The complexity of insurance products and processes has plagued the insurance industry since its beginnings. It has consequences for decisions throughout the customer’s journey with an insurance company.

From the customer (buyer of insurance) perspective, the entire insurance process is flawed, particularly compared to other businesses they engage with. One result of this is a historically low level of individual life insurance ownership, which has led to a staggering amount of “under insurance” among consumers and businesses. A significant portion of this unsold opportunity lies in the coveted 30- to 50-year-old space, Millennials.

The urgency of adapting to Millennials and Gen Z is reaching a critical tipping point. By 2025, the combined Gen Z and Millennial generations will dominate the 30-60-year-old sweet spot for insurance. How Gen Z and Millennials view work and career is very different than how Gen X and Boomers view them. Millennials’ and Gen Z’s behaviors align to employment fluidity and to Gig or on-demand employment, reinforcing a strategy to capture them early in their lifecycle via voluntary benefits that can be ported when they leave, allowing insurers to capture, retain and grow the relationship regardless of their employment.

We have not seen a shift like this in our lifetime, one that will demand core systems that will adapt to their needs and behaviors – moving between jobs regularly, buying benefits that can port to individual insurance and full digital engagement. Insurers unprepared for this new dominant insurance buyer and their extremely different needs and behaviors will increasingly find they are no longer relevant.

While L&A insurers needed to operationally improve prior to COVID-19, they will be pressured to do so even more during and after the crisis. The pandemic rapidly exposed less than desirable customer experiences as they deal with paper-bound processes, non-digital post-service transactions, a rise in “fluidless” online life insurance purchases, and the need for extra caution due to fraud. At the same time, new risks have emerged that demand new products such as “pay gap” for employees unable to work during a shutdown, new health products and simple life coverages – either as individual products or voluntary benefits.

To retain the customer and revenue, insurers must rethink their scope away from a life insurance transaction to a broader lifestyle experience across health, wealth and wellness that includes:

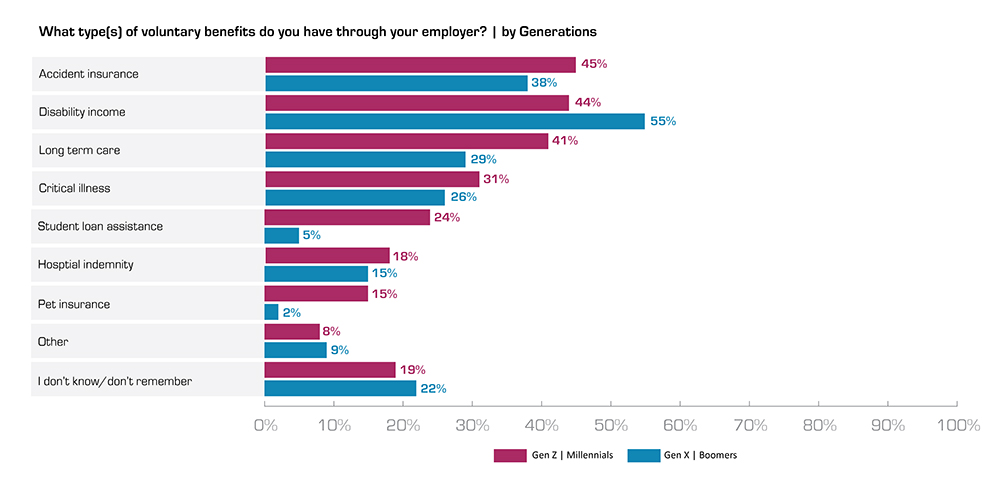

Our research report, Rethinking Life Insurance, highlighted that 40% of Gen Z and Millennials and 49% of Gen X and Boomers have voluntary benefits through their employer. As seen in Figure 1 below, the younger generational group has higher ownership rates on most benefit types, with disability income the lone exception.

The very large gaps between the segments on Student Loan Assistance (4.8x) and Pet Insurance (7.5x) stand out as markers of new innovative products that align to the lifestyles and needs of this younger generation, a strong contrast to their older counterparts.

