In this series, we share insights from a recent study* which seeks to understand the current state of core insurance systems and market sentiment for adopting SaaS-based models.

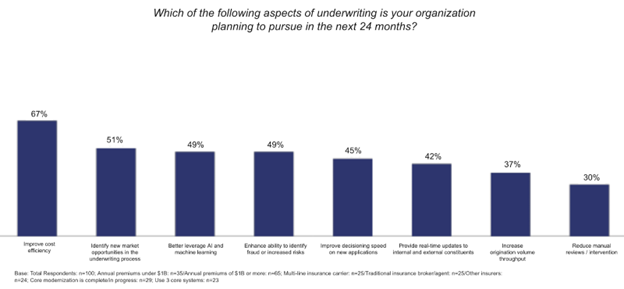

Following a focus on general insurance priorities and the contributing factors that impede their progress, we turn our attention to the profit center of the business, underwriting. It was no surprise that when it comes to this discipline, insurers—especially those at smaller organizations—are most commonly trying to improve cost efficiency. In fact, 86% of those with annual premiums under $1 billion in annual premiums pointed to it as a top priority.

With advancements in artificial intelligence (AI) and machine learning (ML) growing across all economic sectors, underwriters are in good company as they look to better leverage its promised efficiencies. Further delving into the numbers provides an interesting insight behind the organizations best primed to tap this developing technology.

- Multi-line insurance carriers (68%) and MGA/MGU brokers and other third-party administrators (63%) indicated a higher-than-average propensity to tap AI and ML than other organizations.

- A higher interest came from those who have already completed or are in the process of a core modernization of their primary core platform (66%).

- Those currently using three or more core systems also were more likely to look at AI/ML (65%).

- Organizations with annual premiums of $1B or more also showed a higher propensity to prioritize AI/ML (58%).

Improving decisioning speed was also notable at 61% for those currently using three or more core systems; they indicated this is an area of investment in the next 24 months.

Considering this data together shows that while there is healthy interest across the board, the larger, more sophisticated specialty insurers on newer core platforms are prioritizing the adoption of AI and ML at a faster rate than others in the industry. Today’s cloud core systems, with modern API functionality and bespoke integrations are paving the way for increased uptake of insurtech capabilities that show promise of profiting those willing to invest.

To learn more about why the architecture matters for improving efficiency and future-proofing your core insurance cloud technology, download our eBook.

*Research Methodology and Respondent Profile

This research was commissioned by Origami Risk and conducted by Arizent/Digital Insurance between September 22 and October 20, 2022, among 100 qualified respondents. To qualify, insurance industry professionals had to have a management role (in a non-legal/HR function) and have knowledge of their organization’s core systems or primary supporting services.

51% of respondents self-identified as P&C insurance carriers, 25% insurance broker/agent, 12% MGA/MGU and 12% third-party administrators.

Total Respondents: n=100; Annual premiums under $1B: n=35/Annual premiums of $1B or more: n=65; IT/technology role: n=16; Primary core system is all or mostly on-premises: n=26; Senior business unit executive: n=28/Division or dept head/director: n=36.

Despite Break in Car Prices, Soaring Insurance Costs Hit U.S. Buyers

Despite Break in Car Prices, Soaring Insurance Costs Hit U.S. Buyers  Viewpoint: You’re at a Competitive Disadvantage If You’re Not Innovating

Viewpoint: You’re at a Competitive Disadvantage If You’re Not Innovating  La Nina 60% Likely to Develop Between June-August

La Nina 60% Likely to Develop Between June-August  USAA to Lay Off 220 Employees

USAA to Lay Off 220 Employees