Through 2014, the commercial auto insurance industry has seen solid improvements in both underwriting and operating performance. A.M. Best sees trouble ahead in the form of industry trends that could threaten those gains.

Through 2014, the commercial auto insurance industry has seen solid improvements in both underwriting and operating performance. A.M. Best sees trouble ahead in the form of industry trends that could threaten those gains.

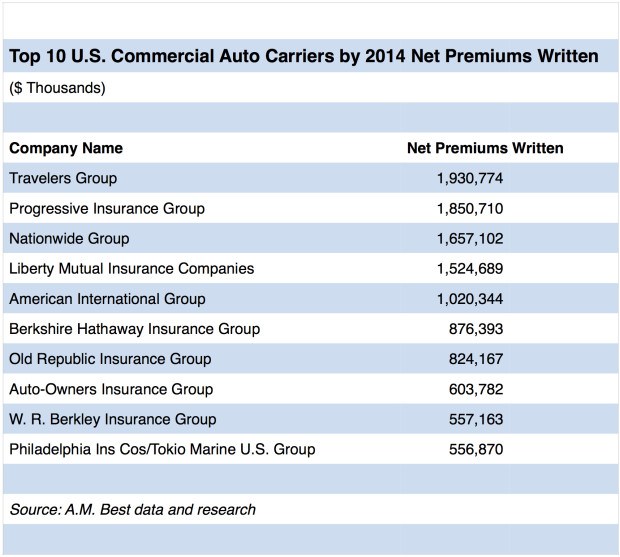

Travelers Group, Progressive, Nationwide and Liberty Mutual, respectively—topping the sector in terms of net premiums written—are among the carriers vulnerable to those market changes.

Until now, it had been a run of multiyear improvements for the sector. Net premiums written for U.S. commercial automobile insurance grew from close to $21.2 billion in 2010 to more than $25.8 billion in 2014, A.M. Best noted in its special report on the commercial auto insurance market.

At the same time, the calendar year combined ratio has soared and then improved, growing from 97.8 in 2010 to a peak of 106.9 in 2012, down to 103.3 in 2014. The accident year combined ratio has generally declined, however, jumping from 104.8 in 2010 to 110.7 in 2011 and then dipping steadily to 98 in 2014.

“Despite the improvement in underwriting and operating performance for the commercial auto insurance industry over the past couple of years, challenges are on the horizon that could negatively impact results over the near term,” A.M. Best said.

Where might upcoming market challenges come from?

“Recent improvements in prevailing rate levels and overall pricing show signs of flattening,” the A.M. Best report noted. But the ratings entity said that prior accident year loss reserve deficiencies are of particular concern.

“More alarming has been the recognition of prior accident year loss reserve deficiencies for the commercial automobile liability line in 2013 and 2014, and in particular, the fact that the reported deficiency grew in 2014 with the trend appearing to be sustained through the first half of 2015,” A.M. Best explained.

A.M. Best added that improvements in operating profitability for the commercial auto industry in recent years will be hard to sustain in the face of current market headwinds. It offers this cautionary warning: “insurers will have to manage capital prudently to successfully deal with changing competitive conditions and emerging issues impacting the commercial auto market.”

Source: A.M. Best Co.