Group and Voluntary benefits are seeing tremendous growth, fueled by high demand for talent and employers seeking to expand voluntary benefit offerings in the midst of higher healthcare costs. This is great news for insurers that are prepared to provide new voluntary benefit-oriented offerings, such as accident, legal, disability, pet insurance and identity theft insurance. In reality, there is almost no kind of insurance that couldn’t be offered as a voluntary product through employers or through other member-oriented groups like AARP.

Wellness, however, isn’t just about health. It is about safety. Employers have a vested interest in keeping their employees safe and employees have an interest in keeping themselves and their families safe. Many employers are using wearables to improve employee wellness. With their insurer partners, they can look at the composite data and design health and wellness programs and communications aimed at correcting issues and keeping costs down.

Finally, it was surprising and somewhat concerning that about 20% of each generational group didn’t know or remember what type(s) of voluntary benefits they have, a clear indication of lack of communication and understanding, which will influence satisfaction and value, or lack thereof. Insurers offering voluntary benefits must flex their creativity to bring new products to market that create more engagement and meet the changing needs of the new generation of employees. COVID-19 has raised awareness in the buying public regrading new risks and these new products will become the “hot” products of 2021 and beyond. New/hybrid products tying together an annuity/retirement product with a pandemic/loss of income rider or standalone product or a gap insurance for the difference between salary and unemployment (in cases of layoffs) will emerge.

