The insurance technology, or InsurTech sector has seen much technological and investment development over the past few years. Traditional insurance business lines such as health, auto, and commercial are being revolutionized by new digital-centric startups. New technologies such as AI and IoT are re-architecting insurance data, the underpinning of the insurance industry. New business models, such as P2P and on-demand insurance, are disrupting the entire ecosystem on all fronts.

This blog post aims to examine how the rest of 2019 can shape up for the insurance technology industry. After conducting a thorough analysis of the sector, we have arrived at three predictions for 2019:

- 2019 will see the highest InsurTech funding on record

- Health insurance technology will continue to dominate the industry

- InsurTech startups will scale up in 2019

Prediction 1: 2019 Will See The Highest InsurTech Funding On Record

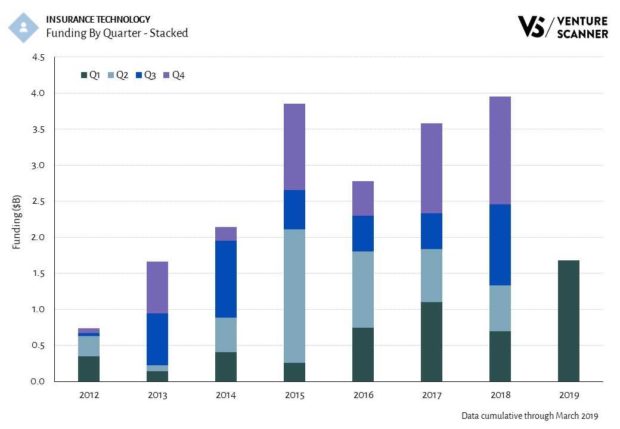

The graph below shows the total VC funding into InsurTech startups by year.

As you can see, InsurTech funding is on a general upward trend with a 5-year CAGR of 19 percent.

What’s most noteworthy on the chart is Q1 2019 funding coming in at $1.7B, a whopping 2.5 times higher than Q1 2018 and the best yearly start to date. A straight line projection would put the full 2019 funding at $6.7B, which would represent a 70 percent year-over-year growth and the highest annual funding on record. The largest InsurTech funding events in Q1 2019 include a $500M round into Clover Health, a $129M round into FRIDAY, and a $125M round into the Wefox Group.

The dramatic funding growth and our 2019 projection demonstrate investor confidence in technology startups fundamentally advancing the insurance industry.

Prediction 2: Health Insurance Technology Will Continue To Dominate The Industry

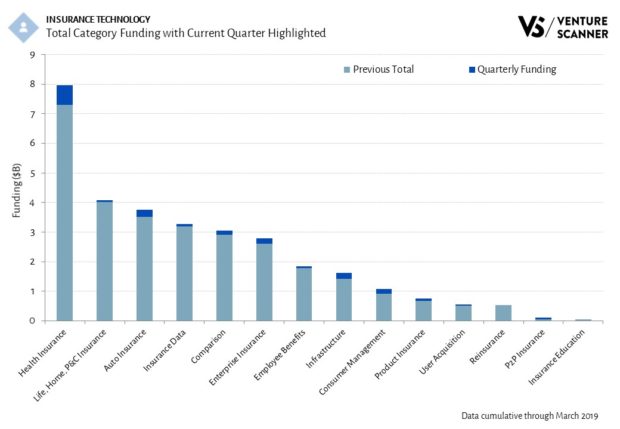

Venture Scanner classifies chaotic startup landscapes into understandable groupings. These groupings are organized by functional categories, which are intended to get at the core offering of the startups categorized therein. For InsurTech, we have broken the sector down into 14 functional categories. Analyzing them reveals a clearly dominant function: health insurance technology.

Health insurance technology startups lead the InsurTech sector in overall funding at $8B. This category accounts for 33 percent of all InsurTech funding and has almost twice the funding of the second highest category–life, home, P&C insurance. In addition, health insurance technology startups raised the most funding this past quarter (Q1 2019) at $650M. Some of the largest funding rounds into health insurance in Q1 2019 include a $500M Series E into Clover Health, a $74M Series B into Shuidihuzhu, and a $45M Series B into Alan.

Health insurance technology startups focus on producing innovative business models and technology products. A notable example in the space is Oscar Health. They provide customized health insurance plans for individuals and businesses. Their website and mobile app enable you to manage all your health information and access doctors 24/7. The Oscar Health mobile app also incentivizes healthy behavior. For example, it tracks your daily steps and if you meet your daily step goal, you earn money for gift cards.

Prediction 3: InsurTech Startups Will Scale Up In 2019

Our third prediction is that InsurTech funding events will shift to later-stage financings as a result of InsurTech startups experiencing increased market traction. Over the past 5 years, seed-stage funding events made up roughly 50 percent of all funding events into InsurTech. In Q1 2019, seed-stage events dropped to 20 percent, while mid and later-stage funding events grew to represent a much larger portion of total funding events.

By the same token, the average funding per deal in InsurTech has been growing steadily. Specifically, over the last 5 years, average funding has grown from $9M to $39M per deal.

Conclusion: 2019 Will See Unprecedented Innovation In InsurTech

In conclusion, the observations and analyses above lead us to predict that InsurTech startups are primed for explosive growth, scaling, and maturation. We predict that 2019 will be the highest funded year on record, that health insurance technology startups will continue to dominate the industry, and that InsurTech funding events will increase in maturity and size over time.

Despite Break in Car Prices, Soaring Insurance Costs Hit U.S. Buyers

Despite Break in Car Prices, Soaring Insurance Costs Hit U.S. Buyers  AM Best Downgrades State Farm General Ratings

AM Best Downgrades State Farm General Ratings  USAA to Lay Off 220 Employees

USAA to Lay Off 220 Employees  That Insurance Talent Crisis? It’s a Global Knowledge Opportunity

That Insurance Talent Crisis? It’s a Global Knowledge Opportunity