View this article online: https://www.carriermanagement.com/features/2021/06/21/222383.htm

The Ransomware Epidemic by the Numbers

June 21, 2021

During a session of the Casualty Actuarial Society Seminar on Reinsurance in June, Alexander Podmore, AVP and cyber underwriter for Swiss Re, defined a growing problem for cyber insurers—ransomware—and shared some data to underscore just how bad things are getting.

Ransomware is a form of malware that enters an insured’s network causing an encryption of data and systems, rendering them unusable until the victim restores their data and systems from backups, and incurs the relevant business interruption costs, or the victim pays a ransom demand to the hacker to provide safe return of the encryption key to restore access to the data and systems.

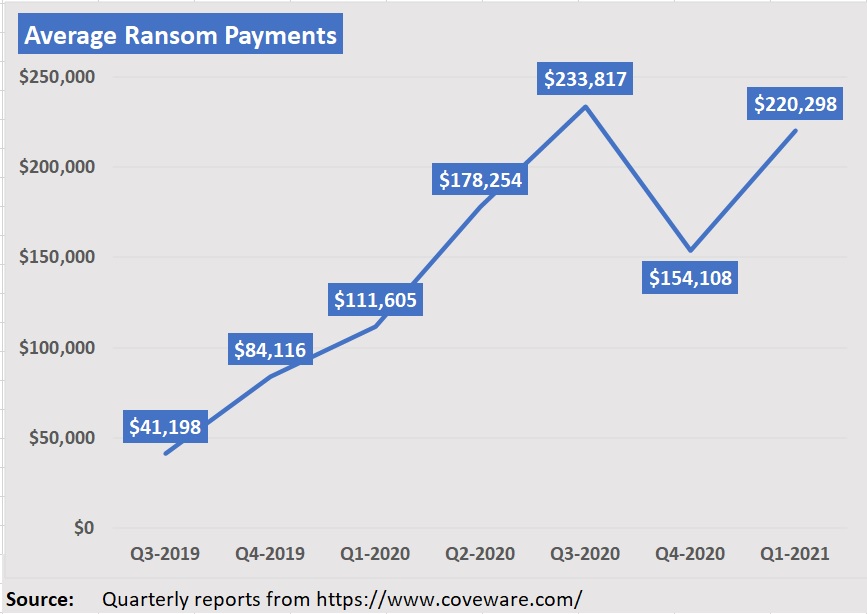

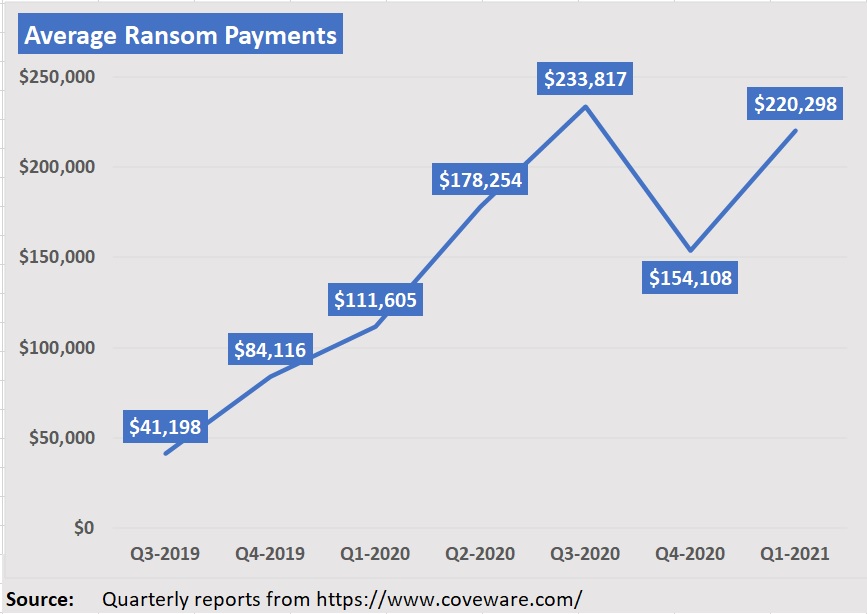

Citing figures from the latest quarterly report of Coveware, a firm that helps businesses remediate ransomware, Podmore noted that the average ransom payment in first-quarter 2021 was just shy of $250,000, having risen from “the low hundreds of dollars” in third-quarter 2018. In the space of two years, there has been an exponential increase, he said.

Below are some other figures and highlights from recent Coveware reports.

- After a temporary decline in fourth-quarter 2020, the average ransom payment increased 43 percent to $220,298 in Q1 2021 (from $154,108 in Q42020). Compared to the Q1 2020 quarter a year earlier, the Q1 2021 average payment has almost doubled.

- Q1 2021 averages were pulled up by a raft of data exfiltration attacks by one specific group.

- The median payment in Q1 jumped to $78,398 from $49,450, a 58 percent increase.

- Temporary declines in average and median payouts in Q3 2020, according to Coveware, were the result of the fact that while ransomware groups continued to leverage data exfiltration as a tactic, the trust that stolen data would be deleted was eroding. Exfiltrated data continued to be made public despite victims paying ransom.

- In Q4 2020, email phishing overtook RDP compromises as the dominant attack vector for the first quarter since Coveware had been tracking data. In Q1 2021, RDP compromise was predominant again, but the gap between the two types of compromises was smaller than in past years.

- Incident duration expanded slightly in Q1 2021 to an average of 23 days. The downtime measure has been creeping up, with prior reports showing 21 days in Q4 2020, 19 days in Q3 2020.

- In Q4 of 2019, average downtime increased to 16 days from 12 days in Q3 2019. Coveware said the increase in downtime was driven by a higher prevalence of attacks against larger enterprises, who often spend weeks fully remediating and restoring their systems.

- Commenting on the highest level reported in recent quarters, in Q3 2020, Coveware said that “attackers discovered that the same tactics, techniques and procedures that work on a 500-person company can work on a 50,000-person company, and the potential payoff is substantially higher.”

- The biggest change over the six quarters ending Q3 2020 was that threat actors had come to “realize that their tactics scale to much larger enterprises without much of an increase in their own operating costs.” In other words, “the profit margins are extremely high, and the risk is low,” the Q3 2020 report said.

In several of the quarterly reports, Coveware notes that although victims may decide there are valid reasons to pay to prevent the public sharing of stolen data, Coveware’s policy is to advise victims of data exfiltration extortion to expect that even if they opt to pay:

- The data will not be credibly deleted. Victims should assume it will be traded to other threat actors, sold or held for a second/future extortion attempt.

- Stolen data custody was held by multiple parties and not secured. Even if the threat actor deletes a volume of data following a payment, other parties that had access to it may have made copies so that they can extort the victim in the future.

- The data may get posted anyway by mistake or on purpose before a victim can even respond to an extortion attempt.

[inline-ad-1]