Although the aggregate operating results for a group of large publicly traded property/casualty insurers improved markedly in 2012 compared to 2011, individual carrier performance remains “below par” for many, according to Fitch Ratings.

Fitch analysts reviewed year-end 2012 operating returns, combined ratios, and other key financial performance measures for 48 publicly traded insurers and reinsurers, calculating a 75 percent jump in operating earnings for the group overall, and an aggregate combined ratio of 98.6 in 2012, compared to 103.4 in 2011.

(Earlier this month, Moody’s Investors Services performed a similar analysis on different set of 25 P/C insurers, also finding overall improvement—a 50 percent increase in the bottom-line net income, which includes investment gains in addition to operating profit.)

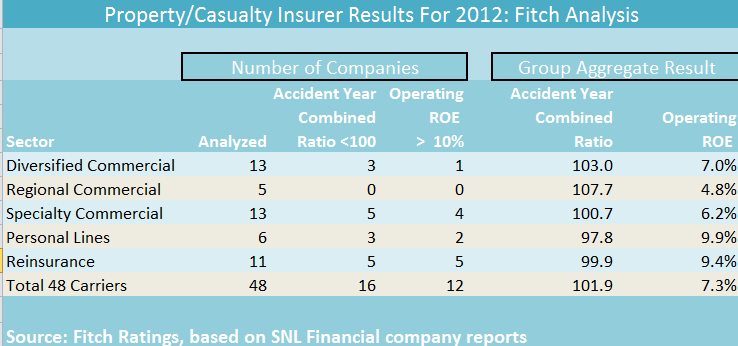

Analyzing the aggregate combined ratio improvement, which was largely attributable to a lower level of catastrophe losses, Fitch also noted that the calendar-year combined ratio of 98.6 includes 3.3 points of favorable loss reserve development from $8.1 billion of prior-year takedowns. On an accident-year basis, excluding the impact of prior-year takedowns, only one-third of the carriers—16 of the 48—reported an underwriting profit in 2012, Fitch said.

In addition, while the aggregate operating return for the group improved to 7.3 percent in 2012, compared to 4.4 percent in 2011, only one-quarter of companies reported an operating return on equity of 10 percent or higher for the year.

As recently as 2009, roughly three-quarters of these carriers reported double-digit operating ROEs, Fitch said in its year-end financial report, which includes charts of individual company results for the 48 carriers.

Fitch also analyzed the results for different segments of the P/C insurance industry—diversified commercial carriers, specialty, regional, personal lines, and reinsurance—finding a higher proportion of reinsurers with double-digit operating ROEs and accident-year 2012 combined ratios below breakeven than any other group. Six of 11 reinsurers had accident-year 2012 combined ratios below 100, and five of the 11 had double-digit ROEs.

Lagging the industry last year were regional commercial insurers. None of the five included in Fitch’s analysis had combined ratios below 100 or double-digit ROEs.

The accompanying chart gives the tallies for the remaining sectors.

Fitch said the outlook for the P/C insurance industry overall is improved for 2013. Noting that earned premiums increased more than 5 percent for the 48-company group overall, the rating agency said that continued pricing improvements bode well for aggregate industry operating performance this year—as long as catastrophe losses revert closer to historical averages of approximately 3 combined ratio points. In 2012, $19 billion of net incurred catastrophe losses added 6.7 point to the combined ratio, Fitch said.

Still, Fitch believes an abundance of capital will continue to promote competitive market conditions, and that pressure on pricing “will likely prevent a return to the broad hard market and strong operating performance of the mid-2000s.”