In this series, we share insights from a recent study* which seeks to understand the current state of core insurance systems and market sentiment for adopting SaaS-based models.

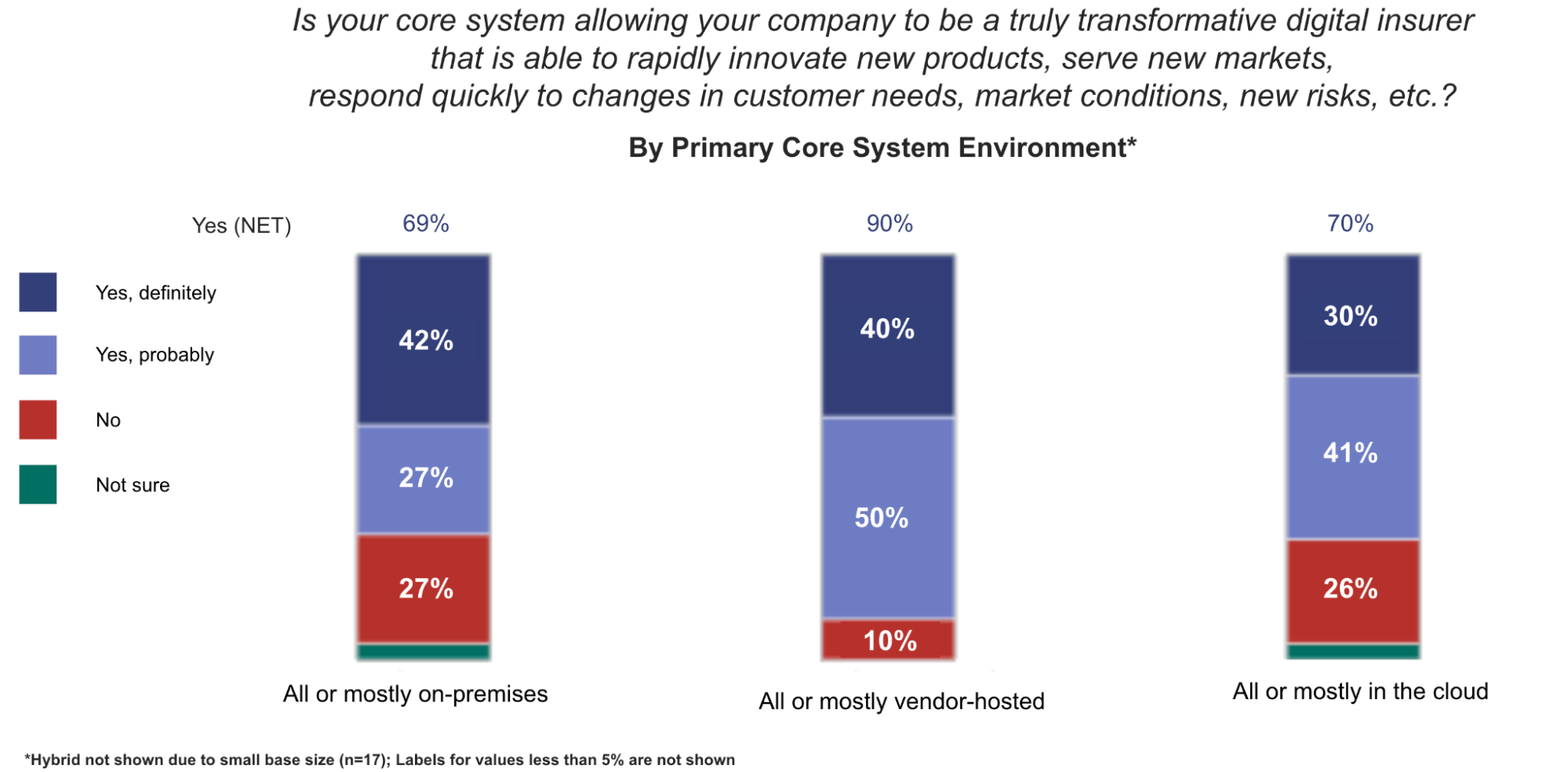

In part 4 of our series, it was reported that 80% of respondents feel they have a competitive advantage against their peers as a result of their technology stack. In this part, we explore an aspect of that advantage — what it means to be a transformative digital insurer. Our definition of the term included the ability to rapidly innovate new products, serve new markets, and respond quickly to customer needs, market conditions, and emerging risks.

We analyzed responses by primary core system environment. The greatest percentage of positive responses, by a wide margin, was for all or mostly vendor-hosted environments. More respondents were positive that their on-premises and private cloud solutions did not allow them to be truly transformative.

It was interesting to note that department heads and senior business executives generally skewed more favorably toward their core systems allowing them to be transformative than managers and executives responsible for strategy who were generally more sure they were not.

We asked respondents to further explain why they don’t believe their core system is allowing their company to be a truly transformative digital insurer. Reasons ranged from the age of the system to barriers in efficiency:

“Because we have too many manual tasks that slow down our efficiency.”

“It’s pretty much an antique.”

“It’s too old to integrate with the newest technology to provide the best experiences for both customers and employees.”

“There isn’t enough scalability and migrating to newer, more efficient technology platforms will require a laughable amount of time.”

While vendor-hosted environments can be helpful in reducing overall internal IT demand, allowing budgets and expertise to focus on innovative strategies for digital transformation, those advantages are just a start. A true multi-tenant SaaS vendor-hosted solution, for example, allows for shared development resources for more quickly launching innovative advancements that support a transformative insurer. Configuration over coding speeds up launch timelines and public cloud services help the business scale to take advantage of new opportunities.

To learn more about why the architecture matters for selecting core insurance cloud technology, download our eBook.

*Research Methodology and Respondent Profile

This research was commissioned by Origami Risk and conducted by Arizent/Digital Insurance between September 22 and October 20, 2022, among 100 qualified respondents. To qualify, insurance industry professionals had to have a management role (in a non-legal/HR function) and have knowledge of their organization’s core systems or primary supporting services.

51% of respondents self-identified as P&C insurance carriers, 25% insurance broker/agent, 12% MGA/MGU and 12% third-party administrators.

Total Respondents: n=100; Annual premiums under $1B: n=35/Annual premiums of $1B or more: n=65; IT/technology role: n=16; Primary core system is all or mostly on-premises: n=26; Senior business unit executive: n=28/Division or dept head/director: n=36.

FTC Issues Worker Non-Compete Ban as Chamber Lawsuit Looms

FTC Issues Worker Non-Compete Ban as Chamber Lawsuit Looms  That Insurance Talent Crisis? It’s a Global Knowledge Opportunity

That Insurance Talent Crisis? It’s a Global Knowledge Opportunity  Uncertainty Keeps Prices Up; No Prior-Year Loss Development: Travelers

Uncertainty Keeps Prices Up; No Prior-Year Loss Development: Travelers  Study: Average Cyber Breach Insurance Coverage Gap is 350%

Study: Average Cyber Breach Insurance Coverage Gap is 350%