View this article online: https://www.carriermanagement.com/brand-spotlight/verisk/8-ways-to-get-personal-auto-back-on-the-road-to-profitability/

8 ways to get personal auto back on the road to profitability

December 5, 2023 by Verisk

SUMMARY

-

Since the pandemic lockdowns of 2020, the personal auto insurance industry hit a rough patch in 2021, went into a ditch in 2022, and is now off-roading.

-

Coming off record-setting profitability pressures—and despite a few things returning to normal—the industry doesn’t appear to be out of the woods yet.

-

While attempting to navigate roads less known, insurance leaders can leverage 8 strategies to get back on track.

Looking back over the past few years, some things are (sort of) back to normal for personal auto insurers. Miles driven, for example, as the U.S. rolling 12-month average crossed back above 3.2 trillion miles in June—a level not reached since early 2020 (although a shift toward commercial vehicle traffic contributed).[1] The frequency of comprehensive claims is also similar to 2019,[2] but in general, little in the personal auto landscape remotely resembles the pre-pandemic picture.

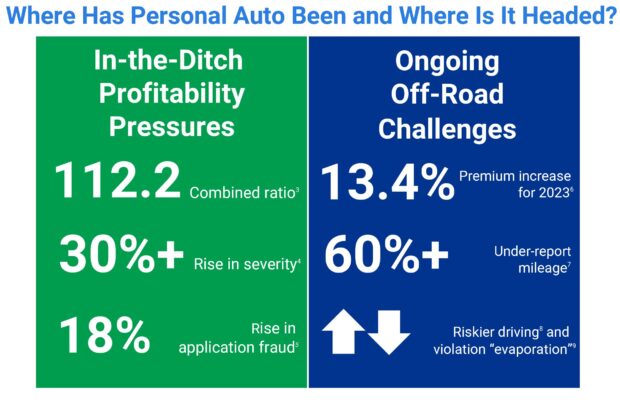

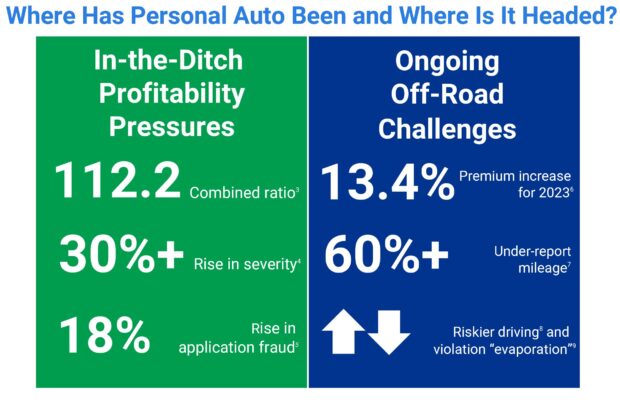

Since the pandemic lockdowns of 2020, the personal auto insurance industry hit a rough patch in 2021, went into a ditch in 2022, and is now off-roading. Personal auto insurers’ “new normal” has been record-setting and brutal. Consider some key indicators.

With more than a 30 percent increase in severity since 2019, the industry experienced its highest combined ratio in the nearly 30 years it’s been recorded. Well-documented issues are contributing to the unparalleled hard market: Skyrocketing inflation, supply chain issues that include a nearly two-month-long strike by the United Auto Workers, pandemic-driven premium leakage, and regulators pumping the brakes on rate increases.[10] Exacerbating the challenges, auto insurance premium leakage is now estimated at $35.1 billion annually,[11] as hard times have led to an increase in application fraud.

Here are some of the ongoing issues:

- Despite taking hefty average premium increases—9.5% in 2022[12] and double digits in 2023—many personal auto insurers are still struggling with rate adequacy as some regulators continue to curtail increases. For example, after a moratorium that lasted more than two years, it is now taking 267 days on average to approve rate increases in California.[13]

- More than 60 percent of policyholders under-report mileage, which was lowered during lockdowns but not updated in many cases as mileage rebounded. This has led to more mispriced risk—compounded by factors such as “boomerang” young adults who moved back home in greater numbers and other pandemic- and inflation-related factors.

- Driving behavior has been riskier coming out of the pandemic, with fatalities per million miles driven about 16 percent higher than 2019. And apparently, fewer tickets are issued in this “off-road” setting, as violation incidents have declined by more than 15 percent compared with pre-pandemic levels. Even with fewer citations issued by police, major and extreme violations have risen 3.3 points as a percentage of all violations since 2019.[14]

- Last, the pandemic and ensuing profitability pressures have affected insurers’ operational goals. A 2023 Celent study of property/casualty information technology (IT) leaders found these top four business priorities: 1) process optimization, 2) growth, 3) operating cost reduction, and 4) digital acceleration.[15]

How to get back to profitability

While the industry may be out of the ditch, it doesn’t appear to be out of the woods. Here’s a breakdown of eight off-roading challenges and potential solutions within the context of similar business priorities expressed by personal auto C-suite and underwriting leaders:

Profitable growth

- Challenge #1: Rate inadequacy and premium leakage are impeding profitability. Many insurers don’t do enough to re-underwrite at renewal and true-up pricing relative to the shifting risks that occurred during the pandemic.

- Solution: Harness non-rate actions at renewal, which can be among the fastest ways to recharge profits. A high-quality solutions provider can analyze an entire renewal book with minimal IT resources, recommend which risks to audit, and provide turnkey policyholder outreach. Capture more accurate mileage. Take advantage of recent enhancements to measure this rating factor and learn how one insurer gained 7.2 percent lift by leveraging more accurate mileage in its rating plan.

