Before everyone started calling their products “bespoke” solutions (a word that is older than you may think), there was just the spoke (a word that is much older). The spoke was a “spike” connected to the hub of a wheel. It might be a ship’s wheel, a cartwheel, or a mill wheel, but the spoke was crucial to the usage of the wheel. In most cases, the spokes were all the same. Their sameness has always been important to the operation and balance of the wheel. On a bicycle, for example, you don’t want different spokes attached to the hub. You need similarity.

Spokes were unique to the mechanical world in how they operated. Spokes work together with the hub. They are each relatively weak, compared to the strength of the whole wheel. Spokes need a hub and a hub needs spokes. Even today, many spokes must work together, tied to the hub, to accomplish the purpose of the wheel.

Of course, at some point, the whole physical aspect of the hub and spoke made for excellent business metaphors, especially when it came to distribution, transport, purchasing, financial processes, and data.

Billing and payments are an area where spoke and hub metaphors are exceptionally relevant but different. Today’s digital hub works best when many different types of spokes work together efficiently, including different payment and data types, differing product types, and even different customer types. In fact, it is the unique needs of the customer that have now caused insurers to need bespoke payment and billing solutions created around a foundational billing and payments hub. The right kind of foundation — the right kind of hub — can now fit almost all insurance billing and payment strategies.

Deloitte and Majesco hosted a roundtable with experienced billing and payments industry leaders to discuss key market trends and subsequent strategies and tactics to elevate billing and payments as a crucial part of the customer journey and experience. For the full coverage of the Deloitte and Majesco roundtable, be sure to read, Rethinking Billing and Payments in the Digital Age. It contains valuable use cases that show just how a revised strategy fits individual and business customers’ operational needs.

In our last billing and payments article, we discussed customer experience and customer loyalty related to billing. In today’s article, we’ll look at how companies can operationalize a billing and payments strategy that will turn billing and payments into a growth generator. Insurers begin by implementing a multi-enterprise billing and payment hub — a step that is more crucial and less difficult than most insurers may know.

To operationalize the strategy, insurers must:

Certain capabilities are mission-critical. For example, a payments hub is foundational to this alignment because of the differentiation and personalization it will deliver and its centrality to customer-first experiences.

A payments hub is at the core of this unified transformation:

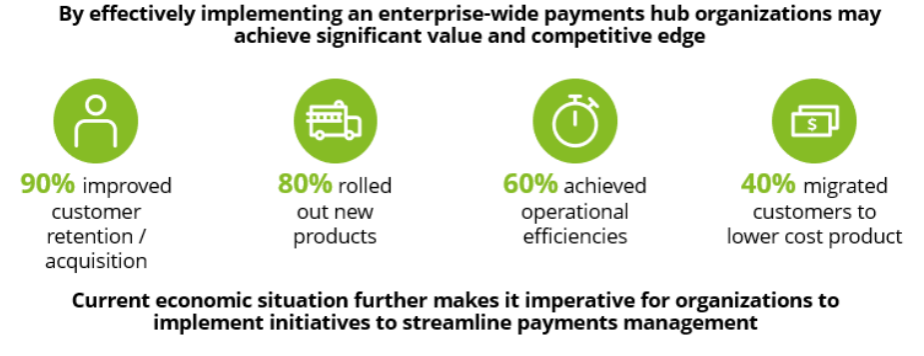

Figure 1: Benefits of implementing enterprise-wide payments hub

Executives within billing and payments are challenged to balance internal and external forces to deliver value to the enterprise. One of the best places to begin to achieve this is the cost of operations. Billing and payments are one of the areas where cost optimization and customer experience and loyalty can be addressed in tandem.

Leaders will start by optimizing costs, because fixed costs do have some level of control, and every other area seems to be in a state of transition. Industry value chains, for example, remain in flux while customer needs continue to evolve and supporting ecosystem participants are re-thinking their billing and payments strategy. All of this is further impacted by increased needs for security and compliance.

Billing and payment methods are some of the spokes in the wheel that are served by their attachment to the hub, enabling the adding/swapping/removing of payment spokes as they shift or customer needs change such as the growth of digital wallet companies versus credit card use. For insurers, fostering digital wallet payments may reduce credit card fees. Can insurers become adept at encouraging users to utilize less expensive methods of payment? Absolutely. This is just one example of how insurers can capitalize on trends and opportunities.

“If you try to apply fixes to what you have today, maybe surround it with some digital, you’re not really changing the core of what it is. You’re only going to get so far.”— Roundtable Participant

Beyond just the initial transformation, billing and payments re-design needs to account for fiscal and operational sustainability. A few specific design elements need extra consideration:

As the strategy moves forward and becomes operationalized, getting all parts of the organization invested in the design journey is critical so they will completely understand the customer impact, the value generated from an improved customer experience, and the associated investments needed to capture that value.

Incorporating the billing and payments strategy into the technology platform design starts with three parallel elements, including:

“Key components and technologies within the overall architecture can drive down the overall cost and allow you to really support growth, whether it’s new products, it’s customers, or it’s partners.“— Roundtable Participant

Process and design considerations:

“We need to look at cultural decision making as it is so critical to any change. It is insufficient to say this is what we’re changing. It has to be the why and the why has to be framed in the cultural nuances of your company. And if you can’t do that, spend time thinking about it, figure it out, because ultimately, it’s going to reduce the cycle time for delivery of that decision, but it’s going to make the decision shared. It will be everyone’s decision, not just yours.”— Roundtable Participant

Specific insurance design considerations should include:

“If you have an API integrated architecture, it will allow you to take advantage of some of these modern payment methods and all that your customers are looking for.”— Roundtable Participant

Are your teams ready to use billing and payments as a strategy for growth? Majesco has the #1, market-leading solution Majesco Intelligent Billing for P&C and Majesco Intelligent Billing for L&AH with embedded analytics, including generative AI to optimize operations and drive business insights for the business and customers and a robust ecosystem of partners like One Inc. with OOTB integration that delivers payment options demanded by customers.

Move billing from the back office to the front office where your customers are expecting it with our next-gen solutions!

To get a new perspective on what’s at stake, be sure to read the Majesco/Deloitte roundtable report, Rethinking Billing and Payments in the Digital Age. You’ll get a detailed look at what is included in a Payments Hub Reference Architecture, plus, you’ll find cases and insights on how transformation will improve customer experiences while driving down costs.

Today’s articleis co-authored by Denise Garth, Chief Strategy Officer at Majesco, and Ajay Radhakrishnan, Principal, Deloitte Consulting