An improving economy in the industrialized world will propel steady but moderate property/casualty premium growth over the next two years, Munich Re concluded in its new Insurance Market Outlook report.

At the same time, P/C premiums in emerging markets will likely climb more rigorously over the same period, hampered from growing even further due to “economic cooling” in those regions.

“After three years of relatively low growth rates, global premium growth is slowly picking up once again,” Munich Re Chief Economist Michael Menhart said in a statement. “Above all, this is due to economic recovery in the industrial nations.”

Munich said global insurance markets experienced 2.1 percent “restrained” growth in 2013, adjusted for inflation and currency rates and buoyed by increasing demand for life insurance. Overall premium rates should grow at pace with the global economy in the medium term, according to the analysis—at the low single-digits.

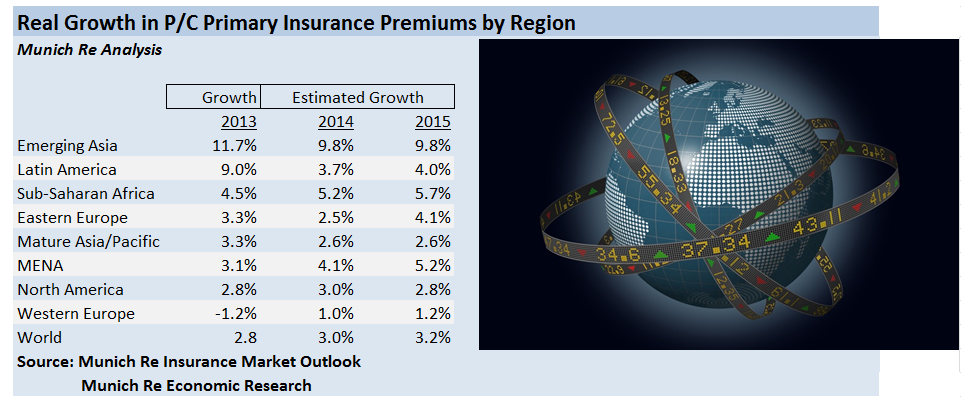

Globally, P/C increases will climb by 3 percent in 2014 and 3.2 percent in 2015, the report asserted. That follows a 2.8 percent increase in 2013, Munich Re said. Munich Re expects similar P/C insurance premium growth rates in North America, at 3 percent and 2.8 percent for 2014 and 2015, respectively, after a 2.8 percent climb in 2012. Western Europe’s P/C insurance premiums will barely budge, as the effect continues from the ongoing euro crisis. After dipping 1.2 percent in 2013, they’ll grow 1 percent and 1.2 percent over the next two years, Munich Re predicted.

While P/C premiums will grow moderately in developed markets, and those markets will contribute more to overall growth, premium in emerging countries will still grow more robustly compared to the industrialized world, Munich Re noted, even in the face of their own economic downturns.

Latin America should see a 3.7 percent growth in P/C primary insurance premiums in 2014 and 4 percent in 2015, Munich Re said, but that’s down from a whopping 9 percent in 2013. Much of the growth is coming from Brazil, with slower growth rates in Argentina expected to balance this out.

Latin America should see a 3.7 percent growth in P/C primary insurance premiums in 2014 and 4 percent in 2015, Munich Re said, but that’s down from a whopping 9 percent in 2013. Much of the growth is coming from Brazil, with slower growth rates in Argentina expected to balance this out.

Asia, on the other hand, remains the hottest of hot spots. After 11.7 percent growth in P/C premiums in 2013, the emerging markets in Asia should generate 9.9 percent premium growth this year and 9.8 percent in 2015, according to the report. Growth rates for mature Asian markets will more closely resemble those generated in North America, Munich Re said.

Another hot spot: Sub-Saharan Africa, which will produce 5.2 percent growth in P/C primary insurance premiums in 2014, the reported noted. That will climb to 5.7 percent in 2015, and both build on 4.5 percent premium growth in 2013, according to Munich Re.

Eastern Europe, meanwhile, will likely produce a 2.5 percent increase in P/C premiums for 2014, and that will grow to 4.1 percent in 2015, according to the analysis. In 2013, the region generated 3.3 percent in premium price hikes.