- Challenge #2: With rising application fraud, some insurers are taking extreme actions to slow growth, such as automated underwriting holds, state-specific business pauses, and mandatory pre-bind documentation.

- Solution: Leverage 65+ fraud-detection triggers in real time with Verisk’s RISK:check® Point of Sale and harness a “stoplight” quote workflow to automate “green” quotes, investigate yellow applications, and mitigate red risks. Application fraud analytics offer more nuance to foster sustainable, profitable growth for good risks, even in states where policies may be underpriced.

Operating cost reduction

- Challenge #3: Coming off a record-setting 112.2 combined ratio, auto insurance leaders are hyper-focused on controlling expenses.

- Solution: Cut underwriting report expenses with innovative tools. Cost-efficient personal auto risk indicators can help contain costs. They can be used in front of an insurer’s full-report ordering workflow to show where there is no adverse activity as part of an ecosystem of smart expense management. Similarly, insurers can save on the Inflection™ credit-based insurance score, powered by Equifax credit data, by harnessing the InitialQuote Score* upfront and only ordering the full score with reason codes when a quote moves to bind.

- Challenge #4: With riskier driving and a shift toward more major incidents in an environment with decreasing violation volume overall, it’s still critical—but harder—to gain a full picture of driver risk.

- Solution: Amid rising motor vehicle record fees, check out expanded violation risk capabilities.

- Challenge: #5 Compliance is complex, costly, constant, and compulsory.

- Solution: Gain efficiency and security by outsourcing insurance compliance for DMVs, lienholders, loss payees, and updates that impact loan and coverage verification with CV-ALIR, CV-Exchange, and CV-VaaS.

Digital acceleration

Process optimization

- Challenge #7: IT resources are in high demand, which can hinder progress toward process optimization goals.

- Solution: Learn from two case studies about auto innovators helping insurers simplify integrations. They achieved this by tapping into a single, award-winning, robust underwriting data and analytics platform; leveraging scalable technologies; and harnessing cloud-based connectivity to develop smarter, more agile workflows.

- Challenge #8: As premiums increase, interest in usage-based insurance (UBI) is increasing, yet it can be difficult to implement.

- Solution: Leverage connected-car telematics to elevate UBI programs for a frictionless customer experience with a single API call, and use an insurance-ready driving score to rate on actual driving behavior.

Time has shown the resilience of personal auto insurers. By leveraging a few of the above strategies, the industry may find its way back to profitability even sooner.

To learn more visit verisk.com/personalauto.

By David Ayers, Brad Magick, CPCU, and Dorothy Kelly

David Ayers, Director of Data Services at Verisk, is responsible for product development and innovation within the auto underwriting and point-of-sale space. Before joining Verisk, he had 17 years’ experience working at insurers in product management, pricing, underwriting, and claims, with a focus on new product development and automation.

Brad Magick, CPCU, leads the management of Verisk products for auto underwriting fraud, application and rate integrity, and book health. These products include Verisk’s RISK:check suite to help insurers mitigate fraud and confront premium leakage—a $29 billion annual problem for the industry. He oversees point-of-sale and renewal solutions, as well as advanced analytics that enable prioritized pursuit of premium recovery and policyholder outreach programs.

Dorothy Kelly, Vice President, leads product management within Verisk’s personal auto underwriting division and is part of a team helping insurers achieve profitable growth through data, analytics, and innovative underwriting tools. She has held leadership and executive roles within claims, underwriting, product management, and business development across personal and commercial lines, including co-founding a successful insurance services startup.

[1] Traffic Volume Trends, U.S. Department of Transportation, Federal Highway Administration, August 2023.

[2] Verisk analysis of ISO Statistical Plan data, 2019-2022.

[3] AM Best Aggregates and Averages, 1995-2022.

[4] Verisk analysis of ISO Statistical Plan data, 2019-2022.

[5] Verisk client analysis of 9.1M transactions from 2019 to August 2023, based on the average RISK:check score.

[6] “US Auto Market Report: Private Auto Struggles to Subside,” S&P Global Market Intelligence, October 25, 2023.

[7] Verisk client analysis, 2023.

[8] Early Estimate of Motor Vehicle Fatalities for the First Quarter of 2023, U.S. Department of Transportation and National Highway Traffic Safety Administration, September 2023; traffic fatalities reached a 20-year high in early 2022, and although the rate per 100 million vehicle miles traveled has declined, it remains 16 percent higher than the pre-pandemic 2019 baseline.

[9] Verisk analysis of 35 million court records, 2019-2022 in AZ, FL, IA, NJ, PA, RI, TX, and VA; number of violation incidents declined by more than 15 percent in 2022 versus 2019.

[10] “Between a Rock and a Hard Market: Solutions for Personal Auto,” Verisk’s Visualize, May 5, 2022.

[11] The Impact of Insurance Fraud on the US Economy, The Coalition Against Insurance Fraud, 2022.

[12] “Large Personal Auto Insurers Increased Rates by 9.5% in 2022,” Auto Insurance Report, February 20, 2023.

[13] “First Signs of Progress Emerge in Troubled California Market,” Auto Insurance Report, October 30, 2023.

[14] Verisk analysis of 35 million court records in AZ, FL, IA, NJ, PA, RI, TX, and VA, 2019-2022.

[15] North American Property/Casualty 2023 CIO Pressures and Priorities, Celent, February 20, 2023.

*InitialQuote Score is patented and trademarked by Equifax.