As part of a research project focused on analyzing leadership demographics in the insurance industry, Saint Joseph’s University examined compensation level for senior officers in various market segments.

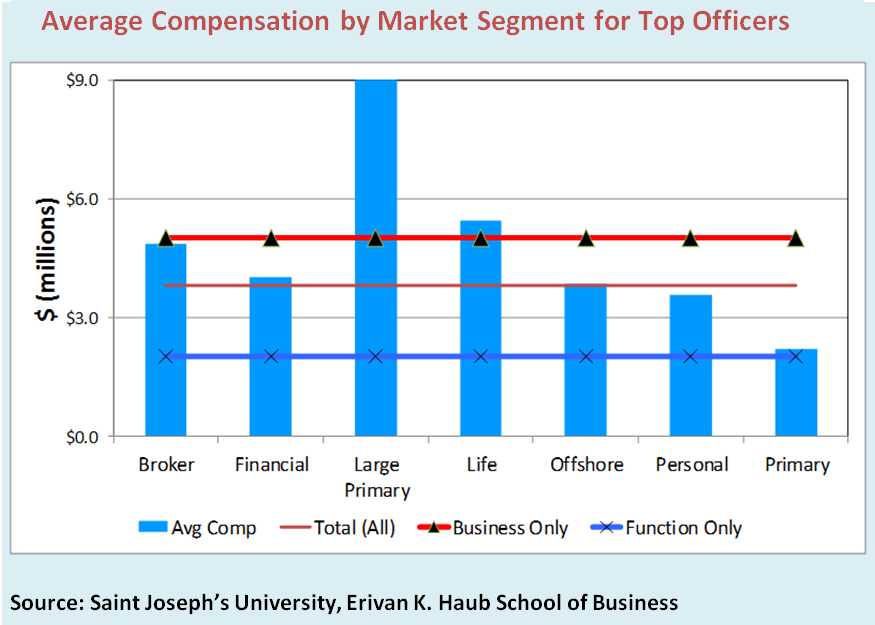

The study uncovered wide gaps in compensation among market-facing (i.e. business-producing) roles such as CEOs or division presidents versus the more functional roles such as accounting, actuarial, claims, finance or legal—regardless of gender—with the top C-suite executives commanding $3 million more, on average, than executives in functional roles.

In addition, the research team led by Michael E. Angelina, executive director for the Saint Joseph’s University Academy of Risk Management & Insurance, found significant differences in gender diversity for the two types of executive positions, which seem to highlight differences in compensation levels for men and women holding executive titles in the insurance industry.

Also apparent are differences in compensation levels for various segments of the property/casualty industry.

Angelina explains the findings about gender diversity in a separate article, Saint Joseph’s University Research Shines Light on Gender Diversity in Insurance.