Every moment of every day, retail operations are under scrutiny. Executives and management teams for grocery stores, gas stations, big box home goods, home repair and department stores are obsessed with merchandising. Product placement is always in flux. Endcaps are changed for a season or a weekend. Special displays are constructed as demand is anticipated.

And now they are equally obsessed with their digital storefronts – the digital version of the physical store – highlighting new products, sales, and suggesting items to customers based on their behaviors and engagement.

A great deal of thought goes into both the digital and in-store experience – the same questions, but just addressed differently. What is the flow like? Can we drive the flow of our store offerings to add more impulse purchases? How can we construct our check out process to make it quick and easy? Can we accommodate for visual space for products at the point of purchase? May we suggest something else that may go with the purchases? In some cases, this results in a mini-maze just prior to the checkout, where by chance some last glimpse of something will trigger an additional sale at the point of purchase. Do I add a warranty? Should I get a Starbucks gift card for my neighbor who took care of watering my plants? At the point of sale – whether in person or digitally – the retailer buys the space that’s in our heads. We advertise to ourselves. We make the decision.

And the process works and creates growth opportunities for retailers who are rapidly transitioning to offer both in-person and digital, like Walmart, to meet customer needs and expectations. It’s a company that disrupted retail 30 years ago, and were in the crosshairs of disruption by Amazon, but are reinventing themselves once again.

Walmart is leveraging their massive store base – which is accessible by nearly every person in the US – with their investments in their e-commerce platform to expand reach, engage customers and grow the business. If you go on their platform, you will see brands that you don’t see in the store – partners selling through Walmart. And with this platform they are now looking to expand by adding a membership service. This traditional retailer has reinvented themselves to meet the expectations and needs of customers and create an experience – like Amazon – that creates loyalty and deepens the relationship with the customer as the place to buy and manage different aspects of their life.

Which makes us wonder, what if life insurers reinvented themselves to be obsessed with the point of purchase – digitally and in-person?

Life insurers, annuity providers and voluntary benefits providers should remind themselves that when it comes to point of purchase, this new retail mindset can be a game-changer. This is the very first step in establishing the need for a flexible, ecosystem approach that will fit as comfortably at any digital checkout queue as it will at the advisor’s office. If we can establish the points of life where purchase can be seamless, easy and almost transactionless, then we’ll drive growth – something that has been elusive the last few decades.

In Majesco’s thought leadership report, Rethinking Life Insurance: From a Transaction to a Life, Health, Wealth and Wellness Customer Experience, we take a closer look at what is driving buyers of life insurance and other related products to cross the line and make the purchase. In our analysis, we identified some indicators regarding product location and the easiest ways to construct simplified purchase experiences. Digging deeper, we looked at how we can help customers sell to themselves through new digitally-enabled opportunities, which may still be connected to in-person engagement.

To better understand just how people’s life experiences relate to their potential life insurance transactions, we surveyed consumers asking them a range of questions related to health, wealth, wellness, life insurance and purchasing habits. The details of the survey results highlight a rapid shift, particularly by Millennials and Gen Z, to wanting a lifestyle experience rather than just a transaction.

This blending of the purchase experience into the life experience is the key to unlocking the point of purchase in insurance.

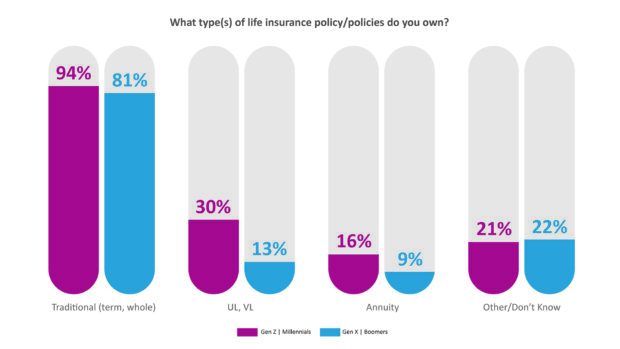

Ownership of life insurance has seen significant declines over the last 50 years. In our survey, the older generation segment, Gen X and Boomers, has overall lower ownership than the younger generations, Gen Z and Millennials, as shown in Figure 1. Across the 3 categories of traditional, UL/VL and Annuity, the younger generation’s total ownership level is 35% more than the older generation, reflecting a potential upswing in the life insurance market as the younger generation matures and expands their need for insurance. Most interesting is that both generations clearly gravitate to traditional insurance – term and whole life – as compared to investment-backed products such as UL, VL and annuities by a factor of 3 to 9 times, depending on the product.

Interestingly, this strong interest in traditional products aligns with the growth of non-traditional, fluidless, rapid issue life insurance from companies like Haven Life, Ladder Life, and other insurers. The two are increasingly compatible.

Figure 1: Types of life insurance owned

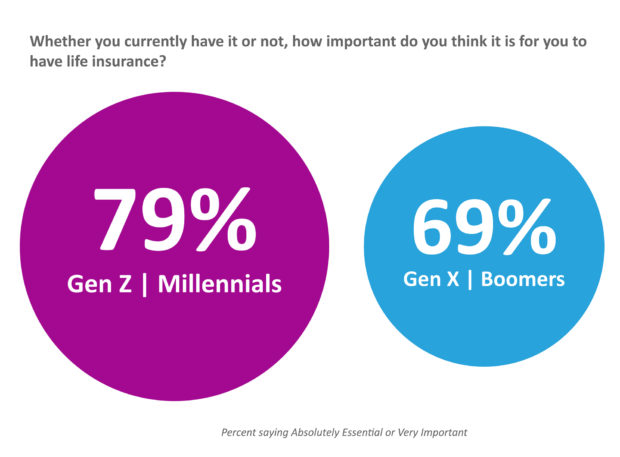

Even more interesting and encouraging, is that the younger generation believes more strongly than the older generation in the importance of life insurance, at 79% versus 69% (Figure 2). The key will be to meet their expectations in the risk product, customer experience and value-added services areas.

