No. 1 risk while damage to reputation/brand was cited as the No. 2 concern, which reflects the potential for significant consequences when corporate mishaps occur amidst a 24/7 news cycle on social medial platforms, explained Aon.

Accelerated rates of change in market factors stemming from an increase in protectionist international trade policies, which include rising regulatory activity and geopolitical tension, jumped from 38 in the previous survey to round out the top three concerns on the 2019 list.

Accelerated rates of change in market factors stemming from an increase in protectionist international trade policies, which include rising regulatory activity and geopolitical tension, jumped from 38 in the previous survey to round out the top three concerns on the 2019 list.

Lowest Level of Risk Readiness

Risk managers are reporting their lowest level of risk readiness in 12 years, as many of the top risks, such as economic slowdown and increasing competition, are uninsurable, said the report. This means that risk managers need to embrace risk management as opposed to risk transfer in order to mitigate these threats and protect their organizations from potential volatility, Aon continued.

Aon obtained responses for its 2019 survey in the fall of 2018, “during a time of enormous uncertainty around the globe, fueled by stock market declines, trade policy disputes, aggressive regulatory actions, massive recalls, an active cycle of devastating natural disasters, far-reaching cyber attacks and corporate scandals.”

These broad macro-economic risks, combined with the speed of technological change, are contributing to the growing prominence of new threats, which can disrupt supply chains and overall business operations, Aon went on to say.

As a result, one-third of the top 15 risks are new entrants to the top 15 list, including accelerated rates of change in market factors and disruptive technologies.

“The complexity of the situation organizations face today is substantial. These challenges are likely to grow in intensity over the next few years as new risks become even more prominent, including the implications of an aging workforce, the impact of climate change, the growing prevalence of cyber attacks and the emergence of ever more disruptive technologies,” said Greg Case, president and CEO of Aon, in a forward to the report.

Key Additional Findings

The Aon report also provided a list of additional risk management concerns:

“Companies of all sizes are struggling to prioritize their risk management efforts amid so much change and uncertainty,” said Rory Moloney, chief executive officer, Aon Global Risk Consulting.

“What was once a tried-and-true strategy for risk mitigation – using the past to predict the future – is now a challenge and coupled with a more competitive global economy, it is causing an all-time low level of risk readiness,” he added. As a result, risk management plans need to take a different approach than they have in the past.”

“The changes in this year’s survey results indicate that the risk management function must evolve to reach the enterprise level,” added Moloney. “This, combined with the use of data and predictive analytics that can generate actionable insights, will help businesses protect their bottom lines while adapting to accelerated change and economic fluctuations.”

Aon plc surveys thousands of risk managers across 60 countries and 33 industries every two years to identify key risks and challenges their organizations are facing.

Participant profiles in Aon’s 2019 Global Risk Management Survey encompassed small (below $1 billion), medium ($1 billion to $15 billion) and large (above $15 billion) organizations, including respondents from privately owned companies, public organizations, government and not-for-profit entities.

Source: Aon

*This story ran previously in our sister publication Insurance Journal.