In this series, we share insights from a recent study* which seeks to understand the current state of core insurance systems and market sentiment for adopting SaaS-based models.

If underwriting is the profit center of the business, the claims organization delivers upon the insurance product and promise to policyholders. As such, the customer experience is often highly prioritized, measured, and obsessed over by claims professionals. In conducting this survey, the value wasn’t necessarily in being reminded of this fact, but rather in gathering more insight into the job roles and organization types most likely to champion key customer experience initiatives.

The data indicates that senior business executives are more likely than their junior counterparts to say they plan to pursue some customer-centric goals. For example, 61% of them prioritize improving the ability to identify customers at the greatest risk of attrition following a post-loss payout, and 57% prioritize providing customers with direct access to input into the claims process.

Likewise, similar to findings when we looked at underwriting priorities, participant organizations with annual premiums of $1 billion or more (55%) and those with three or more core systems (57%) are planning to pursue AI and machine learning capabilities in the claims process. On the other hand, insurers with less than $1 billion in premiums only prioritized these capabilities 20% of the time.

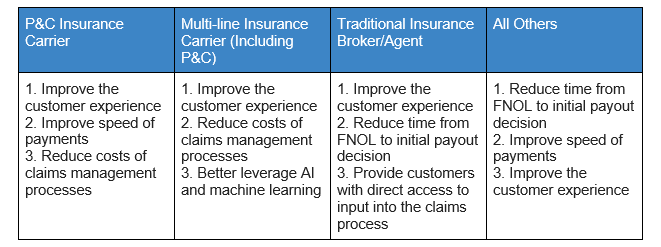

Further examination reveals that organization type drives the pursuits of claims management planned for the next two years.

While improving the policyholder experience is clearly a top initiative for all survey respondents, organizations more mature in their digital transformation journey and larger in organizational size are planning to address identified issues through their technology capabilities. This is a logical approach since those with more advanced platforms are better equipped to orchestrate more efficient and fair claims processes on cloud-enabled platforms, deep ecosystem integrations, and business insights using measurement tools.

To learn more about why the architecture matters for selecting core insurance cloud technology, download our eBook.

*Research Methodology and Respondent Profile

This research was commissioned by Origami Risk and conducted by Arizent/Digital Insurance between September 22 and October 20, 2022, among 100 qualified respondents. To qualify, insurance industry professionals had to have a management role (in a non-legal/HR function) and have knowledge of their organization’s core systems or primary supporting services.

51% of respondents self-identified as P&C insurance carriers, 25% insurance broker/agent, 12% MGA/MGU and 12% third-party administrators.

Total Respondents: n=100; Annual premiums under $1B: n=35/Annual premiums of $1B or more: n=65; IT/technology role: n=16; Primary core system is all or mostly on-premises: n=26; Senior business unit executive: n=28/Division or dept head/director: n=36.