Figure 2: Importance of life insurance

Interestingly, 70% of the younger generation who do not have life insurance still believe it is important – indicating a strong market opportunity for insurers who can meet their needs, demands and expectations. In contrast, only half (49%) of the older generation who do not have life insurance believe it is important.

With the value and importance of life insurance established, what will prompt each of the generations to purchase life insurance? Our research has shown that the younger segment has more life event needs on the horizon that would motivate them toward a life insurance purchase. They are interested. They find it to be important. So…

Why aren’t many of them acting upon their need at common moments of impulse?

Something is standing in the way of the insurance purchase. There is an understood need. There are relevant life events. So, something within current product offerings or the sales and engagement process does not align with their expectations. A hint emerges when you compare preferences for coverage periods.

For typical term insurance, everyone still favors monthly payments. However, coverage for a specific event or short period – on demand insurance – is of higher interest to the younger generation and on par with the other payment options.

What this indicates is the need for different options to meet different needs at any point in time for life insurance, whether planning for a long-term coverage for death, or meeting the need for short-term insurance for an activity like a vacation. It is all about need and placement. The younger generation is poised to purchase at the point of need – and likely digitally.

Validating these assertions, we found that the younger generation is significantly more engaged in activities that would cause them to buy insurance. Nearly a third of the younger generation participated in a sport or activity that could result in injury or death as compared to 8% of the older generation. Millennial and Gen Z generations participate more in extreme sports, they travel more, they do more shopping online. They are the generations that value experiences over ownership, which makes them highly likely to want to protect themselves and their experiences. This sheds new light on ways to capture and grow new customer relationships.

With the Gen Z/Millennials valuing and showing interest in buying life insurance, where and how will they buy?

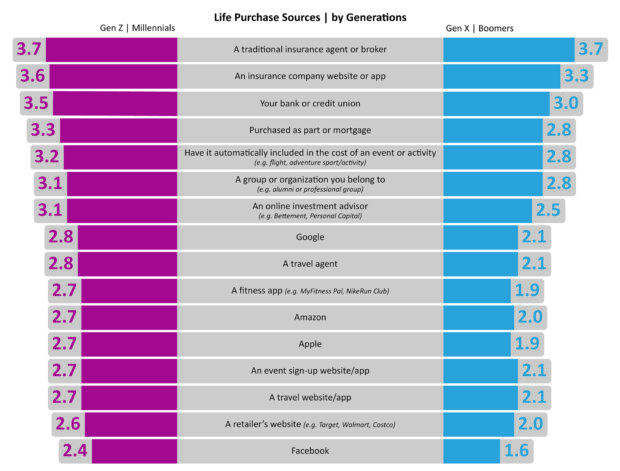

Unsurprisingly, members of the younger generations are open to buying life insurance from a wide array of options, as highlighted in Figure 3. Agents and insurer websites are at the top, but of the 16 options we included in our survey, 7 of them exceed the 50% level of interest (a rating of 3 on the 5-point scale), with the balance of them within just a few tenths of a point of this level – and a majority of these are digital, point of sale focused. In contrast, the older generation has only 3 of the 16 options at 50% interest or greater.

The acceptance of a wider range of purchase options highlights the need for insurers to consider how and where they interact with the younger generation, and to be there with timely purchase prompts. This is where having partnerships and an ecosystem becomes very strategic in helping insurers expand their reach and presence to where their customers will be.

Figure 3: Preferences for different life insurance purchase sources

If customers are interested and willing to purchase insurance from so many different sources and in so many different ways, then we can begin to innovate around what it will take for insurers to place their products in any place at any time – including their own digital platform. Walmart and Amazon are proving that product sales are most effective when they are multi-channel, multi-delivery-type, and easily accessible. They are placing related products, such as warranties and accessories in front of buyers at precisely the right times. Each of them is successful because they understand their market’s purchase patterns, customer behaviors and they customize the purchase process to fit – with a digital platform that also uses sophisticated data and analytics.

When the process conforms to the person, retailers and insurers alike will be able to relax and know that they are not just capturing the up-and-coming generations, but like Walmart and Amazon, they are giving the best service possible to every generation.

Will your products one day sell on auto screens? Will they sell through smart homes? Will they be as easy as a tap on an Apple Watch? Will they be part of another purchase – like buying a home and getting a mortgage. Your best life ideas will come from watching lives and lifestyles and thinking, “We could place ourselves right there.” It all begins with insights and the initiative to transform the insurance model from a transaction to an experience. For more insights be sure to download, Rethinking Life Insurance: From a Transaction to a Life, Health, Wealth and Wellness Customer Experience.

_________________________________________________

By: Denise Garth, Chief Strategy Officer

Denise is responsible for leading marketing, industry relations and innovation in support of Majesco’s client centric strategy, working closely with Majesco customers, partners and the industry.

_________________________________________________