Direct written premiums for the directors and officers liability insurance line rose 6.9 percent last year, according to a recent analysis by Fitch Ratings, which also shows that direct loss ratios improved 3 points in 2012.

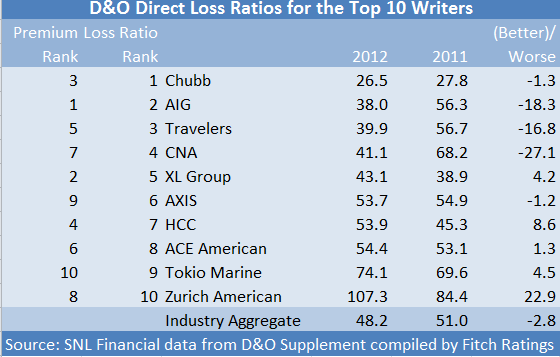

The Fitch analysis, based on a compilation of annual statement supplement data which has been required to be filed by D&O insurers with insurance regulators since 2011, indicates an industry aggregate direct D&O loss ratio of 48.2 for 2012, compared to 51.0 for 2011.

The loss and premium information filed in the D&O supplement are presented on a direct basis—before deductions for ceded reinsurance. In addition, the supplement data does not include loss adjustment or underwriting expenses, which would be needed to estimate net combined ratios for the line.

Still, Fitch was able to present a more complete picture of overall underwriting losses, by looking at annual statement for the other liability-claims made segment (which includes D&O and professional liability written on a claims-made basis). That analysis indicates that calendar-year combined ratios for these claims-made liability segments started to creep above 100 in the last two years.

“From a credit rating perspective, a market pricing shift before extensive underwriting losses materialize promotes future earnings stability, and thus, a more stable ratings profile for participants,” Fitch said, citing an April report on pricing from Aon, in which the broker said that D&O prices (year-over-year) rose 9.9 percent in fourth-quarter 2012.

Fitch said that other liability-claims results for the industry aggregate and top 10 D&O insurers also show that accident year loss ratios in this segment have been relatively stable over the last five years, even though they remain well above highly profitable years in the mid-2000s.

Individually, results for the top 10 writers of D&O insurance are uneven, according to data presented in the Fitch report. The report shows:

The Fitch report notes that while the top-10 D&O writers (ranked by direct written premiums) remained the same in 2012 and 2011, with American International Group taking the top spot, XL jumped into second place ahead of Chubb, and HCC—with a 9.7 percent jump in premiums in 2012—leapfrogged over Travelers to take the No. 4 ranking in 2012. (See related article, “How They Rank: Fitch Reports On Top D&O Insurers,” for the Top 5 ranking based on direct premiums.)

Other changes in position came in the No. 7 and No. 9 spots. CNA overtook Zurich to get the No. 7 ranking in 2012, while AXIS edged out Tokio Marine at the bottom of the top 10 (with AXIS’ $212 million in direct written D&O premiums putting it just in front of Tokio Marine’s $208 million).

Fitch obtained the data for its analysis from SNL Financial.

Although Aon’s quarterly pricing index, published at the beginning of April, showed a 9.9 percent jump in the fourth-quarter of 2012, Aon noted its fourth quarter index was impacted by a large financial institution that was not included in the broker’s fourth-quarter 2011 sample. Removing the effect, by focusing on only those programs that renewed in both fourth-quarter periods, Aon said the pricing jump was only 3.2 percent.

Still, the 3.2 percent hike was the first increase in “same-store” D&O sales that Aon recorded since it began tracking this figure in third-quarter 2009.

Moreover, referring to the 9.9 percent increase for all clients, Aon said that prior to the fourth-quarter of 2012, it had recorded year-over-year D&O price index decreases in 35 out of 37 quarters dating back to fourth-quarter 2003.

Other highlights of the Aon pricing report were: