Satisfaction (at least according to the Rolling Stones) is a bit elusive. It isn’t always easy to find satisfaction in customer experiences because goals and experiences keep changing.

Look at video games. Activision, a video game producer, has been creating games since the late 1970s. The nature of video games is nothing like what it was when Activision produced the popular game, Pitfall in 1982. Pitfall, in all of its pixelated glory, was revolutionary. With a joystick you could run across the screen to another screen, jump, capture treasure and avoid the pits. It was true excitement. But from today’s angle, it looks dated and unexciting. This year Activision released updated versions of Crash Bandicoot and Spyro the Dragon. These are immersive game experiences that have their roots in Pitfall, but they are so engaging that very few players would ever miss the original. What makes them so immersive is the ability to see so much more — especially if you are playing with a VR headset.

Even outside of video games, digital immersion and engagement are challenging hurdles for many organizations, having customers fully relate to the Rolling Stones verse “I can’t get no satisfaction!”

Just last week, J.D. Power announced the results of a survey that points to digital engagement issues as a massive shift of customers moving to digital occurred over the last 15 months due to the COVID pandemic.

“The real challenge for insurers is pushing the envelope on digital innovation,” said Tom Super, head of property and casualty insurance intelligence at J.D. Power. “Customers’ pace of expected change is accelerating, and insurers must be able to take steps to go beyond the basics of simply digitizing customer tasks. Those that can make this leap will be poised to separate themselves from the pack.”[i]

Customers are always looking for the better experience and in insurance that experience can be created and managed with digital tools and digital proficiency, but insurers need to get beyond the basics and traditional “portal happy” approach. Most industries need this proficiency in order to get to know and understand the world of the customer. They need the ability to “look around” and see the impact of potential scenarios. They need data to anticipate possible needs. They need to move from transactions to experiences. They need a 360° view of customers, businesses and market landscapes – like having a VR headset to immerse themselves in the customer’s world.

In Majesco’s latest thought-leadership report, Digital Insurance: The Inflection Point – covering surveys of insurers from 10 months into the pandemic — we analyze this engagement and examine what it will take for insurers to provide digital experiences that will enable them to compete in a world where customer satisfaction is an ever-moving target.

We are at the beginning of the redefinition and value creation revolution for insurance, particularly with the growing ecosystems that provide new data sources, innovative capabilities and interesting services, all of which create a multiplier effect. The result is an irrevocable change to risk markets, the insurance value chain, the definition of a product, channels and so much more.

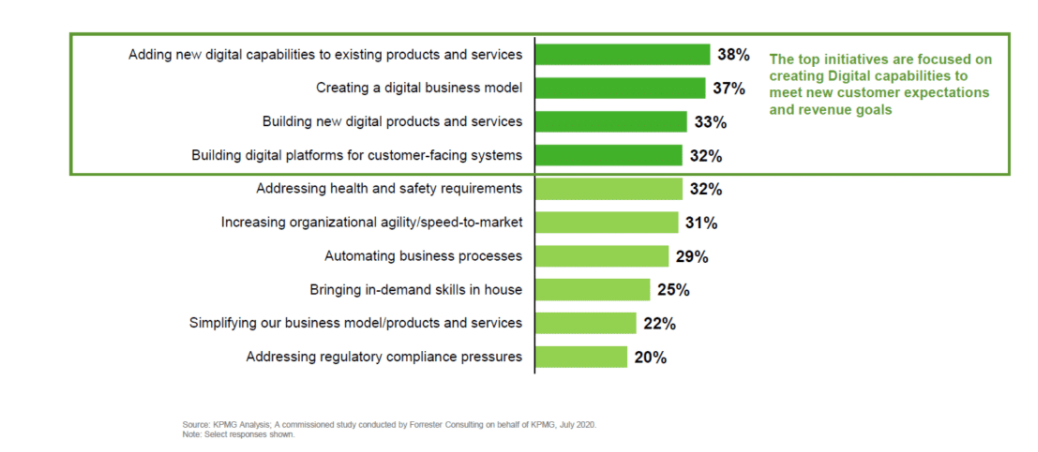

Today’s change requires insurers to gain clarity on how to succeed in the future of insurance, which is coming faster than most realize. Insurers must lay the groundwork of a new digital insurance business model that embraces customer, technology and market boundary changes with vision, energy and speed. In a KPMG sponsored study by Forrester, they found digital initiatives are at the core of organizational priorities to meet their customer experience improvement, revenue growth and cost reduction goals, as reflected in Figure 1.

Figure 1: Digital initiatives at the core of organizational priorities

However, building those digital capabilities must be done with both a different approach and different technology. Next-gen customer experiences that engage and excite customers must take a holistic experience view, rather than a transactional view. Significantly changing customer risk needs and engagement expectations are forcing the insurance industry to move from practices and technologies of the past to new platform-based technologies and business models that will carry them into the future.

The heart of the insurance platform is an orchestration of next-gen technologies including cloud native computing, microservices, APIs, new data sources, and artificial intelligence and machine learning, coupled with an ecosystem of partners that provide innovative or complementary products and services. With this unified combination of components, insurers can shift from being the ‘owners of complex core systems’ to become the ‘owners of greater technical agility and flexibility, digital fluency, innovation and speed to value’ required in today’s pace of change.

Undertaking digital transformation begins with customer-centricity with an outside-in approach that provides the capabilities that deliver the great experience customers increasingly expect.

Automated suggestions, for example, are the wave of the future. They are underpinned by digital engagement, improved data management, and AI and machine learning. When an iPhone offers to set an appointment on your calendar or your Spotify calls up a whole new list of music selections that it knows you will like, they are anticipating what you want or need.

These anticipatory technologies, as complex as they are, are actually pretty basic compared to how cognitive, protective technologies will one day work in insurance. Intelligent assistants and suggestive chatbots are going to help insurers drive down the costs and reduce risk throughout the entire value chain from underwriting through claims. Digital platforms have the potential to lower acquisition costs through a greater understanding of risk. They will keep in contact with customers, lowering the costs of communication and engagement. They will improve retention through better overall service (and service suggestions) and digital platforms will also watch over areas of vital importance.

To prepare for these 360° views insurers need to bring together next gen core insurance platforms, digital experience platforms, APIs, microservices and an ecosystem of other digital capabilities, such as chat bots, artificial intelligence and new data sources – all in the cloud. The ability to channel these capabilities requires the adoption of a modern architecture that supports easy, rapid integration through microservices or APIs running in the cloud to drive speed to implementation, speed to market and speed to value, at scale.

Visionary insurance leaders see the market, customer and technological trends as a many-fold opportunity — preparing to use new sources of data, reach new market segments, offer innovative new products needed by customers, and more.

