Insurance is fundamentally about protecting people’s lives. The sector has evolved over millennia and continues to find ways to innovate as societal needs evolve and change.

In ancient times, it is believed that civilizations including the Romans, Indians and Egyptians had some form of “group protection” to protect members of the society and provide “mutual aid.” In more recent times, the sector has done a pretty good job for the last 600 odd years, effectively adapting to the evolution of society. From Edward Lloyd’s coffee shop in London in the 1600s to Sir Edmund Halley publishing the first known mortality tables in the late 1600s, the trajectory of innovation continues to evolve.

With permission, Carrier Management is republishing this analysis originally posted on the LinkedIn pages of Matteo Carbone or Sri Nagarajan.

While radical innovation in the immediate short term in the insurance sector is not quite as easy as it is in other sectors, it is exciting to see the U.S.-based “P/C InsurTech trio” we follow—carriers Lemonade, Metromile and Root—continue to innovate, and this quarter all show signs of robust growth. Even the loss ratios are moving in the right direction.

The first look at these figures gives a positive feeling about success potential and the possibility of full-stack InsurTech players.

Is There an Illusion of Prosperity?

“Cash burn-rate” is a metric we continue to watch very closely. Even while the companies are not reporting all of their costs in the yellow book (statutory blank) anymore, it is clear that these InsurTechs are burning a lot of cash each quarter.

Since the last article tallying their financials, both Lemonade and Root have raised a few hundred million dollars each, which will allow them to continue in their journey. They both enjoy stellar valuations at $2 billion and $3.6 billion each. To quote a recent article by Professor Scott Galloway, “Private valuations are harmful metrics that create the illusion of prosperity.”Now let’s take a look at sizable M&A deals in the P/C market since 2018:

Insurance M&A transactions are typically done considering return-on-equity and price-to-book, but these examples give a sense of what insurance business can be purchased for a few billion dollars.

So, let’s assume these companies will target multiplying their value by three-times in the next five years.

Now imagine the kind of growth these InsurTechs need to have with respect to traditional performance indicators to justify the above-mentioned valuations. Moreover, they should do it by achieving profitability along the way. In order to assess how these players are proceeding on this path, let’s dive deeper into the evolutions of their top line and loss ratios because it remains true that in the insurance sector, underwriting discipline is key.

Top Line, aka Direct Premium Written, Continues to Grow

While Root’s first-quarter 2019 direct premium written grew by 75 percent (almost in line with the 55 percent growth between the second and third quarters of 2018), Lemonade’s direct premium turned into positive territory, reflecting a 38 percent growth (vs. a 10 percent drop between last year’s third and fourth quarters). Metromile also grew its direct premium written by double digits, although the 14 percent jump was lower than the first-quarter growth rates for Lemonade and Root. Metromile too turned into positive growth territory in first-quarter 2019 compared to a 4 percent quarterly drop recorded for fourth-quarter 2018.

Loss Ratios

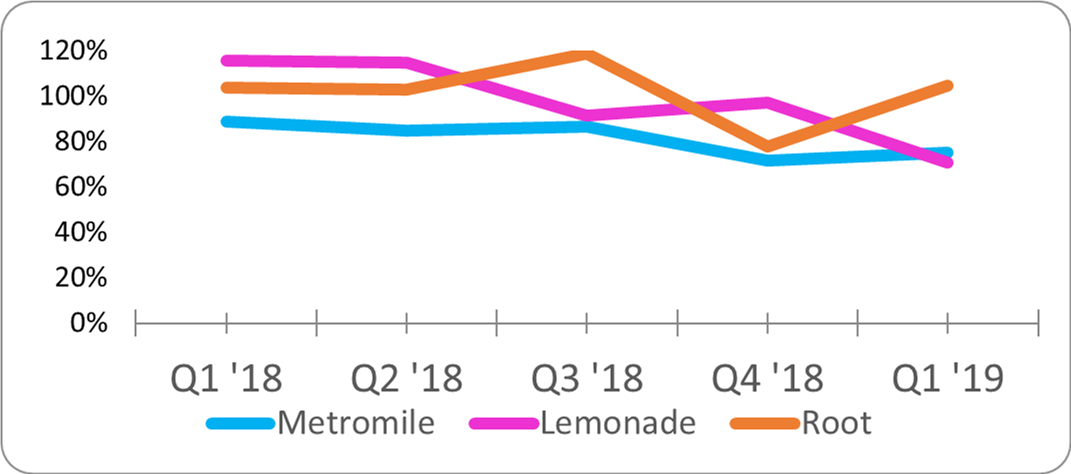

In the first quarter of 2019, the loss ratios continued to evolve in the right direction. The quarterly loss ratio of Lemonade is at 71, a significant improvement (17 points) vs. the previous quarter. Metromile continues to stay slightly above 70. Even Root, which shows a return of a loss ratio above 100, can be considered to be moving in the right direction because 12 points relates to prior-year reserve deficiency. (They underreserved to close better in 2018.)

By the way, those loss ratios are still extremely higher than the average loss ratios in the market and not sustainable in the medium term, which shows that these players are still underpricing the risks in order to sustain their growth.

Loss Ratio (gross premium and loss) shown above. Loss & LAE Ratios shown below.

Loss Ratio (gross premium and loss) shown above. Loss & LAE Ratios shown below.

InsurTech D2C Seems to Be a ‘Price Game’

Metromile continues to be the player with more conservative trends, confirming the niche nature of the mileage-based approach.

Clearly, Lemonade has gone through a year of higher focus on the technical sustainability of their book of business. The gross loss ratio has significantly improved, but the quarterly evolution of the written premium has lost momentum. The gross written premium profile is not resembling the “hockey stick” that the high growth tech companies are expected to deliver. It seems that reducing pricing aggressiveness—necessary to close the profitability gap with the market—has directly impacted the growth, with average quarterly growth at 29 percent in the last four quarters. This trend probably isn’t the kind of growth expected by VCs for evaluating a $2 billion insurance company. The rules of this game are well described in a recent New York Times article: “From the moment a founder signs their first term sheet from investors, they’ve made a pledge to make the startup grow, grow, grow. If your startup isn’t growing, your startup is dying.” (How Uber Got Lost by Mike Isaac, The New York Times, published Aug. 23, 2019)

Net-net it seems that InsurTech full-stack carriers are playing a pricing game. They have not been able to make customers fall in love with anything other than the idea that they can “save money.” As of today, we don’t see around these players the same kind of tribe that FinTech unicorns like UK mobile banker Monzo have been able to create in the same period of time. We will continue to watch this InsurTech trio very closely and assess where and how their trajectory continues to evolve in the long arc of insurance innovation.

With the need for growth to satisfy the venture metrics as well as solid insurance fundamentals, the key question must be: What elements of their InsurTech business models can give them a competitive advantage in playing the pricing war against the incumbents?

We will try to address this question in the next article about second-quarter financial results. Stay tuned for further insights and perspectives coming soon.