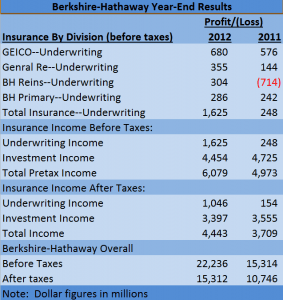

Recognizing the $4.4 billion contribution of Berkshire Hathaway’s insurance operations to its overall after-tax profit of $15.3 billion for the in 2012, Warren Buffett said the group’s insurance operations “shot the lights out last year,” but warned of troubles ahead for other property/casualty insurers.

The insurance operations contributed $1.0 billion in underwriting income and $3.4 billion in investment income to the bottom line on an after-tax basis. Taken together, the $4.4 billion total represented a 19.8 percent jump over insurance earnings for 2011 of $3.7 billion.

Before taxes, 2012 underwriting profit total for the insurance operations was $1.6 billion, and investment income was $4.5 billion.

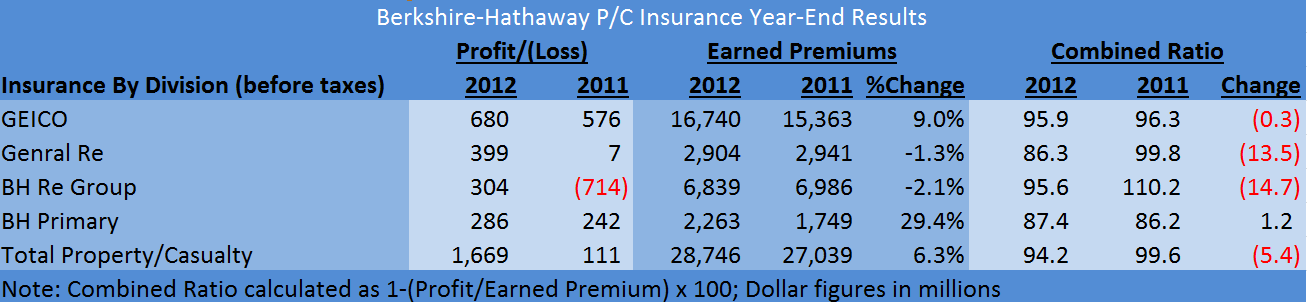

In Buffett’s annual letter to shareholders, released in conjunction with the year-end earnings report, he highlighted the leading contribution of its GEICO unit, which was responsible for $680 million of the $1.6 billion pre-tax underwriting profit of the group, noting that GEICO continued “to gobble up market share without sacrificing underwriting discipline.”

Including the GEICO gecko among the group of 27,000 responsible for GEICO’s performance, Buffett wrote that “the little lizard just soldiers on, telling Americans how they can save big money by going to GEICO.com,” highlighting the jump in GEICO’s premium volume to $16.7 billion, compared to just of $2.8 billion in 1995, when Berkshire obtained control of GEICO. GEICO’s share of the personal auto market is now close to 10 percent, compared to 2.5 percent in 1995, he wrote.

The year-over-year jump in GEICO’s earned premiums was 9.0 percent, and the underwriting profit represented 4.1 percent of earned premiums.

Earned premiums and pretax earnings for the other P/C insurance units are summarized in the accompanying table.

In addition to noting that the overall $1.6 billion underwriting gain represented the tenth straight year of profitable underwriting for the group, Buffett’s latest annual letter, like past letters, discussed the value of “float” arising from the fact that P/C insurers receive premiums upfront, but hold onto funds until they have to pay claims. Year-end float was $73.1 billion, up from $70.6 billion at year-end 2011—rising in spite of Buffett’s year-end 2011 prediction that the level would decline.

In addition to noting that the overall $1.6 billion underwriting gain represented the tenth straight year of profitable underwriting for the group, Buffett’s latest annual letter, like past letters, discussed the value of “float” arising from the fact that P/C insurers receive premiums upfront, but hold onto funds until they have to pay claims. Year-end float was $73.1 billion, up from $70.6 billion at year-end 2011—rising in spite of Buffett’s year-end 2011 prediction that the level would decline.

The letter went on to highlight the interconnection between float, underwriting profit and competition.

“If our premiums exceed the total of our expenses and eventual losses, we register an underwriting profit that adds to the investment income our float produces. When such a profit is earned, we enjoy the use of free money—and, better yet, get paid for holding it. That’s like your taking out a loan and having the bank pay you interest,” Buffett wrote.

He continued, however, that “the wish of all insurers to achieve this happy result creates intense competition,” which in in most years causes the P/C industry as a whole to operate at a significant underwriting loss.

“This loss, in effect, is what the industry pays to hold its float. For example, State Farm, by far the country’s largest insurer and a well-managed company besides, incurred an underwriting loss in eight of the 11 years ending in 2011,” he wrote.

(Editor’s Note: On Friday, State Farm reported a $1.7 billion underwriting loss for 2012.)

“There are a lot of ways to lose money in insurance, and the industry never ceases searching for new ones,” Buffett added.

On the investment side, Buffett shared another “unpleasant reality” for the industry, which he said adds to its “dim prospect.”

Earnings for insurers, he said, “are now benefiting from ‘legacy’ bond portfolios that deliver much higher yields than will be available when funds are reinvested during the next few years—and perhaps for many years beyond that.”

“Today’s bond portfolios are, in effect, wasting assets. Earnings of insurers will be hurt in a significant way as bonds mature and are rolled over,” he said.

Turning the focus back on Berkshire, Buffett noted that the magnitude of float is highest for the Berkshire Hathaway Reinsurance Group run by Ajit Jain, representing $34.8 billion of the $73.1 billion total. While Jain “insures risks that no one else has the desire or the capital to take on,” Buffett said the reinsurance leader never exposed Berkshire to undue risk.

“Indeed, we are far more conservative in avoiding risk than most large insurers,” he said. In fact, he asserted in the letter that if the insurance industry were to experience a $250 billion loss from a mega-catastrophe, “Berkshire as a whole would likely record a significant profit for the year because it has so many streams of earnings. All other major insurers and reinsurers would meanwhile be far in the red, with some facing insolvency,” he concluded.

Buffett’s letter also included a shout-out to Tad Montross, the leader of Berkshire’s General Reinsurance division.

“General Re’s huge float has been better than cost-free under his leadership, and we expect that, on average, it will continue to be,” Buffett wrote, referring to continued underwriting profit ($399 million, or 14 percent of premium in 2012) and float of $20.1 billion. Buffett acknowledged Montross’ insistence on adherence to four commandments of underwriting discipline, including one that other insurers and reinsurers ignore—the willingness to walk away when appropriate premium can’t be obtained.

“That old line, ‘The other guy is doing it, so we must as well,’ spells trouble in any business, but none more so than insurance,” Buffett concluded.

See related articles, “Highlights from Berkshire Hathaway’s Annual Letter,” and “Buffett: Performance Sreak May End This Year,” for more insights from Buffett’s letter beyond the insurance segment.