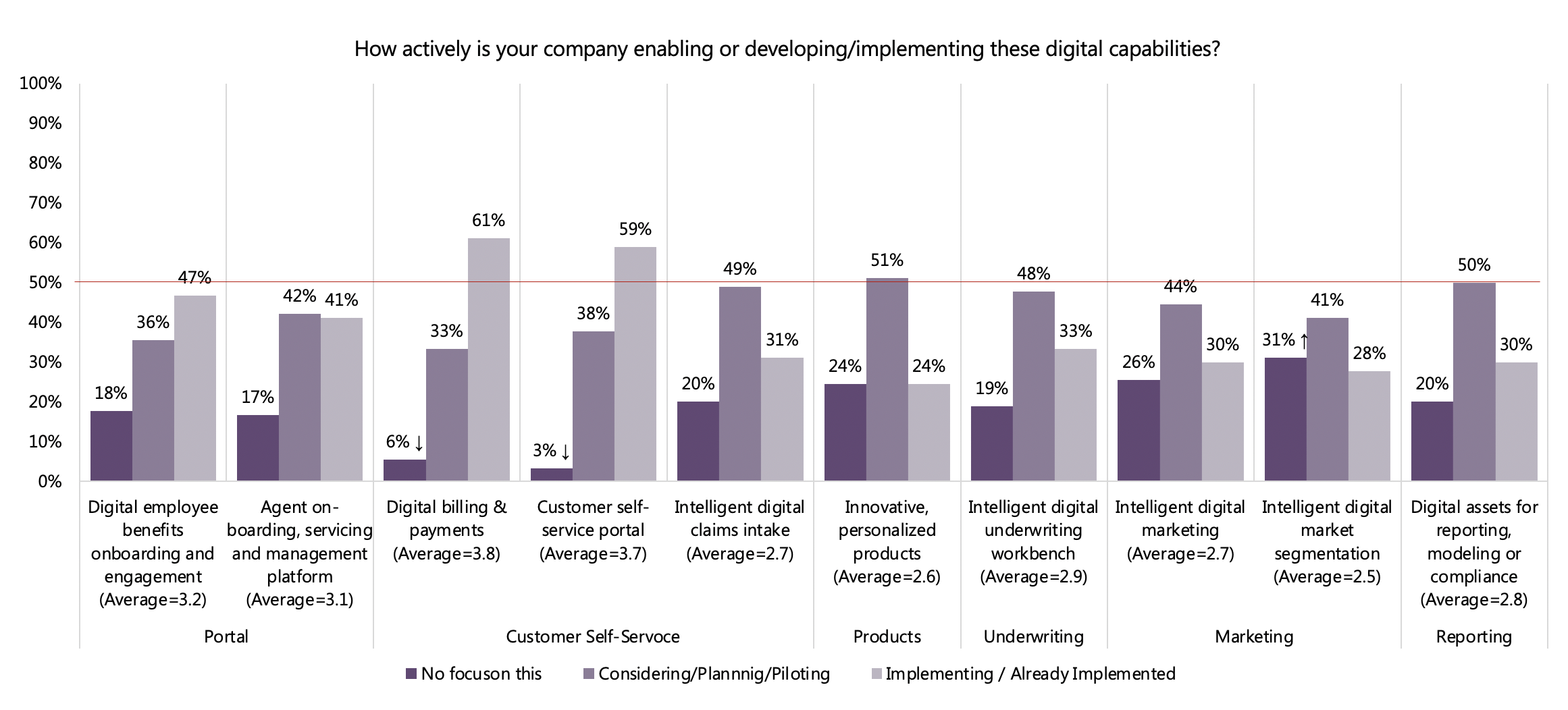

Insurers’ digital transformation is underpinned by customer demands and expectations. In our Strategic Priorities 2021 report, we found that insurers looked at a range of digital priorities. The top three areas of focus, as seen in Figure 2, include:

But do these implementations meet shifting customer expectations? Likely not.

Self-service tools and “out of the box” portals focused on a transaction like claims, payments, quotes and more, which have been the “go to approach” for the last decade, do not meet the shift in customer expectations for a personalized, holistic experience not just required … but demanded today. The days of “there is an app for that” are fading fast! And the proliferation of these apps or not are likely at the root of the dissatisfaction noted by the JD Powers report.

The combination of the shift in customer expectations and dramatic rise in digital engagement becomes the tipping point for insurers to face today’s reality with a next-generation approach using digital insurance platforms. Digital insurance platforms are transforming this siloed approach to create more satisfying, holistic experiences for customers, channel partners and employees as we noted in our life and auto customer research.

This has reshaped a new reality for insurers!

Figure 2: Insurers’ levels of activity in adding digital capabilities

To regain customer trust and satisfaction, insurers now must consider all dimensions of the customer experience across the value chain, creating a next-generation customer experience that is much closer to the “Amazon experience.” But to do that, insurers’ priorities, plans and investments must align to the customer, rather than to internal operations. As stated in the SMA report , Customer Experience in Action: An Approach to Customer Service in the Digital Age, it comes down to enabling the required digital interactions to move beyond being ordinary transactions to become extraordinary experiences.[ii]

Holistic digital experiences will be able to think ahead of the customer, protect individuals and businesses and provide the kinds of service that will be satisfying…improving Net Promoter Scores and building brand loyalty. To get there, however, insurers must think outside the box, think ahead and think innovatively.

In 1965, when the Rolling Stones released Satisfaction, the song was perceived as disturbing, with its’ negative view of commercialism, traditional culture and attack on the status quo threatening to the older generations but inspiring to the younger generation. The result was the Rolling Stones achieved their first number one record in the US followed by their fourth number one in the UK, but only after it was played by pirate radio stations who innovatively broadcast “rock and roll” music to a younger generation via offshore radio stations on anchored ships or marine platforms. Many of the pirate radio stations became new land-based radio station leaders years later.

Just like the rock and roll bands and pirate radio stations leading with a new generation of music, insurance companies need to lead with a new generation of digital experiences in new innovative ways. Tomorrow’s digital leaders need to make bold moves that break the status quo and capture a new “satisfied” generation of customers, just like the Rolling Stones.

These leaders are those who (right now) make the effort to anticipate where and how their digital brand will supply engaging experiences in the future. Are you one of those leaders?

For a deeper look at how digital insurance is going to revolutionize the customer experience, download Majesco’s thought-leadership report, Digital Insurance: The Inflection Point. For a fun and fascinating view on the next generation customer engagement changing insurance with a holistic experience, be sure to watch Majesco’s latest webinar replay, Customer360 — Creating an Enriched Digital Customer Experience.

_________________________________________________

By: Denise Garth, Chief Strategy Officer

Denise is responsible for leading marketing, industry relations and innovation in support of Majesco’s client centric strategy, working closely with Majesco customers, partners and the industry.

_________________________________________________

[i] Golia, Nathan, “Insurers face a higher bar for digital interactions: J.D. Power,” May 26, 2021

[ii] Furtado, Karen, Breading, Mark, “Customer Experience in Action: An Approach to Customer Service in the Digital Age,” Strategy Meets Action, April 2021