Insurers’ technology budgets remain flat in an age of disruption and technology – a risky move in the face of increased rivalry from tech-enabled upstart competitors, consulting firm Novarica said in a new report.

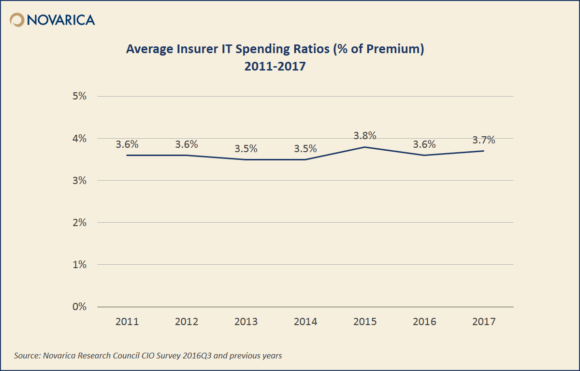

Novarica’s annual study of U.S. insurer IT budgets and projects analyzes results of a survey of more than 100 insurance carrier chief information officers on their priorities for the coming year. The study shows insurers’ IT spend actually went down in 2016 as a percentage of premium and is slated to go up only slightly next year.

“The outlook for insurance IT in 2017 is very similar to 2016. Spending levels will remain essentially consistent, business leaders are demanding additional capabilities in analytics, ease of doing business, and speed to market, and core systems replacement activity remains high – although much of that is continuation of existing projects rather than planned new project starts,” said Matthew Josefowicz, president and CEO of Novarica and lead author of the report.

“Unfortunately, this consistency may itself represent a risk,” he said.

Josefowicz said that as new entrants from Silicon Valley and Wall Street target the industry’s weak record in customer service and its traditional approach to risk assessment and operations, “insurers will need more expansive technology capabilities to compete effectively.”

Yet since resources are not infinite, obtaining more technology will require shifting resources from current expense areas to IT – “something few insurers are inclined to do,” he added.

Source: Novarica