Figure 1: Types of voluntary benefits owned

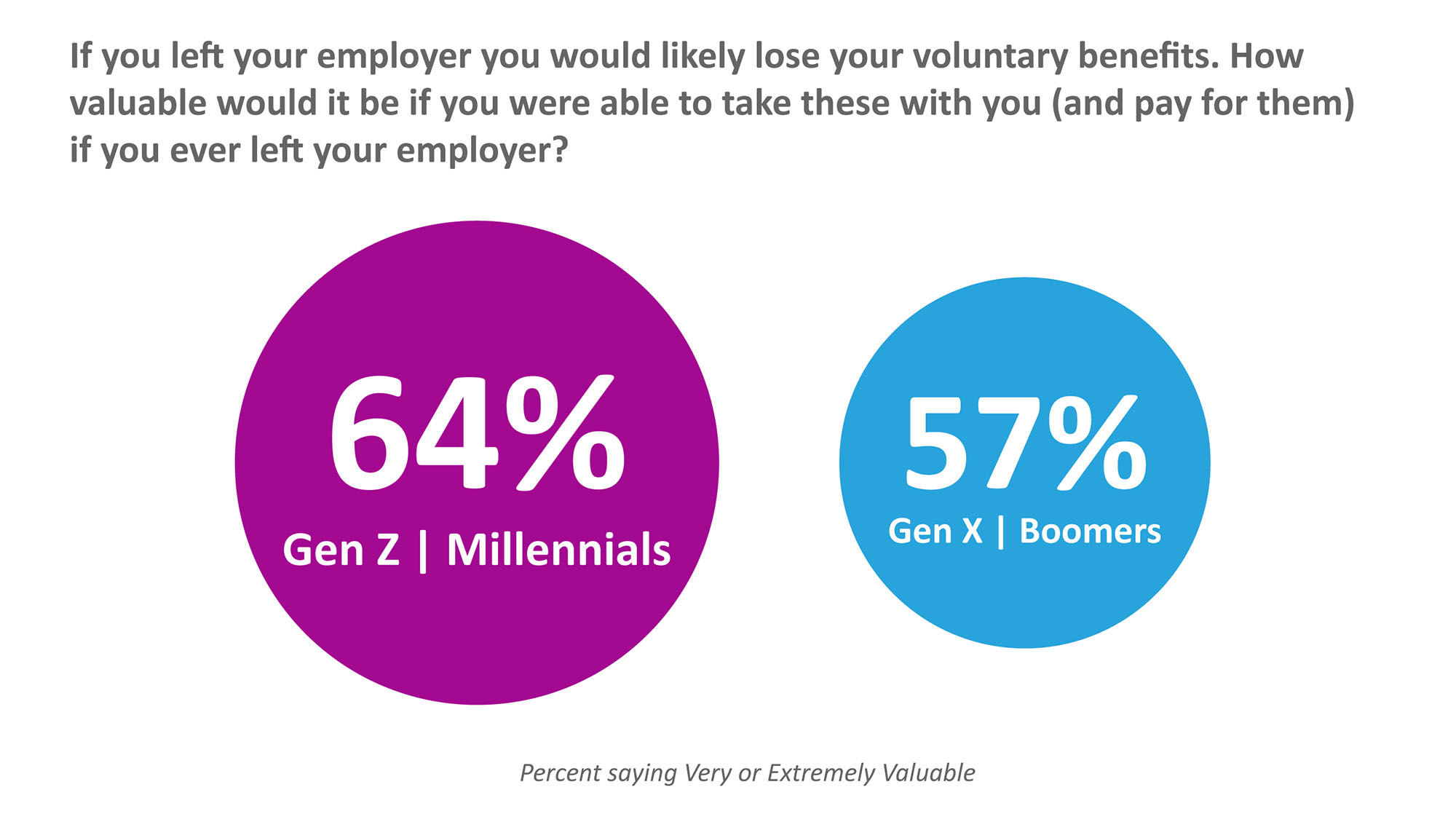

Pre-COVID-19, it was predicted that 52% of the US workforce would be in Gig economy by 2023, up from 36% in 2019.[i] Due to the economic and employee disruption (similar to what we saw during the financial crisis of 2008), this is expected to accelerate, and demand for portable benefits that move from Gig to Gig will grow. Demand will increase in customer-centric product ranges that cater to an increasingly mobile workforce with changing needs throughout a lifetime of work changes, reflecting the increasing need and interest in portability of insurance.

The value of this capability to customers is reflected in Figure 2, with both generational groups giving portability high marks – Millennials and Gen Z at 64% and Gen X and Boomers at 57%. The older generation sees value as they ease into retirement and participate in the gig economy, getting value from benefits offered as a gig worker.

Figure 2: Value of portable voluntary benefits

Digitally enabled experiences that insurers provide to their customers, prospects and distribution partners are now mandatory and expected to be part of core systems. Never before has it been more important to provide full transparency and access to them. Insurers must increase priority on providing digital, self-service capabilities throughout the lifecycle from sales through claims, to enhance the customer experience, mitigate operational risk, and drive cost reduction. Creating and participating in digital ecosystems will be a requirement and critical differentiator, particularly for value-added services that create unique customer offerings and overall customer experience. It will be all about owning the customer relationship, not just a policy transaction.

To create this experience, insurers must rethink their scope and how they can participate and connect with a broader health, wealth, and wellness ecosystem that provides real value to the customer.

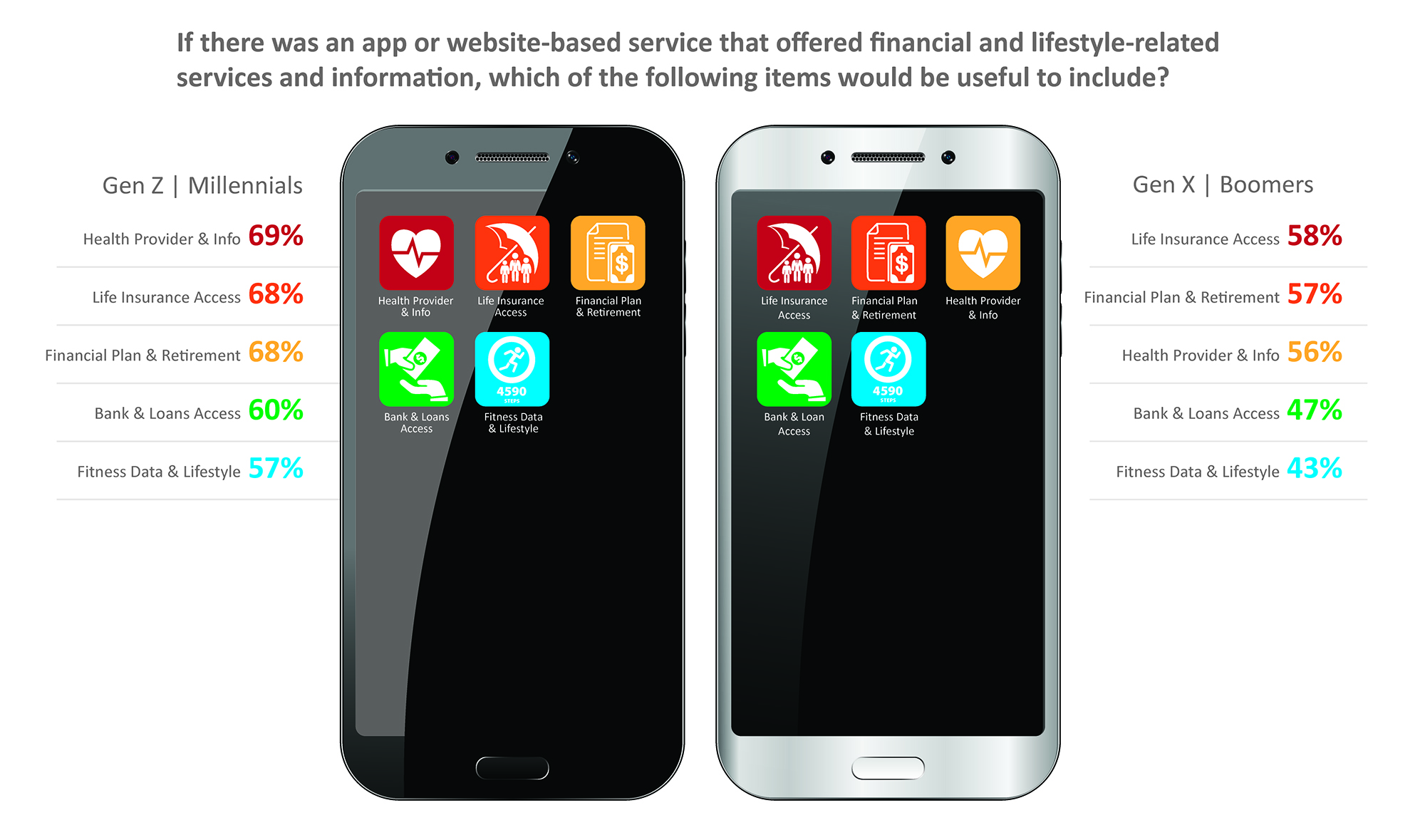

Currently, a customer must go to multiple, disparate places to fulfill their lifestyle needs. Our research identified 14 such needs across life, health, wealth and wellness. We asked customers how useful it would be to have a single source (an app or portal) to access the information, interact and manage their lifestyle for these. Analysis of their responses identified five “job groups” as reflected in Figure 3.

For all the job groups, the younger generation outpaced the older generation by 17%-33% in interest. Both generational groups were more than 50% interested in the Life Insurance Access, Health Provider & Info, and Financial Plan & Retirement, indicating the desire to manage their lifestyle and information more cohesively. The older generation was lower in Fitness Data & Lifestyle and Bank & Loans Access but given the increasing interest by this generation to remain healthy and engage in more digital businesses, this will likely increase.

These results underscore the shift from customers doing singular transactions to managing their lives in a very different way. Those insurers that succeed in meeting this new paradigm will gain customer loyalty and growth.

Figure 3: Life, health, wealth and wellness “job groups”

The importance of managing multiple lifestyle needs within a single focus via an integrated life, wealth and health ecosystem approach for Gen Z and Millennials is underscored by their willingness to pay for it…an amazing 38% of the younger generational segment would pay $10 per month, 2.7 times more than the older generation.

Given the diversity of interest in the various “jobs,” allowing customers to pick and choose their options within a service will be important, ensuring personalization to their needs. Because of the advancement of cloud and API technologies, the ease of doing this makes it easy and workable for companies who want to own the customer relationship, regardless of the products and services they use. This concept is what Apple introduced with the Apple App Store and what Majesco EcoExchange offers – providing access and revenue opportunities to all within the ecosystem.

The results from our research emphasize the divergence in views by the younger generation on how life insurance and voluntary benefits fit into a broader life, health, wealth and lifestyle concept. The obvious next question is … Is anyone doing this today, and how are they doing it? To get some answers, listen to our recent podcast with experts from Deloitte and Majesco: Respond, Recover, Thrive: A Digital Transformation During a Crisis – Part 2.

_________________________________________________

[i] Primack, Dan, “Exclusive: Mary Meeker’s coronavirus trends report,” Axios, April 17, 2020, https://www.axios.com/mary-meeker-coronavirus-trends-report-0690fc96-294f-47e6-9c57-573f829a6d7c.html